The Operating Week Ahead: The Davos 2026 Edition

A Weekly Series From Operating by John Brewton Covering the Economic Future of How Companies Operate

In 2026, I’m working directly with 100 creators building real businesses.

I want to bring operating strategy, competitive positioning, and financial planning to a community that’s fundamentally different from my typical industrial and technology clients.

For the first 100 creator founders: Four 60-minute 1:1 advisory sessions for $95.

Context: My standard engagement starts at $10K/month. This isn’t that. This is me learning from you while helping you build something sustainable.

Limited to 100 spots. Message me with questions or to claim yours.

The week in Davos clarified the operating baseline for the next few years: modest but resilient growth, structurally fragmented trade, AI treated as infrastructure rather than experiment, and a labour market being rewritten in real time. The spectacle around Trump, Greenland and NATO made headlines; the more important signals were in the side rooms where CFOs, CHROs and operators compared notes on how to grow into this new regimented era.

This piece extracts those signals and turns them into an operating agenda for the weeks ahead.

- john -

Full appendix with links to all cited research and publications can be found at the end of the article.

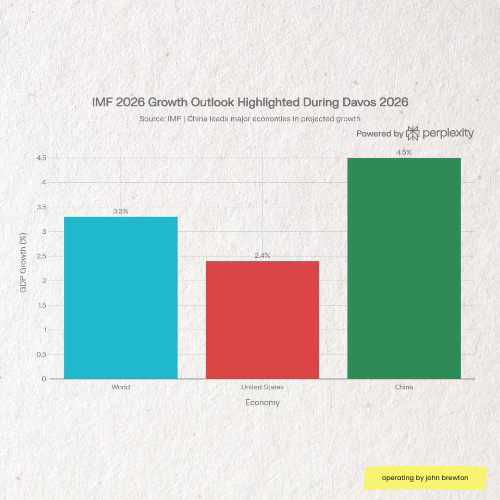

The macro message from Davos was not exuberance but durability. The IMF raised its 2026 global growth forecast to around 3.3%, up 0.2 percentage points from October, citing stronger investment in AI and digital infrastructure as a key offset to trade and policy headwinds. The United States was revised up to 2.4% growth, China to 4.5%, with the global figure anchored in the low‑3s

IMF 2026 Growth Outlook: Global, US and China real GDP forecasts underpin Davos’s ‘resilient but noisy’ narrative.

Chief economists convened by the WEF described this as “reassuring resilience”: lower than pre‑GFC norms but stronger than the gloomy consensus entering 2025. The composition of growth matters more than the headline number. A significant share is now coming from capex into AI, cloud and data centres, which supports equipment, construction and energy demand, and from fiscal and industrial policy, particularly around green technologies and semiconductors.

Bloomberg and FT coverage underscored the tension: equity markets have already capitalised years of expected AI productivity gains, while interest rates remain structurally higher due to debt overhangs, re‑shoring and defence spending. Central banks and investors now treat AI investment as both growth engine and potential source of financial instability if returns disappoint.

For operators, the planning baseline is straightforward: assume low‑3s global growth with high regional dispersion, and treat AI capex and energy prices as first‑order macro variables, not background noise.

If the macro picture is resilient, the institutional picture is not. The WEF’s Global Risks Report 2026 ranks geoeconomic confrontation as the top global risk over the next two years, ahead of state-based conflict, extreme weather and misinformation. A large majority of surveyed leaders expect a more fragmented or multipolar global order within a decade.

The Greenland episode provided a vivid illustration. In the run‑up to Davos, the Trump administration threatened EU tariffs amid a dispute over Greenland, briefly reviving fears of a transatlantic trade war. At Davos, Trump announced a “framework” deal with NATO allies on Greenland and dropped the immediate tariff threat, triggering a relief rally in markets such as India’s equity indices. The sequence showed how quickly trade conditions can be weaponised and then reversed.

At the same time, the EU and India used Davos to flag that their long‑negotiated free trade agreement is close to conclusion, with Brussels branding it “the mother of all deals.” The agreement promises lower tariffs and improved access across autos, alcohol, pharma and textiles, while giving both parties a diversification hedge against US–China volatility.

The underlying pattern is a shift from hyper‑globalisation to risk‑routed globalisation:

Trade, investment and supply chains are being rewired around geopolitical fault lines rather than cost alone.

New corridors (EU–India, Gulf–India, intra‑Asian and South–South links) are gaining strategic weight relative to legacy US‑centric flows.

For corporate strategy, this argues for portfolios and operating models optimised for option value rather than pure efficiency. The critical questions for leadership teams this week are concrete: where is revenue or supply chain exposure overly concentrated in a single political node, and which emerging corridors are under‑represented in the three‑to-five‑year plan relative to likely policy support and demand growth?

Resilience in this setting is a precondition for growth.