Operating Note: The Pendulum's Swing Towards Safety - Week of 12.15.2025 to 12.20.2025

Netflix-WBD Merger, Stagflation Risks, and the AI Productivity Paradox

Check out these reader favorites:

Date: December 15, 2025

The Return of Economic Laws

As we calibrate our operating stance for the week, it’s important to remember the imperative of “second-level thinking.” We can no longer continue to suspend economic gravity. The pendulum, which has been swinging decisively in the direction of growth-at-all-costs and policy-flexibility, appears to be shifting back toward constraints, consolidation, and the immutable laws of economics.

Here is how we’re interpreting the three major shifts of the week.

Key Takeaways

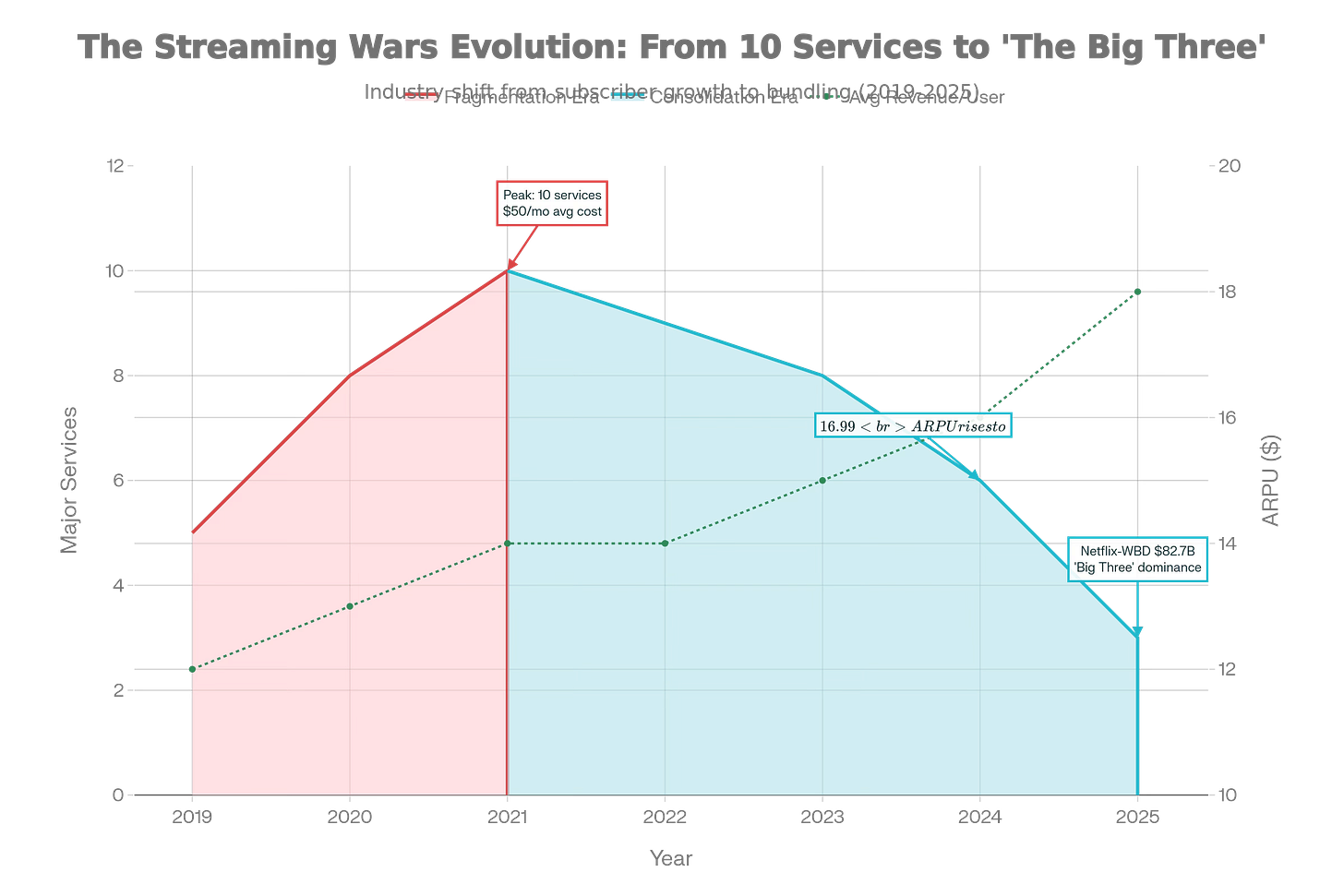

Media: The $82.7B Netflix-WBD deal marks the end of “growth at all costs” streaming and the start of utility-style bundling under stricter 2023 FTC/DOJ merger guidelines

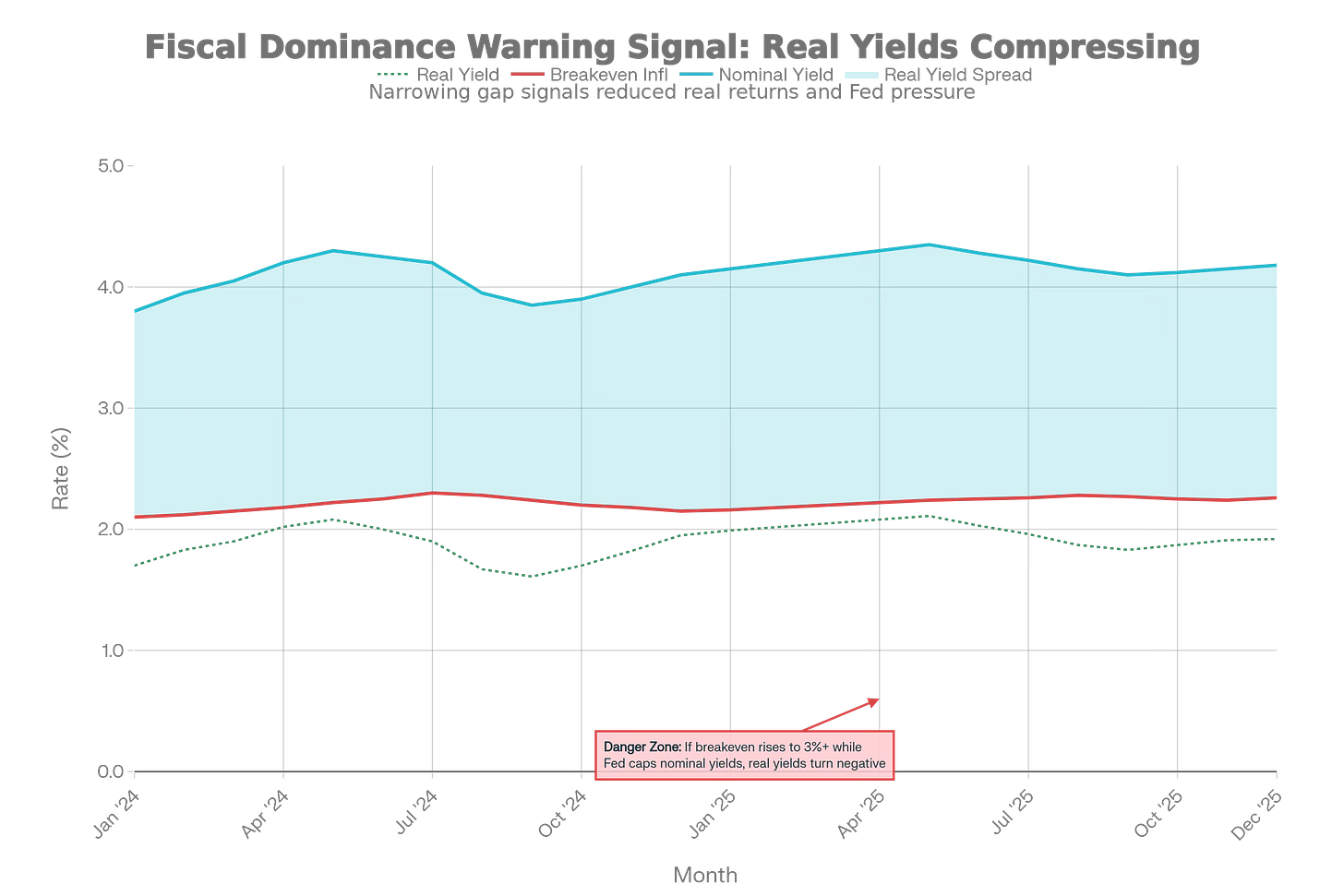

Macro: Kevin Hassett’s likely Fed Chair nomination combined with Trump tariffs creates fiscal dominance risk, watch the 10-year breakeven vs nominal yield spread

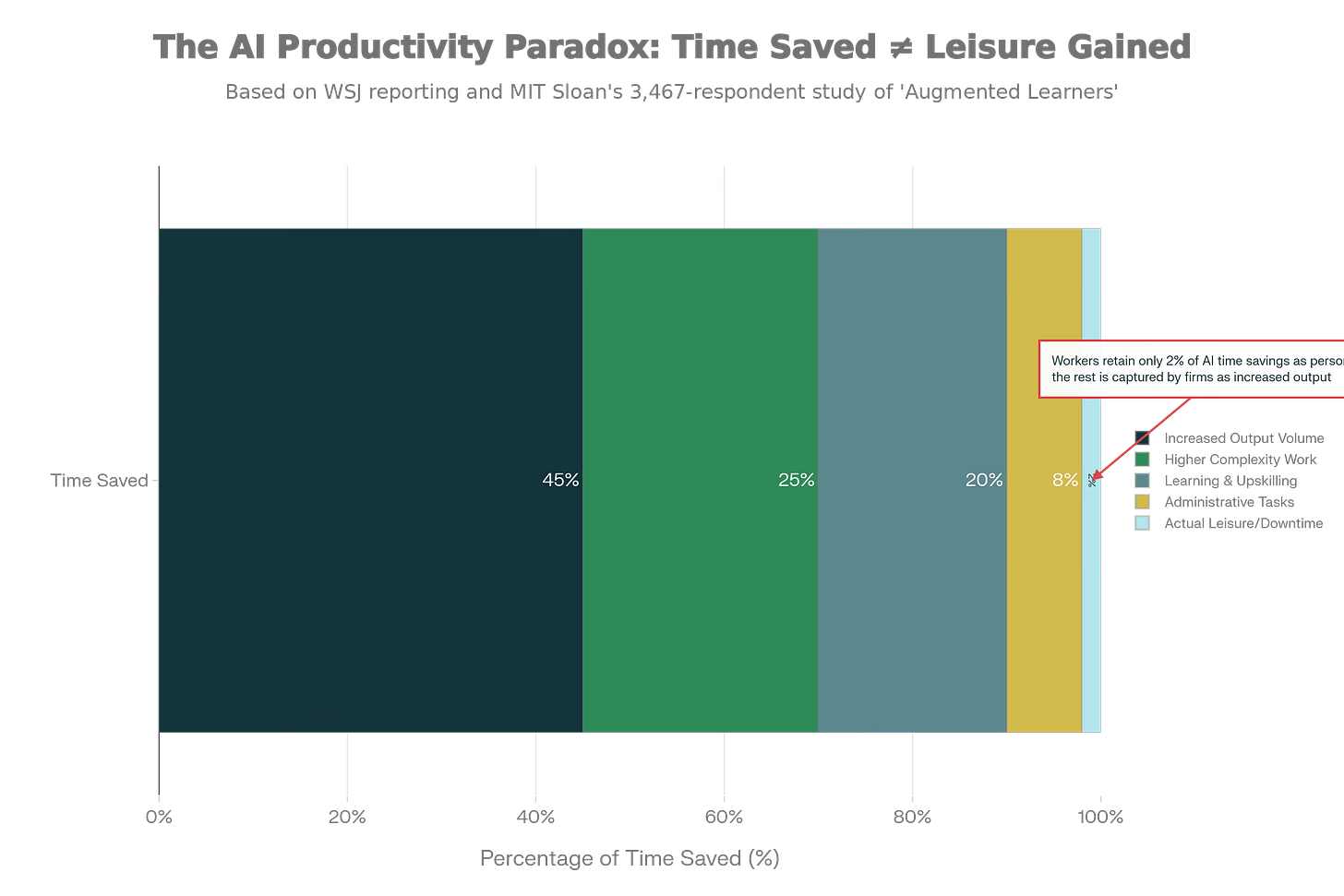

AI: New research shows AI time savings are reinvested as “more work,” not leisure. Augmented Learners are 2x more effective but face 50%+ higher cognitive load

Why Did Netflix Buy Warner Bros Discovery?

The Event: The Warner Bros. Discovery/Netflix deal ($82.7B EV).

The Signal: Growth-at-All-Costs” era is dead. The consolidation minded Bundled-Utility era is in full swing across the media landscape. More to come for sure.

For a decade, the streaming sector ignored the basic calculus of value: that spending $1 for 90 cents of revenue is not a business model, no matter how fast you grow. The Netflix/WBD deal is a capitulation to reality. The pendulum has swung from fragmentation (everyone builds their own platform) to consolidation (utility, scale, bundling).

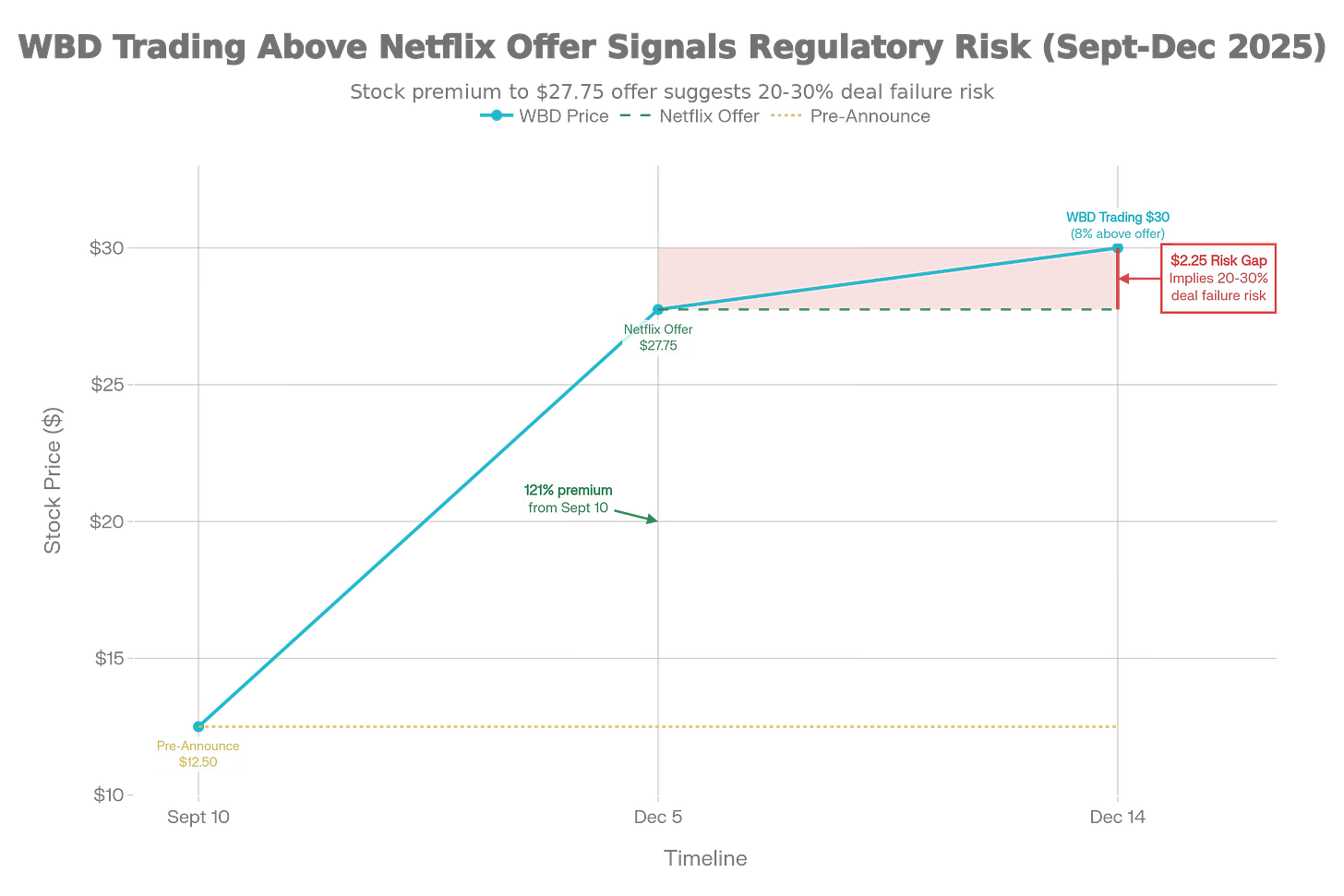

The Market Disputes the Deal: While Netflix offered a massive 121% premium, WBD stock (red line) trades above the offer price. This “negative spread” signals that arbitrageurs are betting the FTC will block the deal or force a higher bid, rather than trusting the transaction will close as proposed.

The “Second-Level” Insight:

The market is offering us a diagnostic tool in the form of the Deal Spread.

Price: Netflix is offering ~$27.75/share.

Market Price: WBD trades at ~$30 (a discount to the offer).

The Disconnect: Usually, target stocks trade below the offer price due to deal risk. Here, the discount reflects a specific fear: the 2023 Merger Guidelines. The market is pricing in that the FTC/DOJ will view this not just as a transaction, but as a structural threat (”trend toward vertical integration“).

The broader consolidation pattern is unmistakable: Disney’s bundle (Disney+/Hulu/Max) launched in July 2024 at $16.99/month is already driving 20% revenue increases, while ~30% of new streaming subscriptions now come through aggregators. The industry shift from growth to operating leverage is complete.

Regulatory Framework:

The December 18, 2023 FTC/DOJ Merger Guidelines are critically important to understand. Guideline 5 on vertical mergers no longer requires a 50% market share threshold to presume competitive harm. A “trend toward vertical integration” is sufficient grounds for challenge.

Operating Directive:

We must stop viewing streaming as a “growth” sector and start viewing it as a “utility” sector with the requisite high barriers to entry, pricing power, and regulatory scrutiny. The “Deal Premium” is a barometer for how much the market believes the government can arrest this pendulum swing.

From Fragmentation to Oligopoly: The streaming market has completed a full cycle. The “Peak Fragmentation” era of 2021 (10+ major services) destroyed capital; the new “Utility Era” consolidates the market into a profitable “Big Three,” driving ARPU from $12 to $18 through bundling rather than user growth.

What Is Fiscal Dominance and Could It Happen in 2025?

The Event: Kevin Hassett’s likely nomination to the Fed + The Tariff Regime.

The Signal: A dangerous attempt to decouple monetary policy from fiscal reality (Fiscal Dominance).

While certainly not a hard science (as economists are so often reticent to admit), it’s still important to remember that governments cannot repeal the laws of economics, try as they might. The current policy mix, imposing supply constraints (tariffs) while demanding demand stimulation (rate cuts), is a textbook attempt to do just that.

The “Second-Level” Insight:

First-level thinking says: “Fed cuts rates, stocks go up.”

Second-level thinking asks: “What happens when you cut rates into a supply shock?”

The answer is Stagflationary Pressure.

The metric to watch is not the Fed Funds Rate, but the 10-Year Breakeven Inflation Rate vs. Nominal Yields.

The Spread: Nominal yields are anchored (~4.18%), but breakevens (~2.26%) are rising.

The Implication: If the Fed (under Hassett) artificially suppresses nominal rates while tariffs push up prices, real yields will collapse. This could be called “Fiscal Dominance,” wherein the Fed ostensibly loses its independence and becomes an arm of the Treasury. The bond market “vigilantes” will eventually exact a price for these movements.

The Political Reality:

Kevin Hassett, Trump’s National Economic Council Director, has 70% probability in prediction markets for the Fed Chair nomination. He argues there’s “plenty of room” for rate cuts despite inflation running at 2.9% (above the 2% target). President Trump’s explicit statement that the Fed Chair should “consult” him on rates effectively ends the era of technocratic independence.

The Tariff Impact:

Trump’s tariffs have already added 0.7 percentage points to CPI, with the CBO warning that they’re pushing inflation higher than baseline forecasts. This creates the classic policy contradiction—demand stimulus into supply constraints.

Fiscal Dominance Theory:

The theoretical framework comes from Sargent-Wallace (1981): when fiscal authority moves first with unsustainable deficits, the central bank must eventually monetize debt through inflation. Recent academic work, including LSE’s “Fiscal Dominance in the Modern Era” and quantitative models on fiscal-monetary interactions, finds a 75% probability of policy conflict under current debt-to-GDP configurations. The Federal Reserve’s own research acknowledges these constraints.

The Danger Zone: Watch the gap between the blue line (Nominal Yields) and the orange line (Inflation Expectations). As this spread narrows, real yields compress. If the Fed caps rates (blue flatlines) while tariffs drive inflation (orange rises), real yields collapse, the hallmark of Fiscal Dominance.

Operating Directive:

Prepare for volatility in real assets. If the market is clear that the Fed has prioritized political expediency over price stability, the “safe” asset becomes the risky.

Does AI Reduce Workload? New Research Says No

The Event: A convergence of new data from WSJ and MIT Sloan on AI’s impact on the workday.

The Signal: The “leisure dividend” is a myth. AI is not an exit ramp; it is an accelerant.

We often hear that AI will usher in a golden age of leisure, similar to the promises made about computers in the 1980s. The data is now in, and it points to the exact opposite conclusion. Recent reporting from the Wall Street Journal and research from MIT Sloan Management Review confirm a new structural reality: Time saved by AI is not returned to the worker; it is reinvested by the corporation.

The “Second-Level” Insight:

First-level thinking says: “AI does the task in half the time, so I work half as much.”

Second-level thinking asks: “What happens to the surplus capacity in a competitive market?”

The answer is Scope Expansion.

In July 2025, the Wall Street Journal analyzed this precise dynamic in “Your Prize for Saving Time at Work With AI: More Work.” The finding was stark: efficiencies are systematically captured by the firm and converted into elevated performance expectations. If you can write code 50% faster, the expectation isn’t that you go home at 2 PM; it’s that you ship 50% more features.

The Reallocation Mechanism: Time savings are treated as corporate currency, not employee dividends. In sectors like consulting and engineering—where “doing more” (more iterations, more experiments) defines competitive advantage—AI functions as a “cognitive force multiplier.”

The Goldman Sachs Confirmation: The bank’s research notes that current GDP growth is driven by demand-side AI investment, implying the output surge is just beginning. The “hamster wheel” is spinning faster, not slowing down.

The Productivity Paradox: Contrary to the “leisure dividend” narrative, only 2% of time saved by AI is returned to the worker. The vast majority (90%+) is recaptured by the firm in the form of higher output volume and increased complexity—doing more work, not less.

The counterfactual is telling: when the WSJ examined whether companies are “training employees to think less, not more,” the discussion centered entirely on cognitive capability development and reinvestment of efficiency gains into workforce upskilling—not into shorter workweeks. Chris Ernst, Workday’s chief learning officer, framed the risk explicitly: “When we offload too much thinking to AI, we risk dulling our people’s ability to analyze, create and adapt.” The solution? “AI itself can help greatly with employee skills development... so you’re not just getting an answer, you’re gaining a skill.” Time freed by AI becomes fuel for learning velocity, not leisure.

The “Augmented Learner” Advantage:

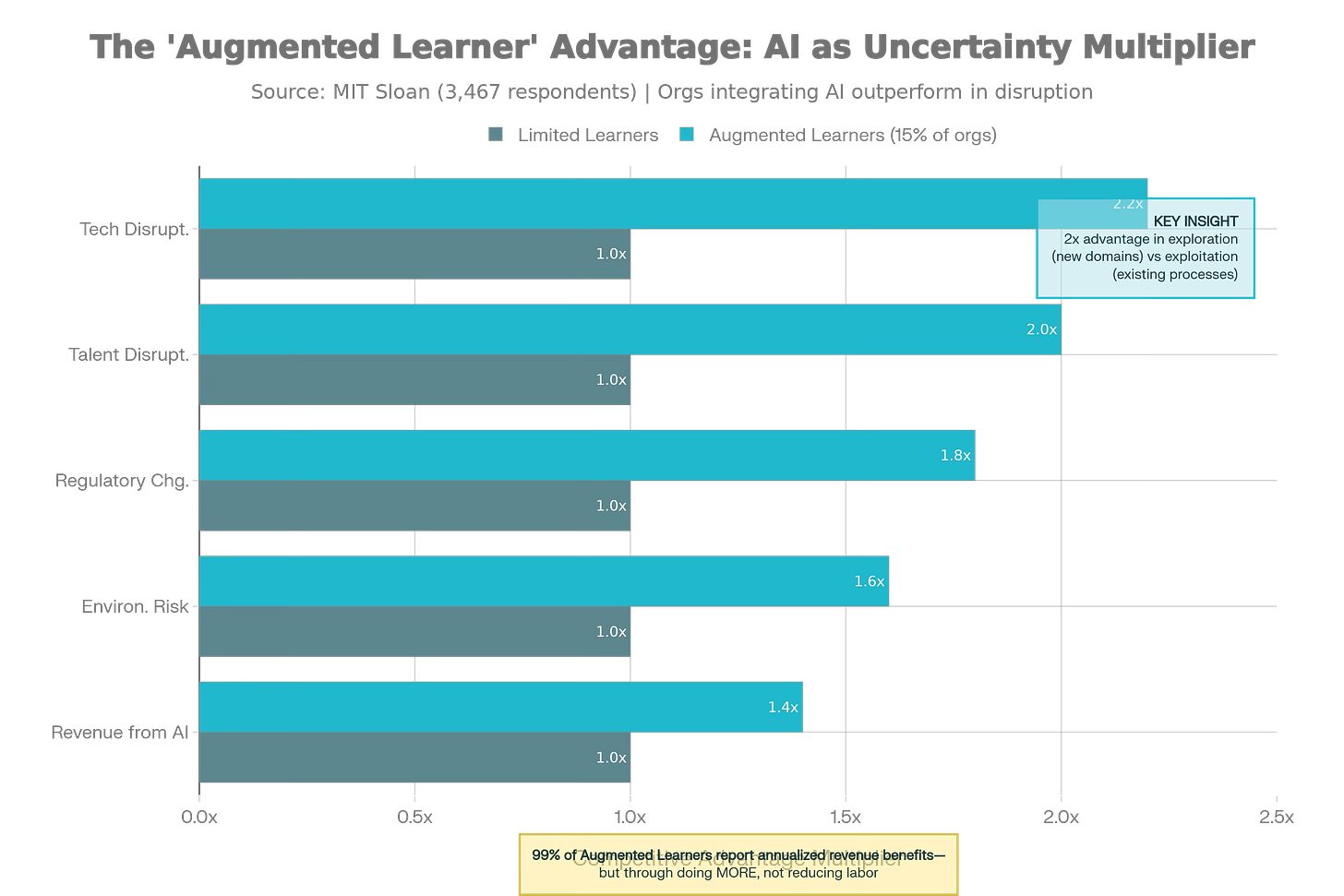

MIT Sloan provides the organizational context through a study spanning 3,467 global respondents. They identified a top tier of companies, ”Augmented Learners” (15% of the market) who are using AI not to cut costs, but to manage uncertainty.

The Multiplier: These firms are 1.6 to 2.2 times more likely to effectively handle disruptions like technological change, regulatory shifts, and talent mobility because they use AI to capture and synthesize knowledge at scale.

The Productivity Multiplication: Aflac projects 5-10x system productivity gains from using generative AI to reverse-engineer legacy code. Estée Lauder uses AI to detect consumer trends via social media and instantly redeploy inventory across 20+ brands. Expedia synthesizes data from 3 million properties and 500 airlines to deliver real-time partner recommendations. In each case, AI doesn’t reduce work hours, it enables radically more complex operations within the same time envelope.

The Behavioral Shift: Crucially, these leaders are twice as likely to use AI for exploration (trying new approaches, entering new domains) rather than just exploitation (optimizing existing processes). Exploration is inherently labor-intensive. It requires more judgment, more strategic choice, and more cognitive load, not less.

The Price of Resilience: “Augmented Learners” (the top 15% of AI adopters) outperform peers by ~2x in managing disruption. The catch? They achieve this resilience by using AI to increase exploratory work and complexity, effectively trading potential leisure for competitive survival..

The Reinvestment Imperative:

Both WSJ and MIT Sloan converge on a common architecture: AI creates a virtuous cycle where efficiency gains are systematically captured and reinvested into higher-order work, not redistributed as leisure. As Workday’s Ernst articulates: “C-suite conversations about AI must shift from a narrow focus on productivity and cost savings to a broader view of growth—for both people and the business.”

The MIT Sloan data quantifies this reinvestment pattern: 99% of Augmented Learners report annualized revenue benefits from AI, and they are 1.4 times more likely to recognize revenue gains than organizations with limited learning capabilities. But the revenue comes from doing more, more knowledge capture, more scenario modeling, more rapid prototyping, not from reducing labor input.

Operating Directive:

We must adjust our expectations for the labor market and our own organizations. The “AI Productivity Boom” will not manifest as a reduction in operating expenses (OpEx) via headcount reduction, but as an explosion in OpEx density, the same number of people producing radically more complex, higher-velocity output.

The Trap: Believing AI will “solve” burnout.

The Reality: AI will likely intensify it by removing the “low-cognitive-load” tasks (the breaks) and leaving only the high-stakes decision-making. As Workday’s Chris Ernst warns, if we offload thinking, we dull our skills. The winners will be those who use the freed time to learn faster, turning the workday into a continuous loop of skill acquisition and deployment.

Summary: The Call to Prudence

The common thread this week is Limits.

Media has hit the limit of debt-fueled growth.

The Fed is hitting the limit of political independence.

Labor is hitting the limit of cognitive capacity in an AI-accelerated world.

In environments like this, where the “crowd” is chasing the next pivot or merger, our edge lies in recognizing the constraints. We will not bet on the laws of economics being repealed. We will position for the moment they reassert themselves.

- j -

Frequently Asked Questions

Q: What is the Netflix Warner Bros Discovery deal worth?

A: Netflix is acquiring Warner Bros Discovery’s film/TV studios and streaming assets for $82.7 billion enterprise value ($27.75/share: $23.25 cash + $4.50 NFLX stock), announced December 5, 2025.

Q: What is fiscal dominance and why does it matter?

A: Fiscal dominance occurs when central banks lose independence and must accommodate government debt through monetary policy. The risk: if Kevin Hassett becomes Fed Chair and cuts rates while Trump’s tariffs drive inflation, real yields collapse and bond markets lose confidence in U.S. monetary policy.

Q: Does AI increase productivity or just increase workload?

A: Research from MIT Sloan and WSJ shows AI increases output but not leisure. “Augmented Learner” companies are 1.6-2.2x better at managing uncertainty but achieve this through scope expansion—employees do more complex work in the same hours, not fewer hours of work.

Q: What are the 2023 FTC/DOJ Merger Guidelines?

A: Released December 18, 2023, these guidelines lower the bar for challenging vertical mergers. Guideline 5 allows agencies to challenge deals that “further a trend toward vertical integration” even without 50% market share thresholds.

The Operating by John Brewton Ultimate Upskillling Holiday Offer

As an “Operating Founder,” you receive four 30-minute quarterly one-on-one working sessions with me. Additionally, for the holiday season, you also receive an extra 50-minute one-on-one Ultimate Upskilling Session, where we can personally plan your future-proofing strategy together.

This is a $1,500 value being offered for $105 (or whatever you can afford above $50 just for the holiday season). The Founding Member tier is priced to remove all friction for those who would like to start meeting and working 1:1.

Monthly: $17 → $10 (Sample the work)

Annual: $95 → $75 (Commit to a year of operating discipline)

Founding Member: $550 → $105 (The “Operator” Tier)

Claim your sessions and Future-Proof Upskilling Plan now:

John Brewton documents the history and future of operating companies at Operating by John Brewton. He is a graduate of Harvard University and began his career as a Phd. student in economics at the University of Chicago. After selling his family’s B2B industrial distribution company in 2021, he has been helping business owners, founders and investors optimize their operations ever since. He is the founder of 6A East Partners, a research and advisory firm asking the question: What is the future of companies? He still cringes at his early LinkedIn posts and loves making content each and everyday, despite the protestations of his beloved wife, Fabiola, at times.

Research & Resources Appendix

This appendix provides complete citations and direct links to all primary sources, academic research, and news reporting referenced throughout this analysis.

I. The New Industrial Organization of Media

Warner Bros Discovery / Netflix Merger

Primary Deal Announcements:

Netflix Press Release: Netflix to Acquire Warner Bros. - Official announcement, December 5, 2025

Reuters: Netflix to buy Warner Bros Discovery’s studios, streaming division - Comprehensive deal structure analysis

CNBC: Netflix to buy Warner Bros. film and streaming assets in $72 billion deal - Market reaction and strategic implications

Dakota: Netflix to Acquire Warner Bros. in an $82.7 Billion Deal - Enterprise value breakdown

Competitive Dynamics:

Reddit r/DC_Cinematic: Netflix wins the Warner Bros. Discovery Bidding wars - Community discussion on competing bids

Pepperstone: Paramount dial up the aggression over Netflix with hostile $100 bid - Counter-bid analysis

Investing.com: Netflix Faces Valuation Questions After Paying Premium for Warner Bros Assets - Deal premium analysis

Industry Consolidation Trends:

Parrot Analytics: Analyzing Potential Streaming Mergers - Industry consolidation forecasting, February 2025

Cord Cutters: Netflix HBO Max Bundle Could End Streaming Price Wars - Bundling trends analysis

Fortune: Netflix-Warner deal would drive streaming market further toward consolidation - “Big Three” thesis, December 7, 2025

24i: Streaming’s Future: Lessons from Industry Consolidation - Historical consolidation parallels, June 11, 2025

Operating Leverage & Business Model:

All Stars: How Netflix is Capitalising On Operating Leverage - Margin expansion analysis, February 15, 2025

AInvest: Netflix’s $1 Trillion Play: Margin Mastery and Strategic Pivots - Long-term strategic analysis, May 25, 2025

AInvest: Strategic Value in Legacy Media Platforms as Streaming Wars Cool - Post-consolidation value analysis, December 13, 2025

Stock Price Data:

Robinhood: WBD Stock Price Quote & News - Real-time pricing

Robinhood: Netflix: NFLX Stock Price Quote & News - Real-time pricing

Stock Analysis: Warner Bros. Discovery (WBD) Stock Price History - Historical data

Stock Analysis: Netflix (NFLX) Stock Price History - Historical data

FTC/DOJ 2023 Merger Guidelines

Official Guidelines:

Department of Justice: 2023 Merger Guidelines - Complete official text

Federal Trade Commission: Merger Guidelines 2023 - FTC official publication

DOJ/FTC Joint Press Release: Federal Trade Commission and Justice Department Release 2023 Merger Guidelines - December 18, 2023 announcement

DOJ: Guideline 7: When an Industry Undergoes a Trend Toward Consolidation - Vertical integration analysis

Legal Analysis:

Skadden: DOJ and FTC Release Final 2023 Merger Guidelines - Legal firm analysis, November 30, 2023

Baker McKenzie: United States: DOJ and FTC issue final merger guidelines - December 18, 2023

Axinn: With Final 2023 Merger Guidelines, DOJ and FTC Formalize Aggressive Enforcement - December 8, 2025 analysis

White & Case: U.S. Antitrust Agencies Finalize Changes to U.S. Merger Guidelines - December 18, 2023

Academic & Policy Analysis:

Mercatus Center: Decoding the 2023 FTC and DOJ Merger Guidelines - February 14, 2024

ProMarket: DOJ and FTC Chief Economists Explain the Changes to the 2023 Merger Guidelines - December 18, 2023

II. The Macro-Policy Paradox: Stagflation & Fiscal Dominance

Kevin Hassett Fed Chair Scenario

Recent Developments:

WSJ: Trump Says He Is Leaning Toward Warsh or Hassett to Lead the Fed - December 12, 2025

Fortune: Kevin Hassett says Trump’s opinion would have ‘no weight’ on the FOMC - December 14, 2025

CNN: A key decision of Trump 2.0 approaches — picking a Fed chair - December 13, 2025

CNBC: Trump says Kevin Warsh is at top of Fed chair candidate list - December 12, 2025

Policy Positions:

Reuters: Fed chair front-runner Hassett says ‘plenty of room’ to cut rates - December 9, 2025

Fox Business: Hassett signals major Fed overhaul plans as Trump’s chair frontrunner - December 10, 2025

NY Post: Fed chief frontrunner Kevin Hassett will do whatever it takes to push through Trump’s MAGA-nomics - December 12, 2025

Independence Concerns:

Evidence Network: Analysis US Federal Reserve Kevin Hassett - a Fed chief at Trump’s behest? - December 10, 2025

Politico: Trump boxes in his next Fed chair - December 10, 2025

Inflation & Tariff Impact

Current Inflation Data:

Trading Economics: United States - 10-Year Breakeven Inflation Rate - Updated December 11, 2025

YCharts: 10 Year TIPS/Treasury Breakeven Rate - Real-time data, December 11, 2025

FRED: 10-Year Breakeven Inflation Rate (T10YIE) - St. Louis Fed official data

Trading Economics: US 10 Year Treasury Note Yield - December 11, 2025

FRED: Market Yield on U.S. Treasury Securities at 10-Year Constant Maturity - December 11, 2025

Tariff Analysis:

American Progress: The Trump Administration’s Tariffs Are a Hidden Holiday Tax - Inflation impact quantification

CNBC: Trump tariffs are fueling inflation, congressional budget chief says - September 15, 2025

ABC News: Inflation climbed in August as Trump’s tariffs intensified - September 13, 2025

CBS News: 4 reasons why the Trump tariffs haven’t caused U.S. inflation to soar - August 20, 2025

Policy Contradictions:

Reuters: Fed rate-cut will animate Trumpian paradox - September 16, 2025

Bloomberg: Trump’s Contradiction: Demanding Steep Rate Cuts for a ‘Booming Economy’ - October 6, 2025

Investopedia: Why Trump’s Newest Fed Appointee Wants Steep Rate Cuts - September 19, 2025

Wage & Employment Data:

Hiring Lab: July 2025 US Labor Market Update: Wage Growth Is Outpacing Inflation - July 23, 2025

USAFacts: Are wages keeping up with inflation? - November 18, 2025

Fiscal Dominance Theory

Academic Literature:

Guillaume Plantin: Fiscal Dominance: Implications for Bond Markets and Central Banking - April 10, 2025 (PDF)

LSE: Fiscal Dominance in the Modern Era: Revisiting Sargent and Wallace - September 17, 2025 (PDF)

St. Louis Fed: Fiscal Dominance and the Return of Zero-Interest Bank Reserve Requirements - June 1, 2023

Federal Reserve: Simple Monetary Rules Under Fiscal Dominance - 2008 working paper

Wikipedia: Fiscal dominance - Concept overview

Policy Analysis:

Cato Institute: Central Bank Policies and the Debt Trap - 2017 (PDF)

Mercatus Center: Fiscal Dominance: How Worried Should We Be? - April 2, 2023

Chicago Booth Review: The Case for and against Central Bankers - November 15, 2023

OFCE: Central banks and public debt: dangerous liaisons? - December 31, 2024

Stagflation Context:

Wikipedia: Stagflation - Historical context

Equitable Growth: Austerity policies in the United States caused ‘stagflation’ in the 1970s - January 11, 2022

Invesco: What is stagflation, and can policymakers do anything about it? - December 7, 2025

III. The Productivity Paradox: AI & Work Intensification

Core Research Studies

Wall Street Journal Coverage:

WSJ: Your Prize for Saving Time at Work With AI: More Work - July 2025, primary source on time reallocation

WSJ: Are Companies Training Employees to Think Less, Not More? - Chris Ernst interview on cognitive capability

MIT Sloan Management Review:

Learning to Manage Uncertainty with AI - November 2024, 3,467-respondent study on organizational learning

Supporting Analysis

AI & Work Intensity:

LinkedIn: Netflix’s free ride on operating leverage: how long can it last? - October 2, 2025

PwC: Global M&A trends in technology, media and telecommunications - June 23, 2025

Additional Context & Framework

Howard Marks Investment Philosophy

Available Memos (Referenced Framework):

“Cockroaches in the Coal Mine” - Credit market risk detection

“A Look Under the Hood” - Risk attitude analysis

“The Calculus of Value” - Asset valuation framework

“More on Repealing the Laws of Economics” - Government intervention analysis

“Nobody Knows: Yet Again” - Uncertainty and tariff impact

Note: These memos inform the analytical framework but are not directly quoted in the article.

Data Sources

Financial Market Data:

Federal Reserve Economic Data (FRED) - St. Louis Federal Reserve

Trading Economics - Real-time economic indicators

YCharts - Financial data visualization

Bloomberg Terminal data (via secondary sources)

Regulatory Sources:

U.S. Department of Justice, Antitrust Division

Federal Trade Commission

U.S. Treasury Department

Bureau of Labor Statistics

Really appreciate the fiscal dominance breakdown here. The idea that real yields collapse when the Fed caps rates while tariffs drive inflation is the kind of second-level thinking people dunno how to price in yet. I was talking with some bond guys recently and they're genuinely worried about the Sargent-Wallace scenario playing out again. The Hassett angle makes this feel less like a academic exercise and more like something markets need to brace for sooner than most expect.

Thanks for sharing this. You highlighted two important things.

1. FED risking becoming a arm of political ambition will surely end in disaster. Having politicians extensibly be allowed to eat the cookie whilst saving it can only end with a catastrophe. There need to be a counterweight in the system, between politicians promising voters x, y, and z and the ability (in the case of the US) be able to fund every such promise. Despite how aweful the policy might be. If the FED goes under this changes now, whenever the democrats retain power, they will be forced to do the same (look at the chicken race with redistricting)

2. The use of AI and it producing more work/output is a hunch I had, and interesting to see the numbers. To me this is a trend driven by game theory relationships, where we think "if I don't do this, my competitors will, and then we lose". Incredibly hard to step off this kind of ever increasing race.