The Operating Week Ahead: How Companies (and Creators) Compete in 2026

A Synthesis of the Week’s Most Important Trends Across Corporate, Media, and Creator Economy From Operating by John Brewton

A Bifurcating Operating Model

The week’s coverage from the Wall Street Journal, Financial Times, The Economist, Harvard Business Review, MIT Technology Review, Wired, Fast Company, and creator-economy trend pieces reveals a single underlying pattern: the future of operating is splitting into two distinct architectures, each with radically different governance, cost structures, and competitive advantages.

Traditional firms are exhausted by perpetual transformation cycles. Creator-led micro-firms are just beginning to scale. Both are converging on the same understanding: adaptive capacity, embedded in operating systems and governance, is the only sustainable moat.

The Transformation Paradox

“Get Off the Transformation Treadmill” (Harvard Business Review, Jan–Feb 2026) landed this week with data that should terrify executives: 95% of large organizations have undergone 2+ major reinventions in the prior two years; 61% have hit four or more transformations.

Serial transformations breed employee burnout, erode investor confidence, and drain resources. McKinsey’s CEO Bob Sternfels, marking the firm’s 100-year milestone in an HBR interview, is shifting McKinsey from pure advisory to outcomes-based partnerships, a signal that consultants no longer believe in advice-giving alone; they now want to share risk with clients.

The implication is stark: perpetual transformation is failing. The escape route is not another big-bang reinvention. It is embedding adaptive capacity directly into the operating model (faster decision-making cycles, clearer governance, continuous sensing) so that organizations can adapt without periodic organizational trauma.

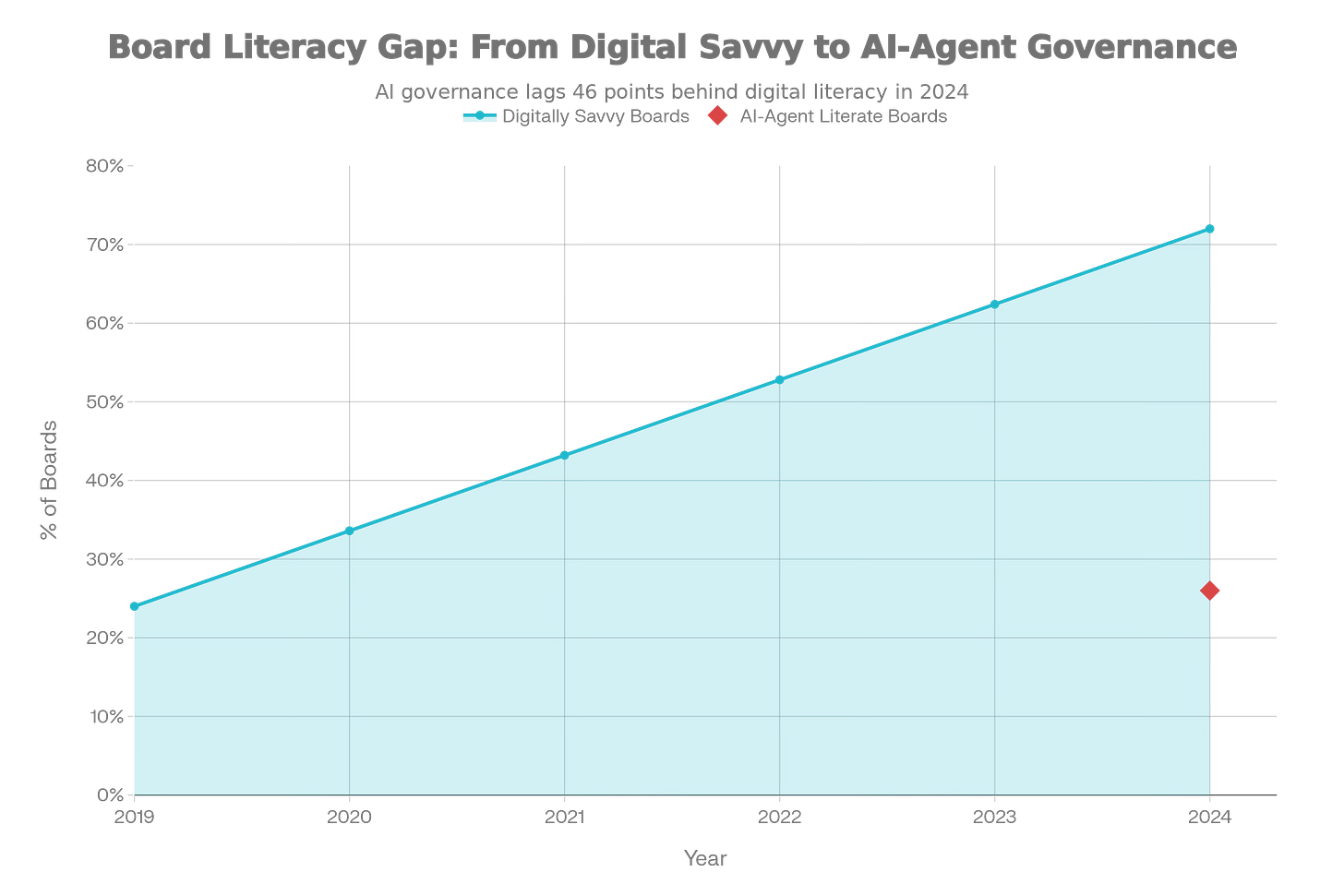

Board Literacy and AI-Agent Governance

While digital board literacy has improved dramatically (24% to 72%), only 26% of boards are equipped to govern next-generation AI systems—revealing a critical new gap

“AI-Savvy Boards Drive Superior Performance” (MIT Sloan Management Review, Winter 2026) reveals a striking finding: only 26% of large firms have boards equipped to understand and govern next-generation AI (AI agents, robotics, specialized tech like fintech and regulatory tech). This gap is a leading indicator of which firms will make smart AI investments and which will squander capital.

Why? Because boards govern the boundary between human and machine decision-making, the delegation of discretion to autonomous systems, and the governance of data-driven strategy. If boards don’t understand these questions, they cannot effectively oversee them.

The data point that matters: 70% of large enterprises now have Chief Data Officers in established, successful roles (up from 50% last year). Only 3% view the CDO role as a failure. This suggests that data and AI governance, properly embedded in the C-suite, is becoming a competitive differentiator.