Operating Week Ahead: When Growth Decouples from Hiring

The Operating by John Brewton Weekly Note on the World We Inhabit

In 2026, I’m working directly with 100 creators building real businesses.

I want to bring operating strategy, competitive positioning, and financial planning to a community that’s fundamentally different from my typical industrial and technology clients.

For the first 100 creator founders: Four 60-minute 1:1 advisory sessions for $95.

Context: My standard engagement starts at $10K/month. This isn’t that. This is me learning from you while helping you build something sustainable.

Limited to 100 spots. Message me with questions or to claim yours.

January 19, 2026 | by John Brewton

On January 11, 2026, Fortune reported something extraordinary: U.S. worker productivity surged 4.9% while hiring remained frozen. Companies are growing—revenues climbing, profits expanding, but the headcount that once powered that growth has flatlined. Wells Fargo shed 65,000 employees since 2019 while maintaining operations. Shopify told managers: no new hires unless you can prove AI can’t do the job. IBM’s voluntary attrition hit a 30-year low because workers know the exit doors have narrowed.

This is the defining economic story of 2026, and it has a second act that most people are missing: When corporate growth decouples from headcount growth, the creator economy doesn’t just grow, it becomes structurally necessary.

Fewer entry-level roles mean more people must build their own income engines. Flatter organizations mean companies increasingly “rent” distribution, trust, and expertise from the outside, hiring creators and contractors, not employees. The same AI tools letting Shopify operate with frozen headcount are letting solopreneurs run $500K businesses from their laptops with <$500/month in tool costs.

Two operating systems are emerging:

The corporate OS: productivity leverage without hiring.

The creator OS: owned audiences, productized expertise, micro-teams of AI agents.

And they’re not separate, they’re feeding each other.

Starting this week, Operating Week Ahead will do something different.

Part one will track the big stories—Fortune 500 strategy, macro trends, geopolitics, the stuff that excites entrepreneurs and shapes how we all think about business.

Part two will translate those forces into actionable intelligence for the one-person builder—the newsletter writer, the solopreneur, the operator figuring out how to build durable income in a world where corporate ladders are narrowing.

The big world sets the context. The small builder captures the value.

Let’s begin.

I. The Decoupling Is Real—and Accelerating

The macro confirmation came last week. Fortune reported that U.S. labor productivity jumped 4.9% in Q4 2025, while hours worked rose just 0.5%. Translation: companies extracted dramatically more output from existing workers, not by adding people. This follows years of AI investment, process automation, and organizational redesign. Economists frame this as “good news”—growth without wage pressure or inflation risk.

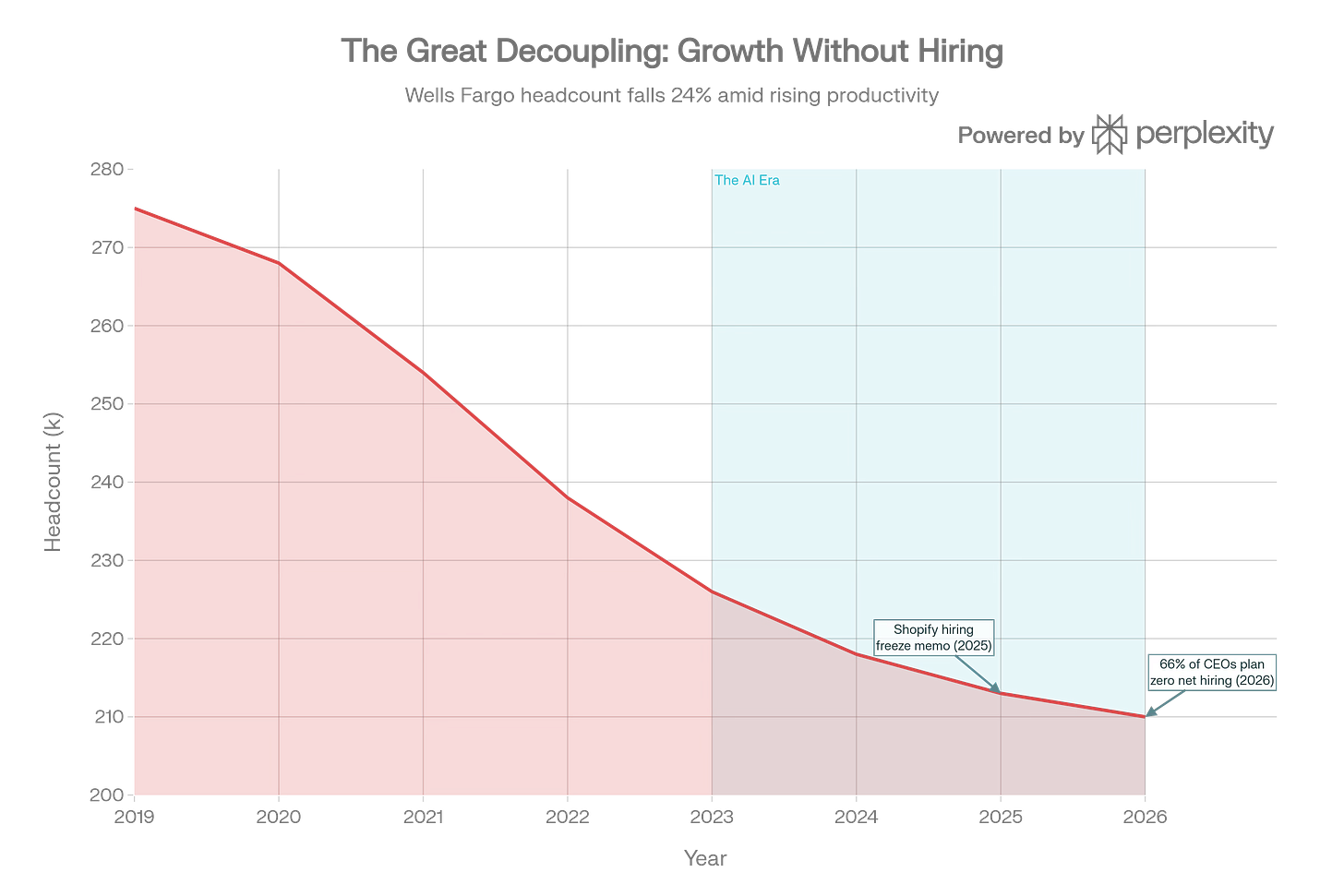

“Wells Fargo’s headcount has fallen roughly 24% since 2019 even as U.S. labor productivity accelerates to 4.9% growth—illustrating how corporate growth is increasingly driven by technology and process leverage rather than hiring.”

But zoom into the Fortune 500, and the human story becomes stark. A Yale School of Management CEO survey found that 66% of CEOs plan to cut staff or maintain current team sizes in 2026. Only 34% plan to expand headcount. Wells Fargo has gone from 275,000 employees in 2019 to 210,000 today—a 24% reduction—while maintaining operations. IBM’s voluntary attrition fell below 2% in the U.S., the lowest rate in 30 years, because people aren’t leaving—they know jobs are scarce.

Shopify’s CFO put it bluntly: “I don’t see us needing to increase headcount in any way. We’ve been at this headcount for over two years.” And in April 2025, Shopify CEO Tobi Lütke sent a memo that’s become the unofficial manifesto of this new era: no new hires unless managers can prove that AI cannot perform the required tasks.

Operating Insight: The corporate ladder didn’t just get harder to climb—it got narrower. Entry-level and mid-tier roles are compressing as AI and process redesign absorb what juniors used to do. If you’re early in your career or considering a pivot, plan for independence. The path up is uncertain; the path out—building your own thing—is increasingly viable.