Markets reached a pivotal moment this week as confidence in AI-driven equities collided with real-world economic anxieties. Eli Lilly became the first pharma firm to reach $1 trillion valuation on surging demand for obesity drugs. Yet the American household experience is increasingly recession-like: consumer sentiment fell to its second lowest level in two decades, layoffs surged, and inflation’s aftershocks reshaped daily life.

Simultaneously, more than $380B in capital flowed into AI infrastructure, an investment cycle comparable to the railroads, highways, and electrification booms of American history. This outlier growth masks an otherwise bifurcated economy: technology, healthcare, and infrastructure are surging, while manufacturing, construction, retail, and middle-income spending are stagnant or shrinking.

Ahead: essential economic data (including Black Friday/Cyber Monday retail results, inflation readings, and confidence reports) will test whether 2025 ends with optimism or caution. For investors and operators, the divide between AI winners and traditional losers has never been starker.

A. The AI Correction and Market Volatility

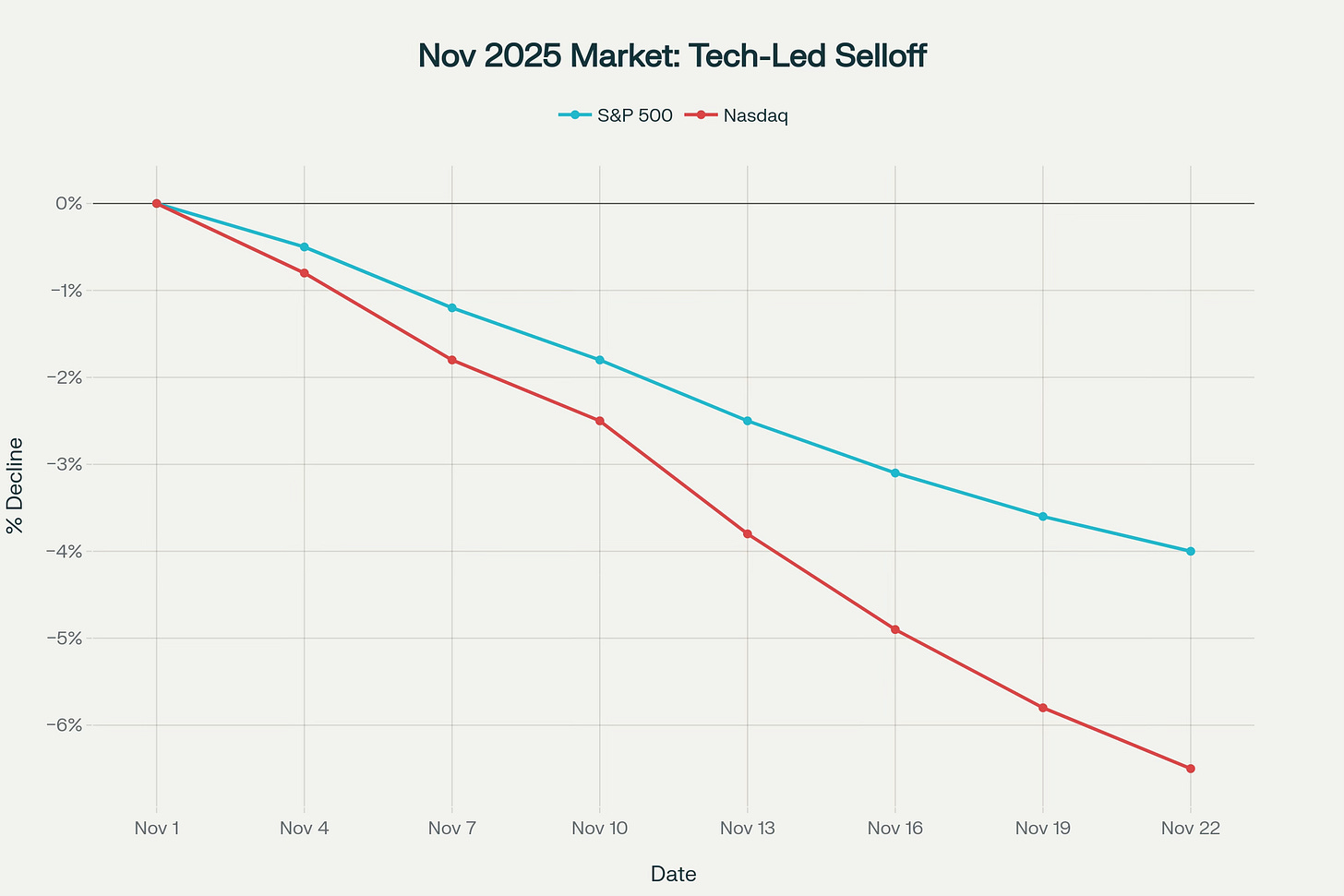

The artificial intelligence “Super Seven” stocks finished the week deep in the red—Nvidia down 3.6%, Tesla off 6.6%, Oracle, Meta, and Alphabet all tumbling. The tech-led Nasdaq posted its steepest three-week slide since spring, fueling broader concerns about concentration risk.

Line chart: S&P 500 (-4%), Nasdaq (-6.5%) from Nov 1–22, 2025, highlighting the accelerating tech selloff.

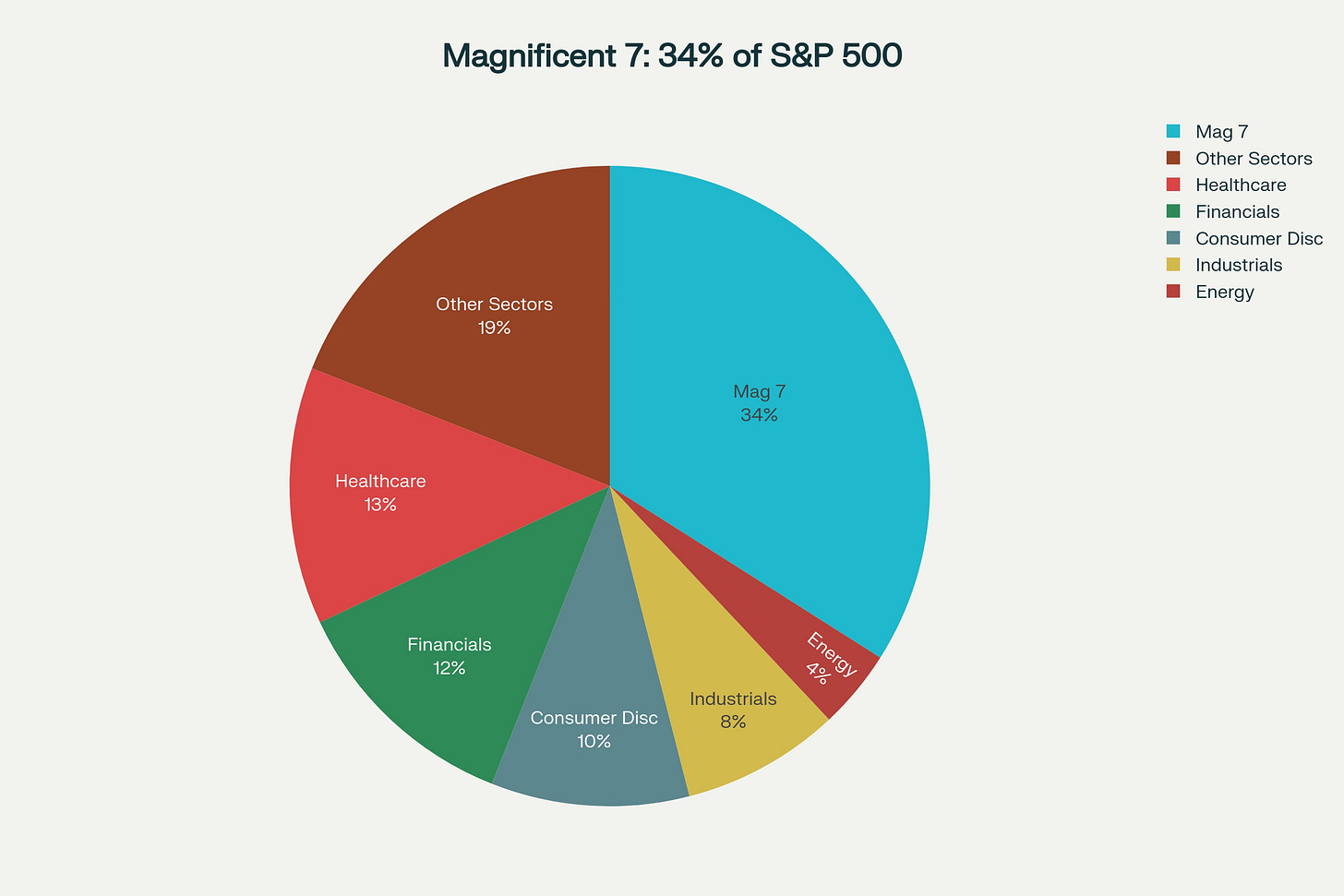

Goldman Sachs’s CEO publicly warned of a likely 10–20% correction as even noted AI bull Michael Burry revealed heavy short positions against Nvidia and Palantir, signaling a shift in institutional sentiment. The “Magnificent Seven” now comprise an unprecedented 34% of S&P 500 market capitalization—a record share once matched only in the most euphoric moments of the dot-com bubble or “Nifty Fifty” era.

Pie chart: 34% of S&P 500 attributed to seven tech stocks—Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta, and Tesla.