The Sorting Year: What We Learned From 2025 & Where We're Going in 2026

The Operating by John Brewton AI Year in Review & Predictions For the Year Ahead

Check out these reader favorites:

I. The Wrong Question Was Answered in 2025

We entered 2025 asking whether AI works, but that was never the binding constraint.

The actual constraint, the delineator between a thin slice of companies from the rest—was whether organizations could absorb and operationalize what AI makes possible. The models got better. The infrastructure was built. The individual users proved that AI could meaningfully move their needle. None of it mattered much because 95% of corporate AI projects failed to reach measurable P&L impact.

This is the core lesson from 2025:

AI is no longer a technology question. It is an organizational design question.

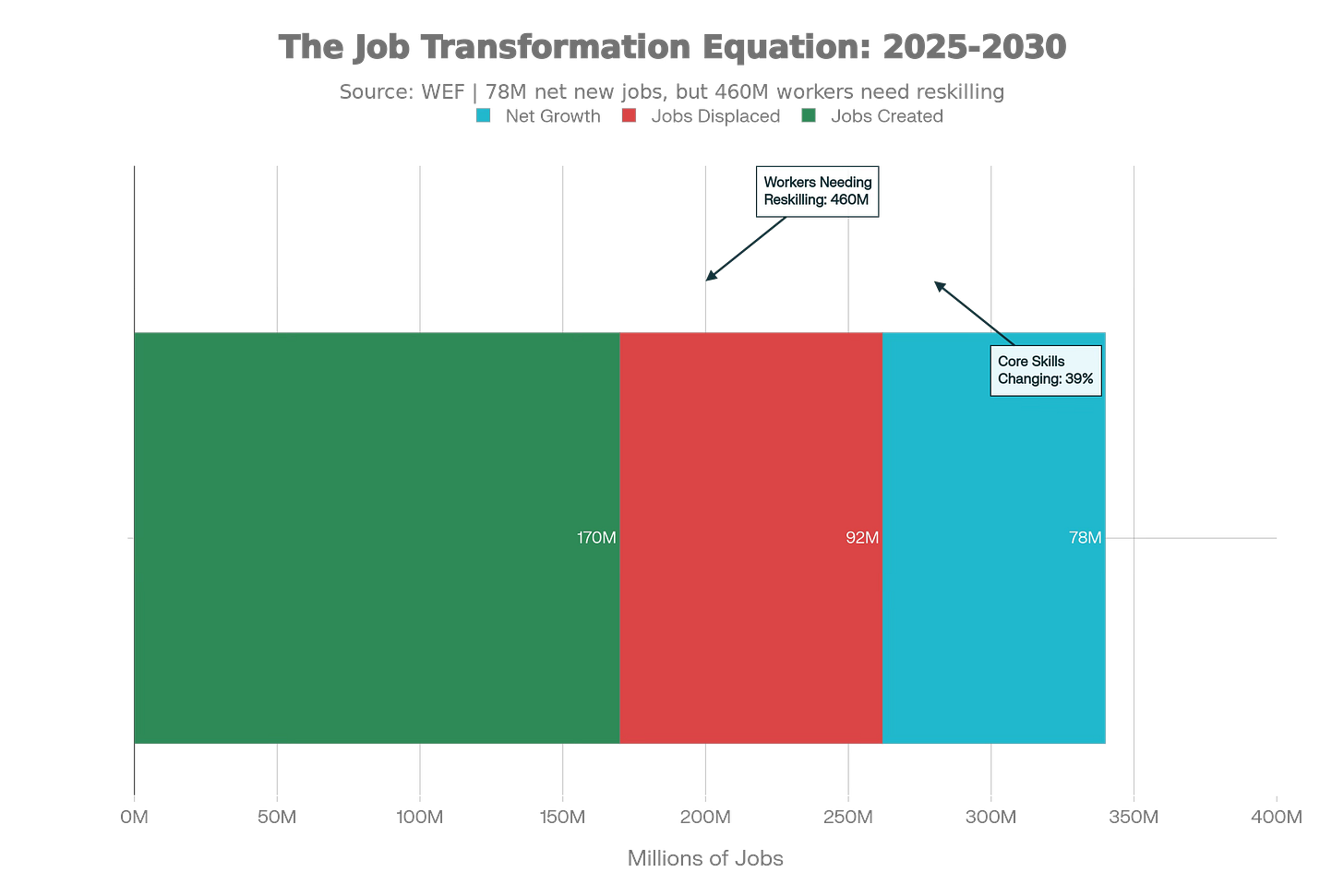

The World Economic Forum entered 2025 projecting 170 million new jobs, offset by 92 million displaced, a net gain of 78 million positions by 2030. McKinsey announced that 92% of executives planned to boost AI spending. Consultants and banks built models of 1.5% to 3% GDP uplift over the coming decades. Agentic AI was supposed to transform how work got done.

It’s arguable how much calling actually took place in 2025. But the extent to which this piece succeeded or failed is a matter of timeline, not operating constraints.

The constraint was not models. It was not capital. It was not infrastructure.

It was the ability of human organizations to redesign their workflows, rebuild their governance, and sustain the change. In other words: management.

2026 will be the year that the quiet, turbulent work of 2025 becomes visible. The companies that treated AI as an organizing focus for their work in 2025 will enter 2026 with measurable advantage. The rest will be cutting projects and hiring consultants.

II. What We Expected from 2025

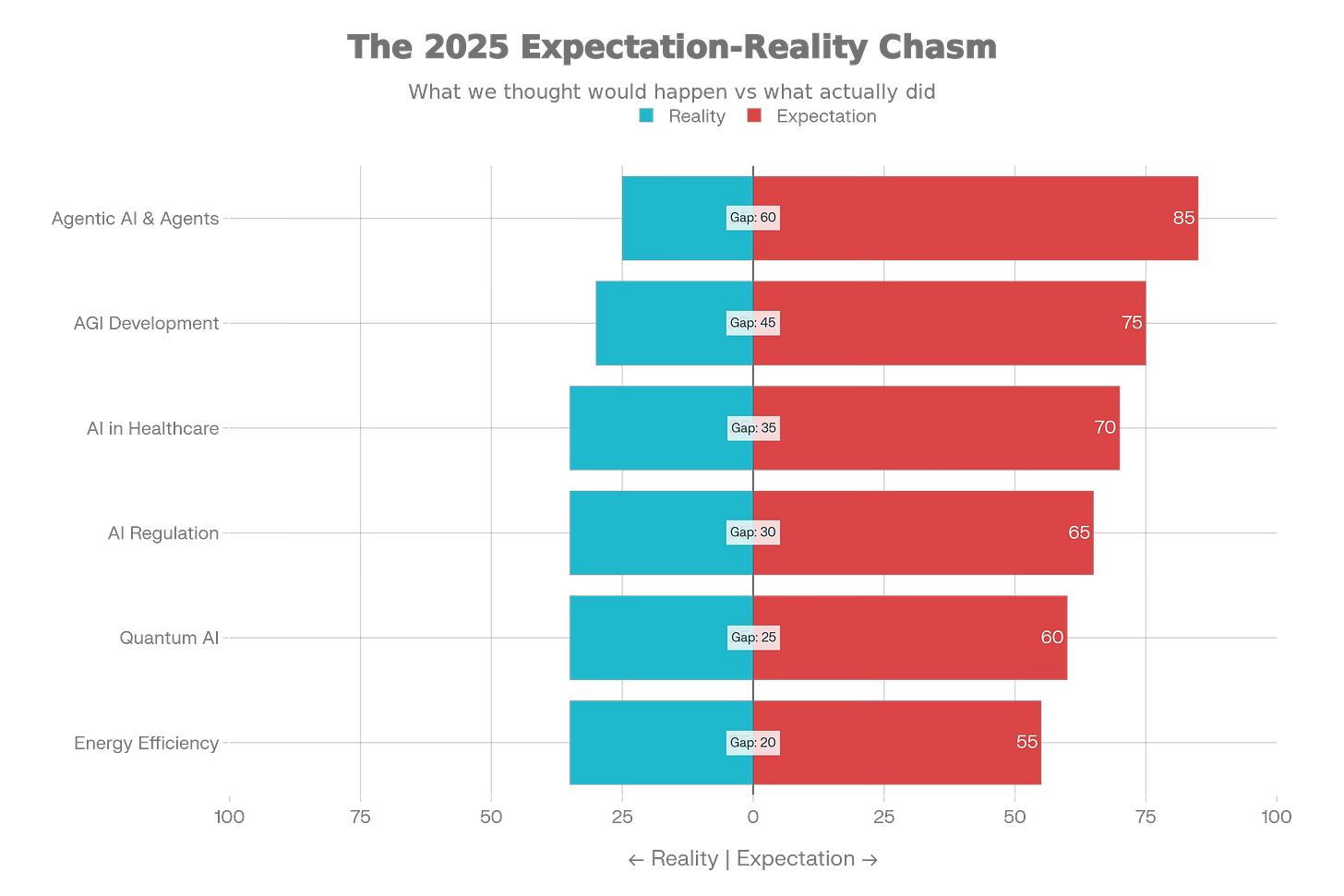

The Agentic Takeover

The dominant narrative entering 2025 was that agentic AI, systems capable of autonomous planning and multi-step task execution, would break through from research to production. Gartner predicted that 40% of enterprise applications would include agentic AI by the end of 2025. McKinsey and Accenture framed 2025 as the pivot year from copilots (tools that assist) to agents (tools that act).

AI would move from second brain to junior employee. Agents would manage workflows, coordinate across systems, and reduce the need for human orchestration. Knowledge workers would offload not just analysis but coordination and decision-making. The question was not whether agents would disrupt work, but how fast.

The Productivity Windfall

The macroeconomic case was more concrete. PwC’s Global AI Jobs Barometer showed that productivity in AI-exposed industries had nearly quadrupled between 2018 and 2024, from 7% to 27% growth. The World Bank, Wharton, and the St. Louis Federal Reserve all published research suggesting that AI would add 1.5% to 3% annual GDP growth by mid-century. The job forecasts suggested that while displacement would occur, net job creation would exceed it by nearly 5 to 1.

For companies, the implication was clear: AI would be a growth accelerant if you could capture it. For workers, it meant that the overall pie would expand enough to accommodate disruption and transition.

The Infrastructure Arms Race

Hyperscalers and big enterprises were in a capital race. Microsoft, Google, Amazon, and Meta announced plans to spend $320 billion combined on AI infrastructure in 2025. This was framed as table stakes, a race to own the compute layer before the returns compounded. Global AI spending was projected to hit $1.5 trillion in 2025 and $2 trillion by 2026. The logic was that early leaders in compute infrastructure would inherit the downstream applications and data advantage.

For corporate leaders, the calculus was: build pilots now, scale infrastructure, and harvest ROI as adoption accelerated.

WEF job transformation outlook: 170M jobs created, 92M displaced, yielding 78M net new positions by 2030. But 460M workers will need reskilling as 39% of core skills change. The math looks positive in aggregate but masks massive structural churn.

Global AI investment trajectory: from $988B (2024) to $2T+ (2026). Capital deployment is massive, but growth rate is decelerating (from 50% YoY to 37%), signaling market maturation even as absolute dollars continue climbing.

III. What Actually Happened

The 95% Funnel

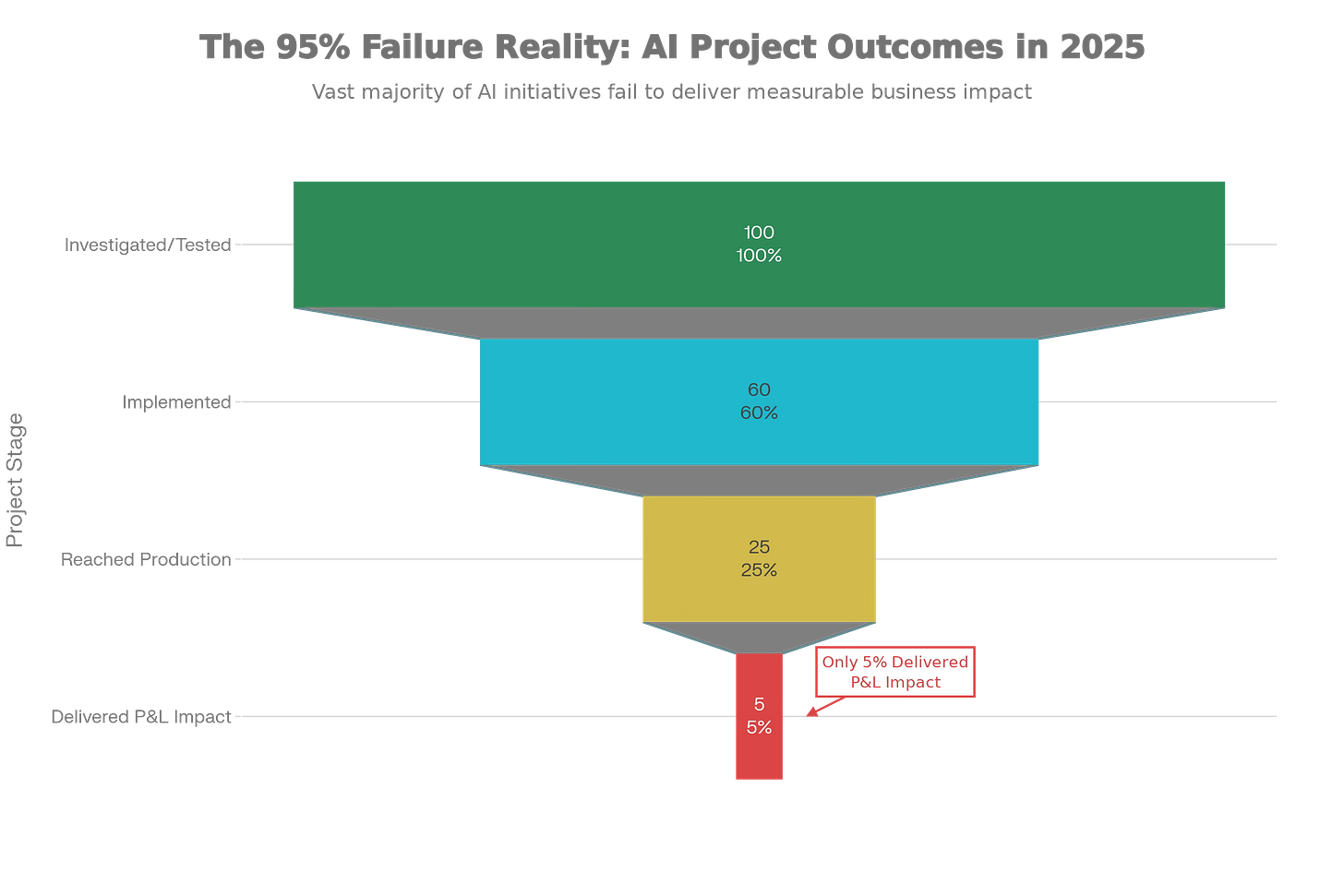

MIT research published in mid-2025 offered the cleanest diagnosis: 95% of corporate generative AI pilots failed to deliver measurable P&L impact.

The funnel was not encouraging:

80% of companies investigated or tested tools

40% actually implemented something

20% reached production

5% achieved measurable financial impact

This was not because the tools were weak or the business cases were unsound. It was because the projects stalled at every transition point: from experimentation to implementation, from implementation to production, from production to impact. Each step required organizational change that didn’t happen.

The stark funnel of AI adoption in 2025: 80% of companies investigated AI tools, yet only 5% achieved measurable P&L impact. Most projects stalled at the transition from experimentation to implementation to production.

The Abandonment Surge

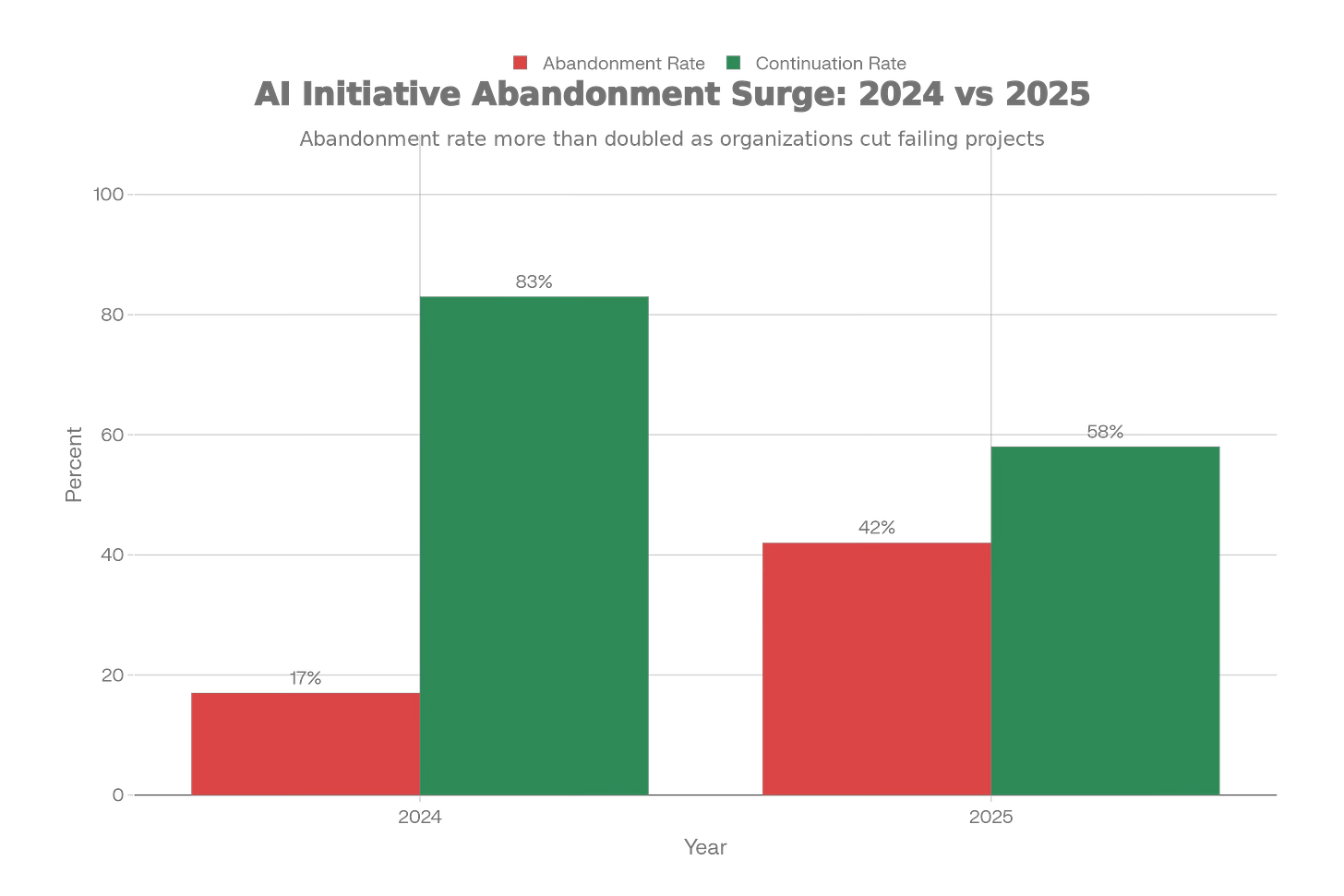

Midway through 2025, CFOs began to act on this reality. Abandonment rates for AI initiatives jumped from 17% in 2024 to 42% by year-end. Forrester found that 25% of planned AI spend was being deferred to 2027. Only 15% of AI decision-makers reported EBITDA lift from their initiatives.

This was not random. The companies cutting were largely those that had funded multiple pilots without closing any. The projects being abandoned were those that required significant process redesign but offered only incremental value.

Caption: Abandonment rates more than doubled in a single year (17% to 42%), signaling the hard reality check as CFOs cut underperforming AI initiatives. What was launched with optimism in 2024 was being pruned by mid-2025.

The Maturation Problem

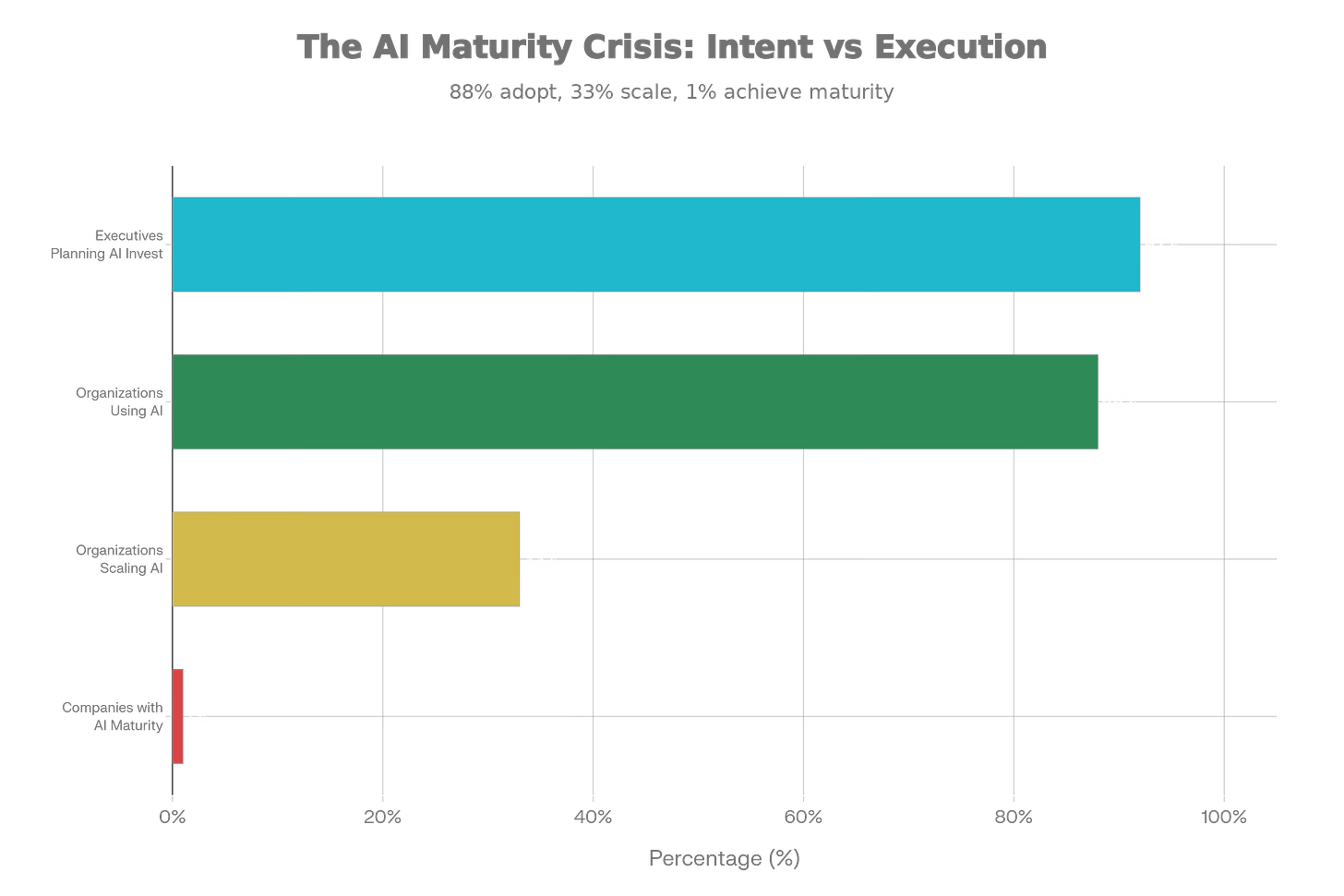

The metrics on adoption and maturity revealed a yawning gap:

92% of executives said they were planning to increase AI spending

1% considered themselves “mature”—meaning AI was fully embedded into workflows and driving material business outcomes

This was adoption theater, not transformation. Employees were using ChatGPT. Departments were running pilots. But core processes remained unchanged. The operating model remained unchanged. The org structure remained unchanged.

Caption: The maturity crisis exposed: while 88% of organizations use AI and 92% of executives plan investment, only 33% are scaling and a mere 1% have achieved maturity. Intent is widespread; execution is rare.

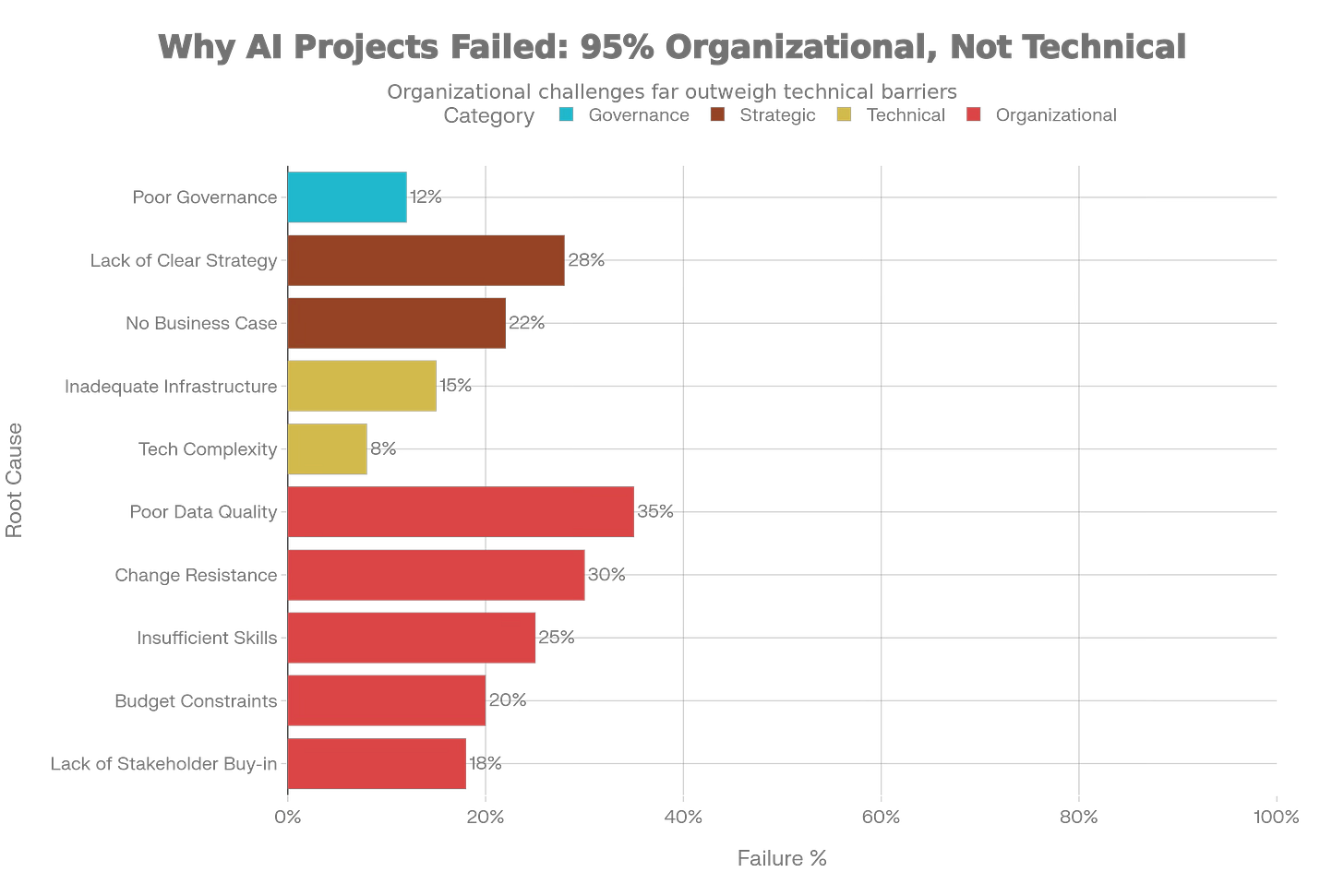

Organizational Failure

When you decomposed why projects failed, the picture was a bit stark. The MIT research and internal reviews from major consulting firms showed:

95% of failures traced to organizational issues, not technical ones

Data quality and governance problems affected 85% of failed projects

Integration with legacy systems was a barrier in 75%

Resource misallocation (wrong budget went to wrong problem) was present in 52%

Leadership disconnect (business and technical teams misaligned) in 70%

The pattern was consistent: companies underestimated the friction of changing how work gets done. They overestimated the ease of plugging AI into existing processes. They built pilots without redesigning the workflows those pilots were supposed to improve.

Caption: Root cause analysis of AI project failures in 2025: 95% were organizational, not technical. Data quality, integration challenges, and leadership misalignment dominated. Technology was not the constraint.

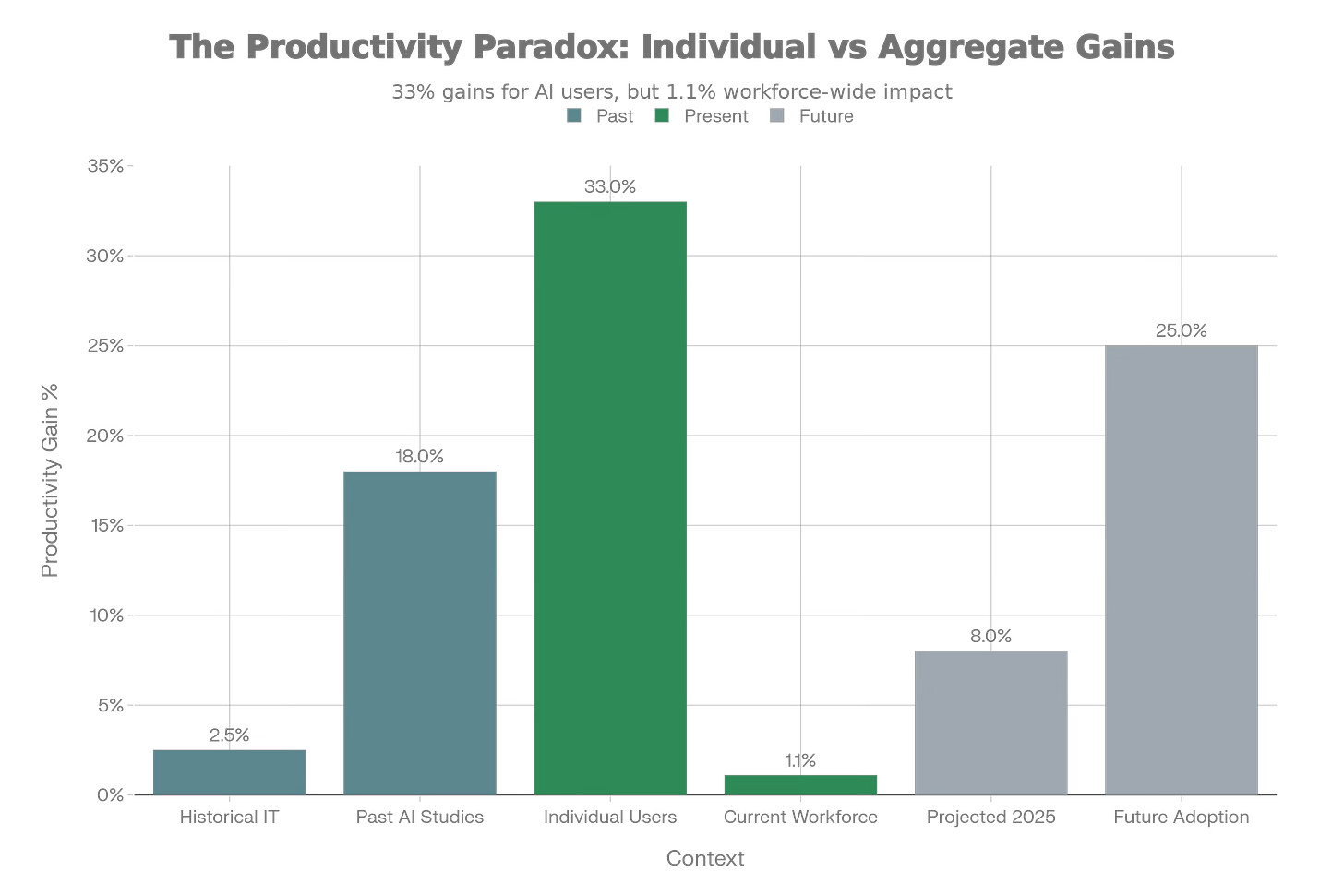

The Productivity Paradox

Yet, there was a paradox at the heart of 2025: at the individual level, AI worked. Workers who actively used generative AI reported roughly 33% productivity gains per hour. The St. Louis Federal Reserve found that AI users saved 5.4% of their work time, suggesting a 1.1% productivity boost across the workforce if usage scaled. Information services workers using AI saved 2.6% of their total time. The gains were real and measurable.

But at the aggregate level, the impact was invisible. Workforce-wide productivity growth in 2025 remained modest. GDP growth attribution to AI was negligible. The bottleneck was at the system design level, not individual or technological.

This was the core insight: individual leverage is real, but without process, org, and systems redesign, those gains dissipate into the friction of legacy ways of working.

Caption: The productivity paradox: individual AI users saw 33% hourly gains, yet workforce-wide impact remained just 1.1% in 2025. The gap between user-level benefits and organizational transformation reveals why projects fail despite strong individual ROI.

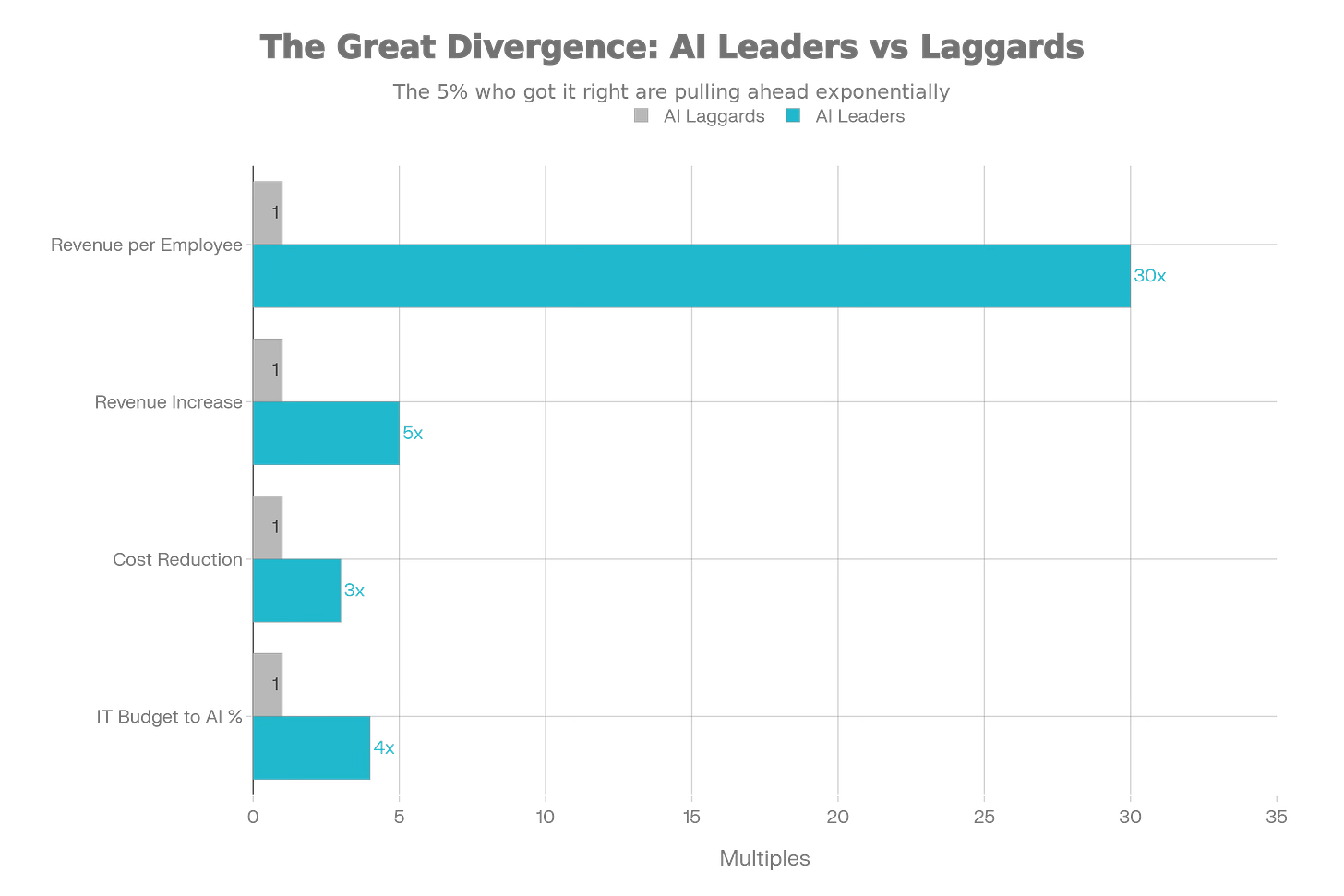

Leaders of the Pack

A small cohort of companies did manage to convert 2025 into structural advantage. BCG identified them as “future-built” companies—5% of the firms they studied. These companies operated fundamentally differently:

25-35 times revenue per employee versus traditional peers

5x revenue increase (2x higher than standard trajectory)

3x cost reduction (versus 1x for laggards)

64% of IT budget allocated to AI (versus baseline 10%)

These companies had redesigned core workflows around AI. They had rebuilt their data infrastructure. They had changed their operating model. The economics were not incrementally better; they were categorically different.

For everyone else, 2025 added cost, complexity, and political friction without measurable return.

Caption: The performance chasm between AI leaders (5% of companies) and laggards: 30x revenue per employee, 5x revenue growth, 3x cost reduction, and 4x higher AI budget intensity. The gap is not marginal—it is categorical.

IV. The Binding Constraint

Caption: The 2025 expectation-reality chasm: expectations were highest for agentic AI and autonomous agents (90 and 85), but reality delivered only 30 and 25. Job displacement fears (60) proved unfounded (15). Even productivity gains (80 expected vs 40 realized) fell short by half.

This is the move that matters for 2026.

In 2020-2023, the question was whether AI worked. By 2024, that was settled. The question became whether companies could adopt it. By late 2025, it became clear that adoption without redesign was made transformation effort impotent.

So the question for 2026 is different: Which organizations can treat AI as a redesign exercise rather than a tool deployment?

This requires seeing AI not as “software that gets implemented” but as “an operating system for the company.” In an AI-native organization, workflows are decomposed, redesigned, and reassembled around human-AI collaboration. Data governance is not a compliance box but a strategic capability. Process ownership is explicit. Change management is embedded into the operating model, not bolted on.

The organizations that did this in 2025 are now five years ahead of their peers.

The space between the leaders and the pack will only continue to widen.

V. Six Predictions for 2026

Prediction 1: The Year of AI Triage—CFOs Kill More AI Than They Fund

2026 is the year AI budgets get seriously analyzed for immediate productive contribution.

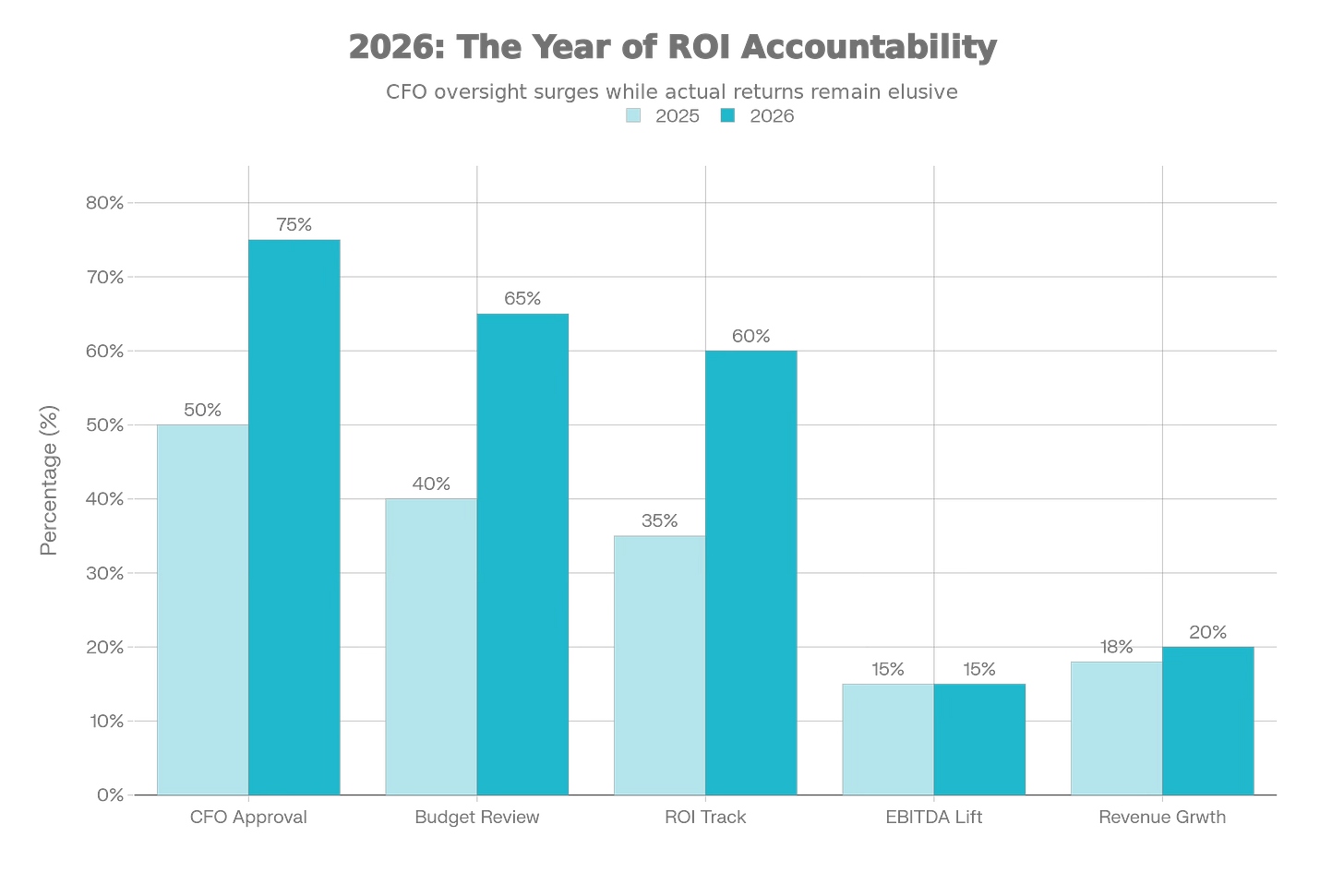

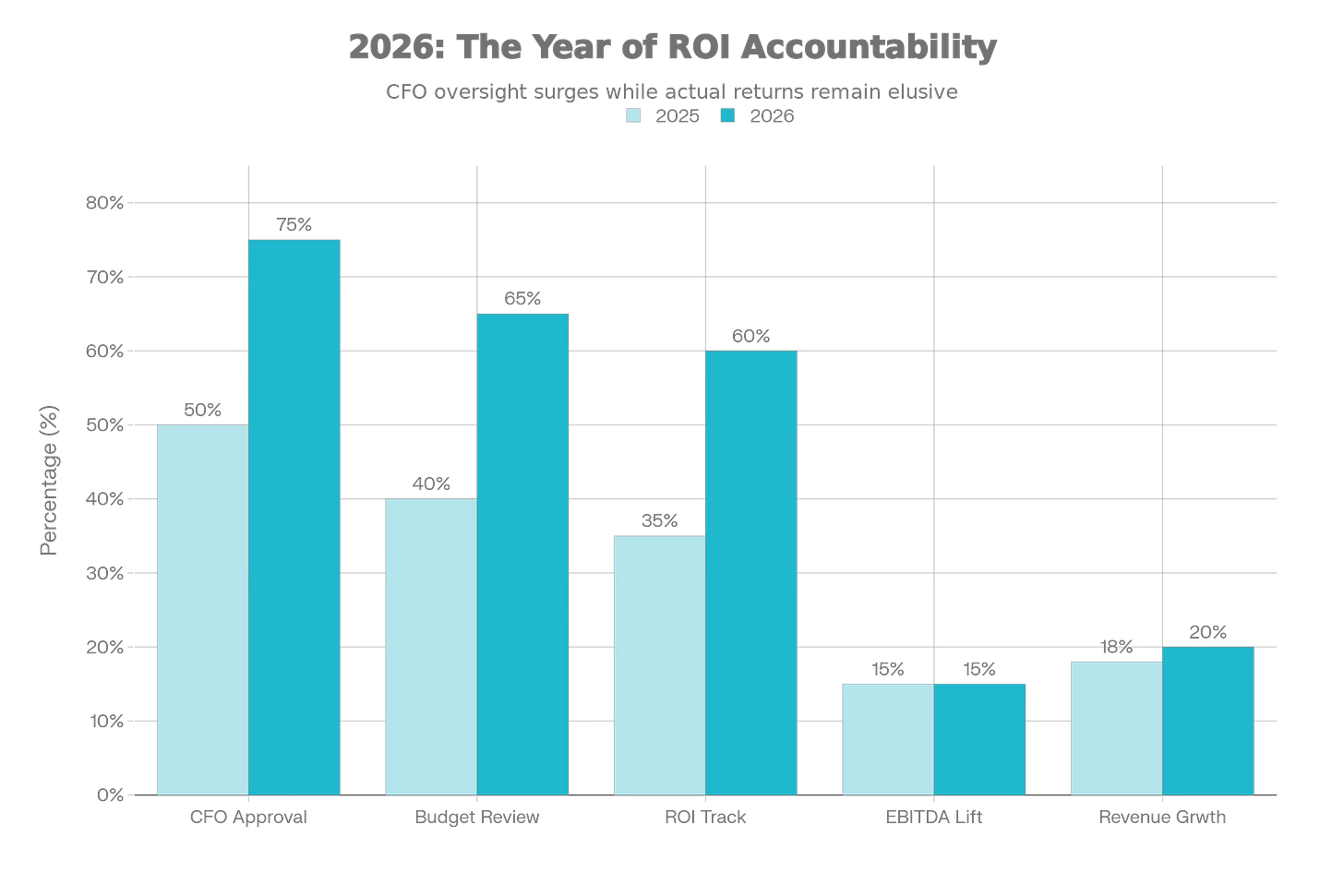

CFOs have now seen enough data to draw conclusions. Abandonment accelerated in 2025 (17% to 42%). ROI language tightened. The narrative shifted from “What’s our AI strategy?” to “What’s actually working and why?”

In 2026, expect:

25% or more of planned AI spend will be deferred, delayed, or permanently cut

CFO approval will be required for 75%+ of AI initiatives (up from ~50% in 2025)

The burden of proof will shift: projects now need clear P&L linkage before funding, not after

Successful pilots will graduate into production and and actual productivity analysis; unsuccessful efforts will be sunset.

The implication is straightforward: “We’re experimenting with AI” will no longer be a funded statement. Experiments that have run for six months without measurable impact will be shut down. Resources will consolidate toward initiatives with clear business logic.

For companies, this is a healthy triage. For individuals, it means that ambiguous AI projects become risky. The safe bet in 2026 is to attach yourself to one or two initiatives with clear ownership, clear metrics, and a clear path to production.

Caption: The ROI accountability shift from 2025 to 2026: CFO oversight surges from 50% to 75%, 25% of planned spend gets deferred, and only 15% report EBITDA lift despite higher expectations. Financial discipline is replacing experimentation rhetoric.

Prediction 2: The Real Moat Is Operating Discipline, Not Models

Advantage in 2026 accrues not to companies with better models, but to companies that can repeatably turn AI into redesigned workflows and measurable returns.

This is the flip from 2024-2025’s conventional wisdom. Everyone focused on model capability and infrastructure. The companies that won were the ones that built:

Explicit process redesign capabilities (ability to look at a workflow and re-architect it around AI)

Governance and oversight mechanisms that work at scale

Change management and organizational redesign (the boring stuff that’s actually hard)

Continuous monitoring and improvement loops (so pilots don’t become permanently half-baked)

The evidence for this is now in the data. The 5% of companies seeing 25-35x revenue per employee have access to the same models and chips as everyone else. Their advantage is operational.

In 2026, the companies that maintain and expand that advantage will be those that:

Have a named AI function with clear ownership (not scattered across departments)

Enforce governance on what models/agents can do and how they’re monitored

Rebuild their operating model to include explicit human-AI handoffs and oversight

Measure and iterate on AI-enabled processes with the same discipline they apply to any capital deployment

For professionals, this means the rising scarcity is in roles that sit at the intersection of process, org design, and technology. Product managers who can redesign workflows. Operators who can run transformation at scale. Data leaders who can build infrastructure for continuous improvement.

Prediction 3: Agents Matter in 2026—as Process Plumbers, Not Digital COOs

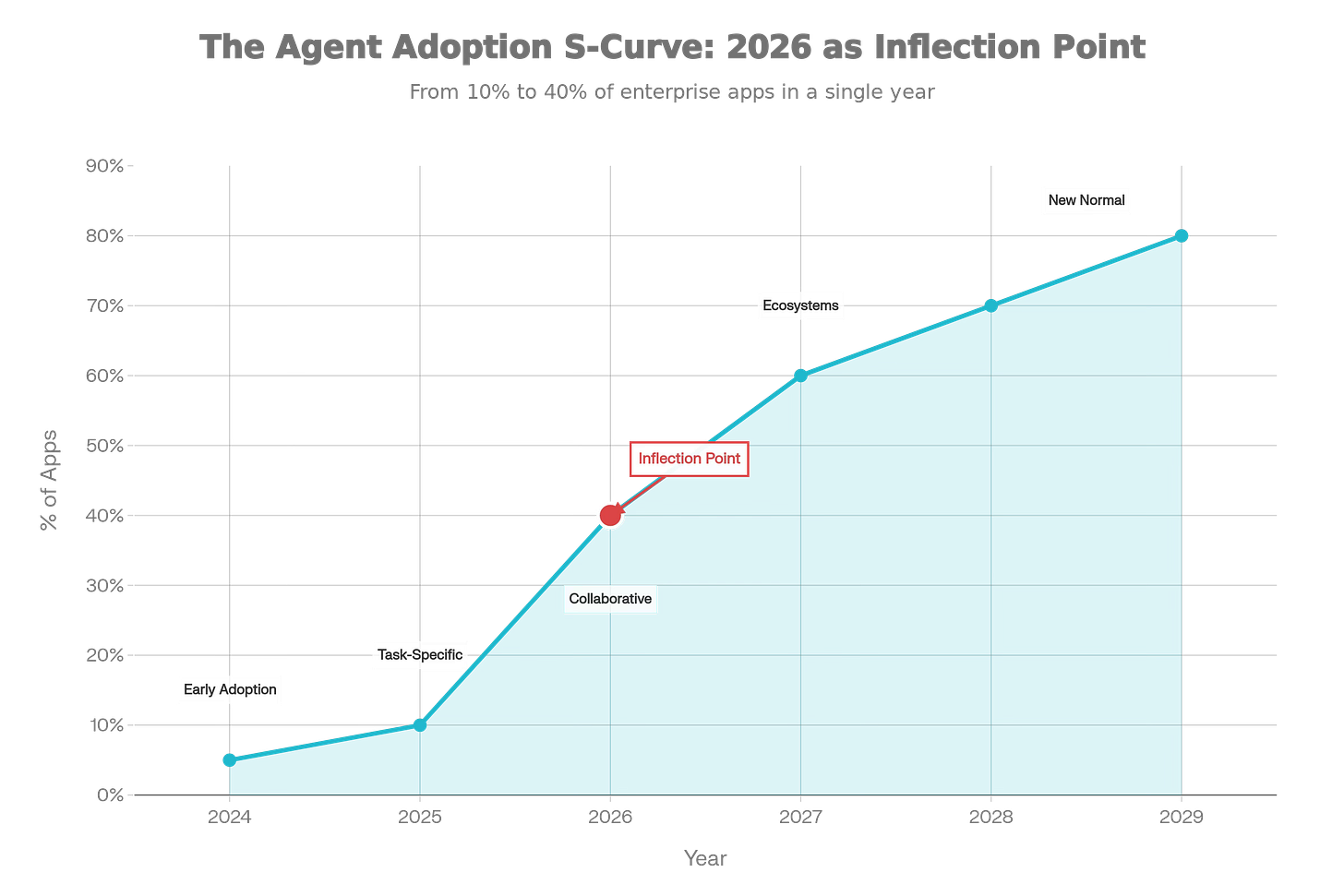

Agentic AI will break through in 2026, but not in the way most people expect.

The agent adoption S-curve is real. Gartner predicted 40% of enterprise applications would include AI agents by end of 2025; that is tracking to 40% by end of 2026. The agents that will matter are not the ones that “run your company” or “make strategic decisions.” They are the ones that run middle-office and back-office workflows: accounts payable, claims processing, data reconciliation, routing, scheduling, low-level QA. Boring AI will enable exponential productivity increases for the top minds and teams within many orgs.

Caption: AI agent adoption inflection point: from 10% of enterprise apps (2025) to 40% (2026) to 80% (2029). The jump from 2025 to 2026 marks the transition from early adoption to mainstream deployment, but primarily in rule-based workflows, not strategic decisions.

These are workflows that are:

Rule-heavy and repeatable (agents can be built and tested rigorously)

Integrable into existing systems (APIs and orchestration are manageable)

Measurable (cycle time, cost per transaction, error rate)

High-volume (so even modest per-instance improvement aggregates to material impact)

The agents that will not scale in 2026 are those that require high-context reasoning, cross-organizational coordination, or strategic judgment without human oversight. Those need another year or two of capability development.

For companies, the value play in 2026 is not “let’s deploy agents everywhere” but “which three processes are rule-based enough, measurable enough, and high-volume enough to justify agent orchestration?”

For professionals, this opens a new micro-discipline: workflow optimization and agent orchestration. The people who can take a grimy, repetitive process and decompose it into agent-friendly tasks will have a skill that’s in short supply.

Prediction 4: Career Ladders Restructure from the Middle Out

The 460 million workers needing reskilling by 2030 (per WEF) will not be evenly distributed. The disruption will hit middle and entry-level roles hardest—specifically, roles that consist primarily of information processing, coordination, and routine analysis.

By end of 2026, this restructuring will be visible:

Entry-level: Fewer apprenticeship roles. Routine writing, analysis, and drafting are being automated or augmented. Companies are not backfilling these positions. The classic “grind for two years in the mailroom to learn the business” is disappearing.

Middle management: Status reports, performance tracking, basic coordination—the bread and butter of middle management—are increasingly automated or handled by agents. Managers will need to add either (a) domain expertise or (b) system-level design skills to remain valuable.

Senior roles: Skew toward orchestrators and redesigners. The people who can take a workflow, understand its constraints, redesign it around AI, and own the outcome.

The implication is that companies will need to deliberately rebuild apprenticeship and training pathways. “Learn by doing routine work” will no longer be a viable skill development strategy. In its place, you will see rotations, structured projects, mentorship, and explicit skill development.

For individuals, the signal is clear: being purely administrative or coordinative is a declining asset. Value accrues to those who either (a) go deep (deep domain expertise that’s hard to replicate) or (b) go wide (systems thinking, cross-functional design).

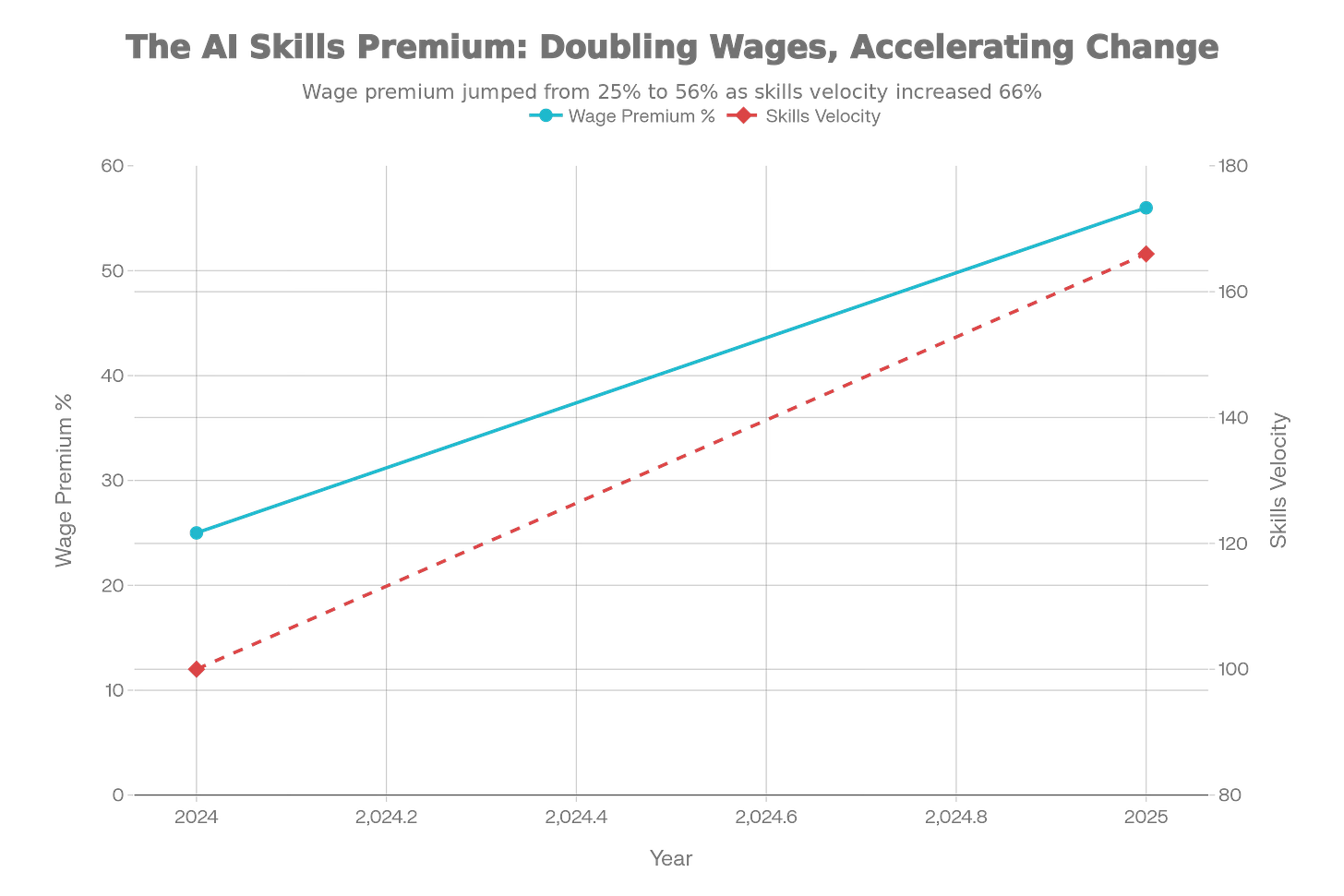

Prediction 5: The AI Skills Premium Shifts from “Tool Use” to “System Design”

The wage premium for AI skills is real and visible: from 25% in 2024 to 56% in 2025. In 2026, that premium will continue—but the skills it rewards will shift.

“Can use ChatGPT or Copilot well” will increasingly be table stakes, not differentiation. UIs will improve. AI will be embedded in every tool. Tool fluency will cease to be a scarce skill.

AI skills wage premium doubled from 25% to 56% in 2025, while skills change velocity increased 66%. But in 2026, the premium will concentrate in system design and workflow redesign, not tool fluency.

The premium will concentrate in people who can:

Redesign a workflow or product around AI and prove measurable impact

Stitch together models, data, and processes to solve non-routine problems

Understand the failure modes and guardrails of AI systems well enough to deploy them safely

This is a shift from “user” to “designer” or “architect.” And it requires not just AI literacy but deep domain knowledge plus systems thinking.

For professionals, the question to obsess over in 2026 is not “Am I good with AI tools?” but “Can I identify a recurring process that AI can improve, redesign it, implement it, measure it, and defend the ROI?” That is the skill that will command premium.

Prediction 6: 2026 Is the Last Year You Can Be “AI-Experimental” Without Structural Consequence

By end of 2026, the cost of waiting will be visible in the financials.

The companies that converted 2025 into structural advantage (5% of the sample) will enter 2026 already showing it in their operating metrics: revenue per employee, margins, time-to-market. The companies that remain in “pilot mode” will be increasingly aware that they are falling behind.

In 2026, the bar moves from “Do you have AI projects?” to “In which critical value streams is AI embedded, measured, and improving outcomes?” If the answer is “still figuring it out,” the structural gap is opening.

This is not hyperbole. The productivity and revenue differentials between AI leaders and laggards are already 30x on revenue per employee. Those will compound. Companies that start the AI-native redesign in 2026 will enter 2027 in a different economic league than those that are still debating strategy.

For organizations: 2026 is the window to pick 2-3 core value streams (not 10), redesign them end-to-end around AI, lock in measurable improvement, and prove you can do it repeatably. Failing to do so risks being permanently slotted into the laggard camp.

For professionals: this is the flip side of Prediction 1. The projects to attach yourself to in 2026 are the ones being accelerated and funded precisely because they have clear ownership, clear metrics, and a shot at production by Q4. Ambiguous portfolios are being cut. Real transformations are being resourced.

VI. What This Means: A Practical Frame for 2026

For Leaders and Operators

VII. 2026: The Sorting Year

2025 was the year we learned that AI’s binding constraint is organizational, not technological.

2026 is the year that constraint becomes visible in the financials and career trajectories. The companies that treated AI as an operating system redesign in 2025, rebuilding workflows, governance, and org structures, will enter 2026 with measurable advantage. The rest will be cutting projects and asking hard questions about what went wrong.

This is not a tech or solely an investment cycle, it is a management and organizational design cycle. The winners will understand this first.

The six predictions above are not forecasts of what might happen. They are descriptions of what is already happening at the margin and will accelerate in 2026. CFOs are already tightening discipline. Operating discipline is already the differentiator for the 5%. Agents are already moving toward production in back-office workflows. Career ladders are already restructuring. Skills premiums are already shifting. And the window for “still experimenting” is already closing.

When we look back from 2030, will 2026 be the year your organization moved AI from pilot to operating system, or the year the gap became permanent?

The data from 2025 suggests the answer will already be written into your revenue per employee, your margins, and your ability to attract and retain talent.

The sorting year is here.

Get to work, friends.

- j -

Until the first full operating week of 2026 is upon us (1.5.26), I’m offering this deep discount on monthly, annual, and Founding Operator Memberships to the Operating by John Brewton community.

The 2026 “Operating Founder” Steal

As an Operating Founder, you receive four quarterly 1:1 working sessions with me and a bonus 50-minute AI Upskilling Session (see the Operating by John Brewton Ultimate Upskilling Guide).

For $197 ($997 on Monday, the 5th), the Operating Founder tier is priced to remove all friction for those who would like to start meeting and working 1:1.

Here are some examples of what the 1:1 sessions can be used for:

Business operating review and strategy setting for your company

Development of solutions to an immediate team building or cultural challenge

Career, job hunting and interviewing strategy (I’ve interviewed more than 2,000 candidates over the years and hired more than 300)

Graduate school applications, preparation, and student career planning (I’m a graduate of Harvard and the University of Chicago)

Creator and solopreneur business plan strategy and brainstorming

Content and social growth strategy (I’ve been growing an audience of +46,000 across my LinkedIn Channels and Substack)

Anything else that you would find useful!

The 2026 New Year’s Weekend Offer

Monthly: $27 → $17 (Sample the work)

Annual: $197 → $75 (Commit to a year of operating discipline)

Founding Member: $997 → $197 (The “Operator” Tier)

Click here to claim your discount:

Sources and Further Reading

Key Reports Referenced

McKinsey & Company

Superagency in the Workplace: Empowering People to Unlock AI’s Full Potential (January 2025)

The State of AI in 2025: Agents, Innovation, and Transformation (November 2025)

Boston Consulting Group

Are You Generating Value from AI? The Widening Gap (October 2025)

Agents Accelerate the Next Wave of AI Value Creation (December 2025)

BCG-FICCI Report: AI to Perform Majority of Tasks by 2026 (December 2025)

World Economic Forum

Future of Jobs Report 2025: Jobs of the Future and Skills You Need (January 2025)

Beyond the Inflection Point: New Forces Shaping Work Transformation (December 2025)

PwC

2025 Global AI Jobs Barometer (June 2025)

2026 AI Business Predictions (December 2025)

Forrester Research

Predictions 2026: AI Agents and New Business Models Transform Enterprise Software (November 2025)

Forrester’s 2026 Technology and Security Predictions (October 2025)

Gartner

Top Strategic AI Predictions for 2026 and Beyond (October 2025)

40% of Enterprise Apps Will Feature AI Agents by 2026 (September 2025)

Deloitte

TMT Predictions 2026: The AI Gap Narrows But Persists (November 2025)

The Agentic Reality Check: Preparing for a Silicon-Based Workforce (December 2025)

Academic and Research Institutions

MIT / Wharton / Federal Reserve

MIT Report: 95% of Generative AI Pilots at Companies Are Failing (August 2025)

Wharton Budget Model: Projected Impact of GenAI on Future Productivity Growth (September 2025)

St. Louis Federal Reserve: The Impact of Generative AI on Work Productivity (February 2025)

Stanford / Harvard / IBM

IBM Think: AI Agents in 2025—Expectations vs. Reality (March 2025)

Stanford AI Experts Predict What Will Happen in 2026 (December 2025)

Harvard Business Review: How AI Is Redefining Managerial Roles (June 2025)

Industry Analysis and Commentary

Technology and Business Media

Bloomberg: Agentic AI in 2025 Brought More Hype Than Productivity (December 2025)

MIT Technology Review: The Great AI Hype Correction of 2025 (December 2025)

Forbes: AI’s Honeymoon Is Over—12 Predictions for the 2026 Reckoning (December 2025)

The Economist: Lessons from the Frontiers of AI Adoption (December 2025)

Failure Analysis and Lessons Learned

ISACA: Avoiding AI Pitfalls in 2026—Lessons Learned from Top 2025 Issues (December 2025)

TechFunnel: Why AI Fails—The Untold Truths Behind 2025’s Biggest Lessons (October 2025)

Harvard Business Review: Why Agentic AI Projects Fail—And How to Set Yours Up for Success (October 2025)

Investment and Market Dynamics

Goldman Sachs: Why AI Companies May Invest More than $500 Billion in 2026 (December 2025)

BlackRock: AI to Continue Dominating Markets in 2026 Despite Risks (December 2025)

John Brewton documents the history and future of operating companies at Operating by John Brewton. He is a graduate of Harvard University and began his career as a Phd. student in economics at the University of Chicago. After selling his family’s B2B industrial distribution company in 2021, he has been helping business owners, founders and investors optimize their operations ever since. He is the founder of 6A East Partners, a research and advisory firm asking the question: What is the future of companies? He still cringes at his early LinkedIn posts and loves making content each and everyday, despite the protestations of his beloved wife, Fabiola, at times.

I think 2026 will be a massive wake-up call for people who thought tool fluency was the finish line.

The real premium is moving toward the architects who can actually redesign the workflow, not just the people who know how to write a good prompt.

Only 5% of the companies reached measurable impact… crazy low but I think will change in the coming years