The Operating Week Ahead (Free Version): A Bifurcating World

How the best companies and creators compete in 2026 (Free Version)

Check out these reader favorites:

This week’s coverage from the Wall Street Journal, Financial Times, The Economist, Harvard Business Review, MIT Technology Review, Wired, Fast Company, and creator-economy analysts reveals a single pattern: the future of operating is splitting into two distinct architectures, each with radically different governance, cost structures, and competitive advantages.

Traditional firms are exhausted by perpetual transformation cycles. Creator-led micro-firms are just beginning to scale. Both are converging on the same realization: adaptive capacity, embedded in operating systems and governance, is the only sustainable moat.

Harvard Business Review’s “Get Off the Transformation Treadmill” landed this week with data that should terrify executives: 95% of large organizations have undergone 2+ major reinventions in the prior two years; 61% have hit four or more transformations.

Serial transformations breed employee disengagement, erode investor confidence, and drain resources. McKinsey’s own CEO Bob Sternfels, marking the firm’s 100-year milestone, is shifting from pure advisory to outcomes-based partnerships—a signal that the firm believes advice-giving alone no longer works. The implication is stark: perpetual transformation is failing. The escape route is not another big-bang reinvention. It is embedding adaptive capacity directly into the operating model—faster decision-making cycles, clearer governance, continuous sensing—so that organizations can adapt without periodic organizational trauma.

The winning playbook: treat adaptive capacity as a property of the system, not an overlay initiative. This is a C-suite and board question.

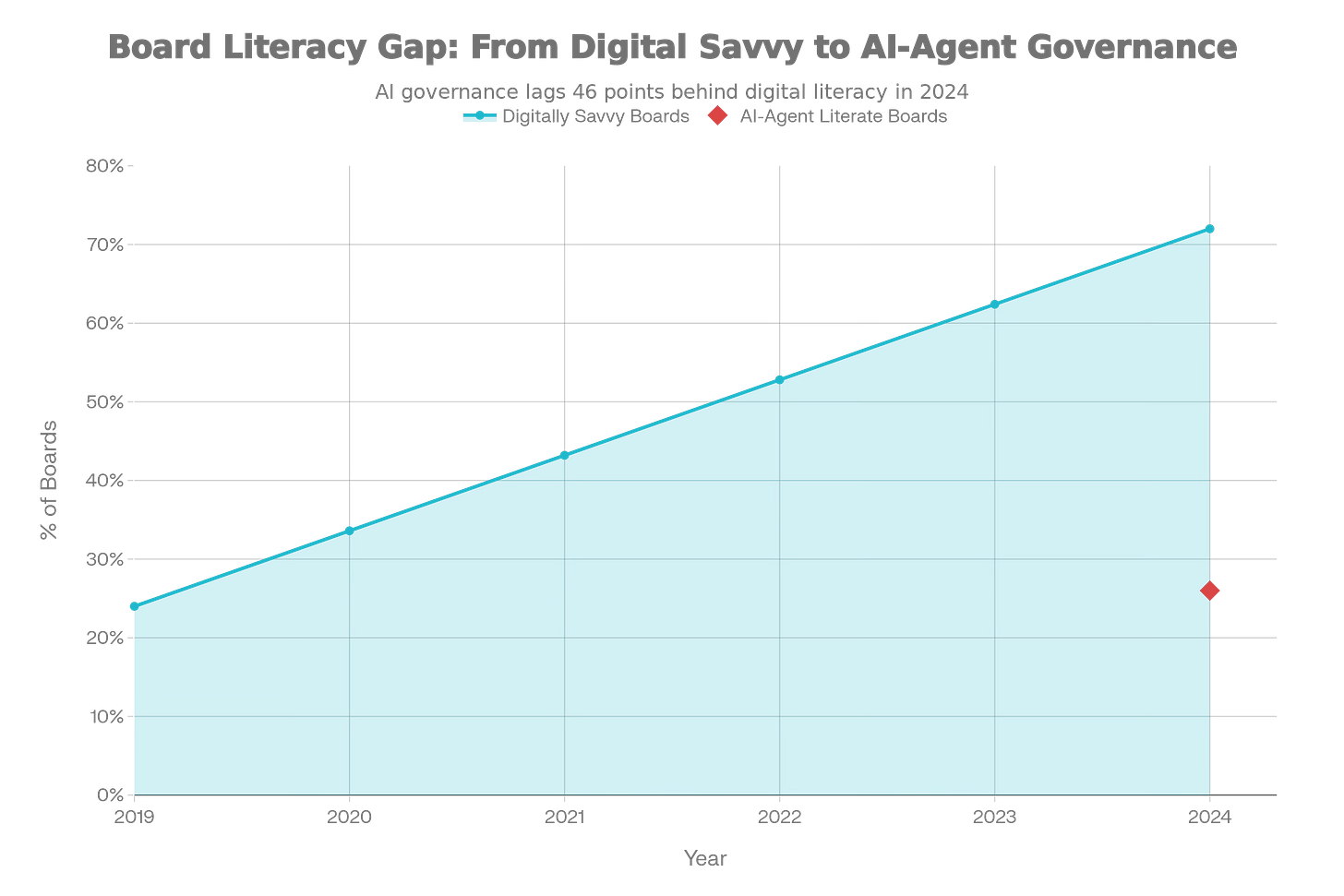

The AI Governance Gap

MIT Sloan’s “AI-Savvy Boards Drive Superior Performance” reveals a striking finding: only 26% of large firms have boards equipped to understand and govern next-generation AI—AI agents, robotics, specialized tech like fintech and regulatory tech.

This matters because boards govern the boundary between human and machine decision-making. If they don’t understand this boundary, they cannot effectively oversee it. Meanwhile, 70% of large enterprises have Chief Data Officers in established roles (up from 50% last year), with only 3% viewing the role as a failure. Data and AI governance, embedded in the C-suite, is becoming a competitive differentiator.

The gap is widening: firms that upgrade their board literacy on AI-agent systems now will make faster, higher-quality decisions and pull ahead of the pack.

While digital board literacy has improved dramatically (24% to 72%), only 26% of boards are equipped to govern next-generation AI systems—revealing a critical new gap

The full paid subscriber article includes five strategic charts, an organized source appendix, and a complete analysis of how both traditional firms and operating creators compete in 2026 (paid version releases at 8:00 PM on day of publication).

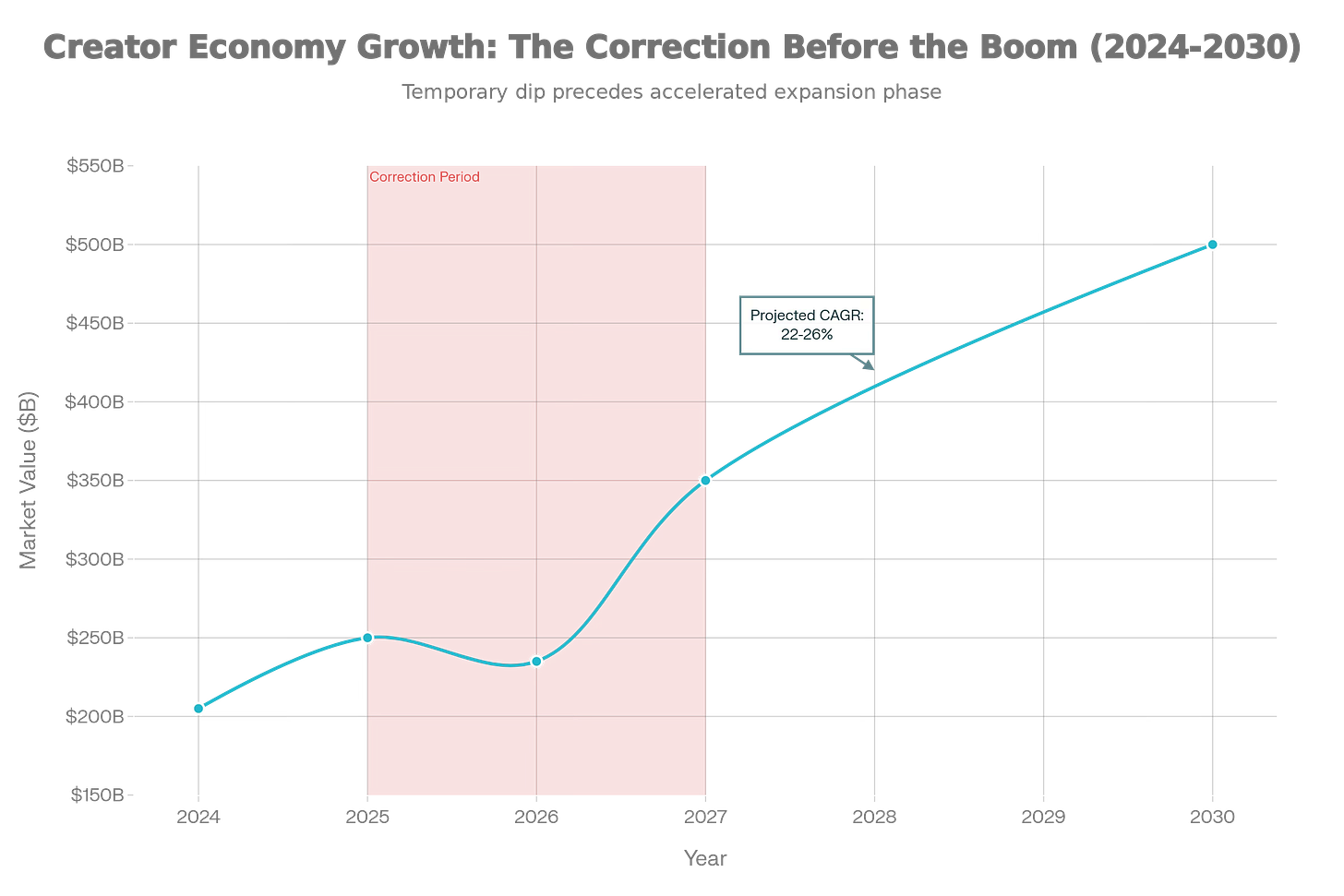

The AI Bubble (And the Correction Coming)

MIT Sloan’s “Five Trends in AI and Data Science for 2026” is blunt: generative AI valuations are decoupling from measurable productivity gains.

Most GenAI deployments (email, documents, presentations) show “incremental and mostly unmeasurable” productivity gains. Only 39% of companies have implemented AI in production at scale. The dot-com parallel is explicit: high valuations, user-growth emphasis over profit, expensive infra buildout, and limited tangible ROI.

What this means: Firms over-investing in splashy GenAI pilots without coherent infrastructure or organizational alignment are vulnerable. Winners will be those building agentic AI infrastructure and governance now—before the correction forces consolidation.

Energy and Infrastructure Are Now Strategic Constraints

The MIT Technology Review’s “10 Breakthrough Technologies for 2026” reveals that hyperscale AI data centers are constrained by energy supply, not compute capability. Vistra and Oklo (nuclear power companies) surged after being selected by Meta for AI data-center power.

The competitive implication: The next moat is not software; it is control over energy, compute, and data-center capacity. Firms must think strategically about their energy footprint.

The creator economy is projected to cross $500B by 2030, but a correction in 2026 may separate serious infrastructure plays from hype-driven valuation.

The full paid subscriber article includes five strategic charts, an organized source appendix, and a complete analysis of how both traditional firms and operating creators compete in 2026 (paid version releases at 8:00 PM on day of publication).

The creator economy has crossed an inflection point. ~200M creators globally, with an estimated $250B market in 2025, projected to exceed $500B by 2030.

But scale is not the story. The strategic shift is that winning creators are no longer playing an “influencer” game—they are building vertically integrated micro-firms that compete directly with traditional organizations.

Venture capital has already pivoted. Over half of $2B in 2025 creator-economy funding went to AI creation tools and social-commerce infrastructure, not to individual creator stars. Platforms like Substack (1.1B valuation, Series C in 2025) are betting that creator-owned media infrastructure—where creators control relationships, not algorithms—will be the durable moat.

The 2026 operating creator is not a freelancer. They are a firm, with product, media, distribution, and community under one roof, orchestrated by AI and systems rather than people.

Foundational architecture: AI and automation are not optional; they are the cost structure. AI agents handle back-office operations, content repurposing, customer lifecycle management, and product development. This dissolves the cost structure that once made small teams uncompetitive.

Revenue architecture: Where prior creators relied on ads (8% margins, algorithmic risk), 2026 operators are diversifying into owned digital products, memberships, and commerce, capturing 70–90% margins and control when algorithms shift.

Competitive positioning: Niche depth replaces broadcast reach. As AI-generated content floods feeds, authenticity gets repriced. Winners focus on tight positioning, episodic community arcs, and superfan depth—high-trust micro-communities over commoditized follower counts.

Whether you are a Fortune 500 firm exhausted by transformation cycles or a one-person creator competing against AI slop, the pattern is identical:

Organizations that embed adaptive capacity into their operating systems outcompete those that don’t.

For traditional firms, this means: faster decision cycles (embedded in governance), upgraded board literacy, systems for continuous sensing, and optionality to absorb political volatility.

For creators, this means: AI as a foundational architecture, systems that scale without increasing headcount, rapid iteration on positioning and channels, and community infrastructure that is resistant to algorithm changes.

Both point to the same insight: leverage and systems beat headcount. McKinsey encodes expertise into outcomes-based partnerships. Creators encode strategic decisions into AI agents. The future competitive advantage accrues to those that invest in governance systems and AI-native operations, not those that hire smarter people.

The Fork in the Road

The bifurcating economy has two trajectories.

Winners will: embed adaptive capacity into governance, upgrade board/leadership AI literacy, own revenue surfaces, build community as moats, treat purpose as governance.

Losers will: remain exhausted by change cycles, lock capital into inflexible strategies, and depend on fragile, algorithm-dependent revenue surfaces.

The future of firms is being written by those building the systems and governance to operate at speed in a world of higher volatility, deeper government intervention, and faster adaptation cycles.

Where are you on this continuum?

How can Operating by John Brewton be more helpful along your path ahead?

- j -

Paid subscribers get:

Full synthesis across corporate strategy, AI governance, energy constraints, and creator economy

Deeper causal models: what drives what and where the competitive flywheels are

Week-to-week evolution: what changed and what to watch next

Operating implications: how these trends compound and what happens if they don’t

More charts, more

The full article includes six strategic charts, an organized source appendix, and a complete analysis of how both traditional firms and operating creators compete in 2026. (paid version releases at 8:00 PM on day of publication).

John Brewton documents the history and future of operating companies at Operating by John Brewton. He is a graduate of Harvard University and began his career as a Phd. student in economics at the University of Chicago. After selling his family’s B2B industrial distribution company in 2021, he has been helping business owners, founders and investors optimize their operations ever since. He is the founder of 6A East Partners, a research and advisory firm asking the question: What is the future of companies? He still cringes at his early LinkedIn posts and loves making content each and everyday, despite the protestations of his beloved wife, Fabiola, at times.

This is less of an 'Operating Week Ahead' and more of a 'Corporate Strategy Decade Ahead.' 😉

Brilliant map of the terrain (Energy, Governance, Micro-Firms). The point on 'Energy as the new Moat' is something 99% of digital operators are sleeping on.

I appreciate the energy angle. To that, I'd add control of shovels and diggers. Lining up projects is one thing, having ENOUGH physical labor might be another story