Operating Leaders: How JP Morgan Chase Showed the Rest of Us What AI Transformations Can Achieve (Part One)

A Financial Performance and AI Investment Analysis (2021-2026)

Welcome Readers! This article is the first of a two-part series, a collaboration between Operating by John Brewton and The Data Letter author and Asaura AI founder, Hodman Murad.

Hodman Murad founded Asaura AI to develop artificial intelligence systems that help people with ADHD and executive dysfunction. She publishes Asaura, exploring how AI can enhance human productivity and mental health. She builds in public, connecting high-performance systems with their users.

Hodman also writes The Data Letter, analyzing common failures in AI and data systems, including hallucinated growth metrics, customer loss from misguided optimization, and mismanaged AI agents.

We set out to merge my expertise in corporate financial and economic analysis with Hodman’s deep technical background in data science and engineering, with the hope of creating a case study valuable to operators, founders, builders, students, and investors alike. JPMorgan Chase’s comprehensive approach to AI transformation stands out as unparalleled in both scope and execution. Amid widespread narratives about struggling digital transformations, we wanted to examine what’s demonstrably working.

Hope this helps! Thank you for reading!

Part Two from Hodman, How JPMorgan Built AI Infrastructure That Delivers $2 Billion in Annual Returns, will be released on Wednesday of this week, and we will also be doing a Substack Live to talk about this work.

Start Here: Executive Summary

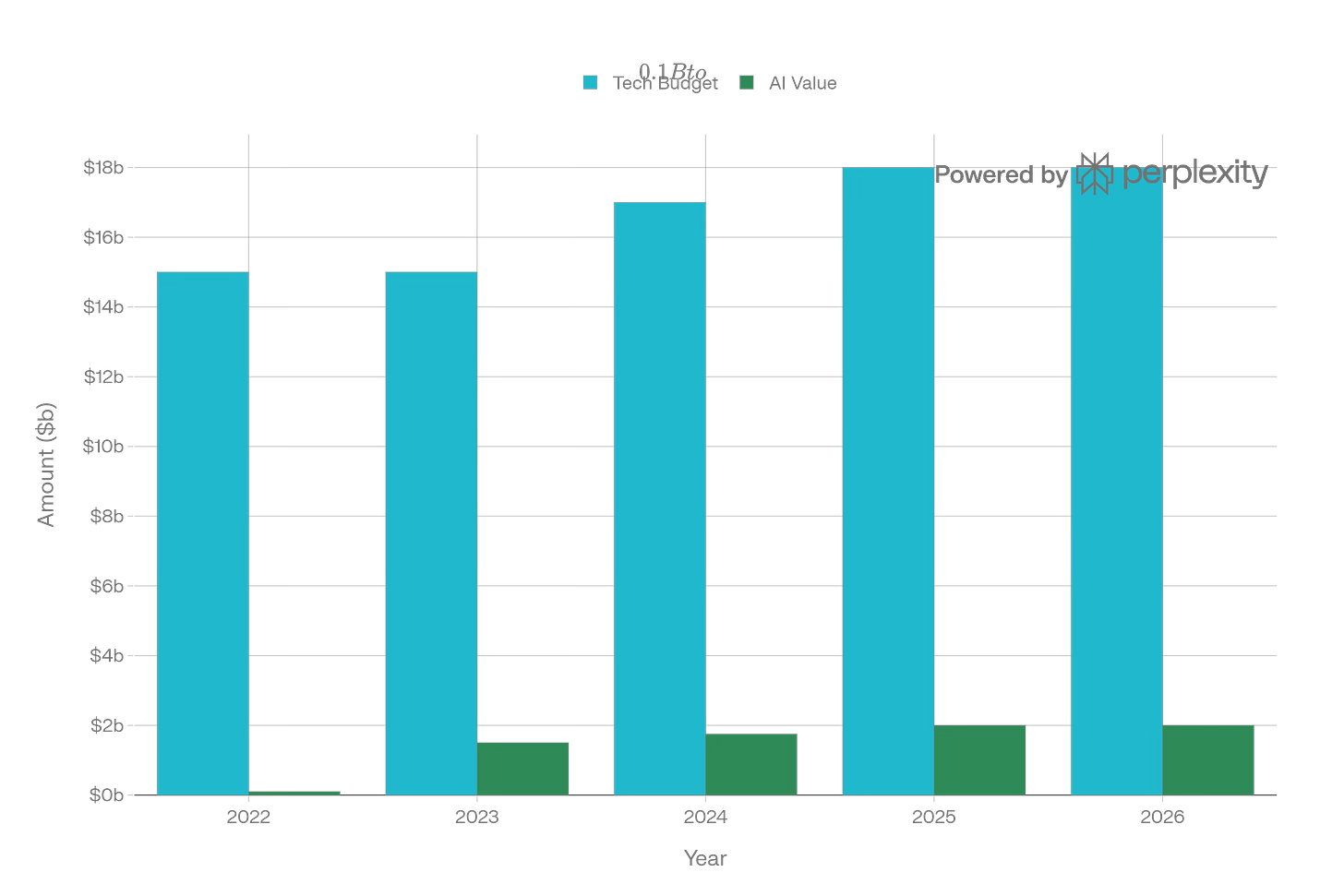

JPMorgan Chase has executed one of the most aggressive and transparent artificial intelligence strategies in global banking, transforming a $15 billion technology budget in 2021 into an $18 billion AI-enabled competitive engine by 2025. This analysis examines the bank’s financial performance since 2021 alongside explicit mentions of AI spending and operational impact across quarterly earnings reports, annual shareholder letters, and executive statements. The evidence reveals a deliberate, multi-year AI buildout that has delivered measurable returns—from $100 million in business value in 2022 to $2 billion annually by 2025—while positioning the institution as the clear AI leader among global financial institutions.

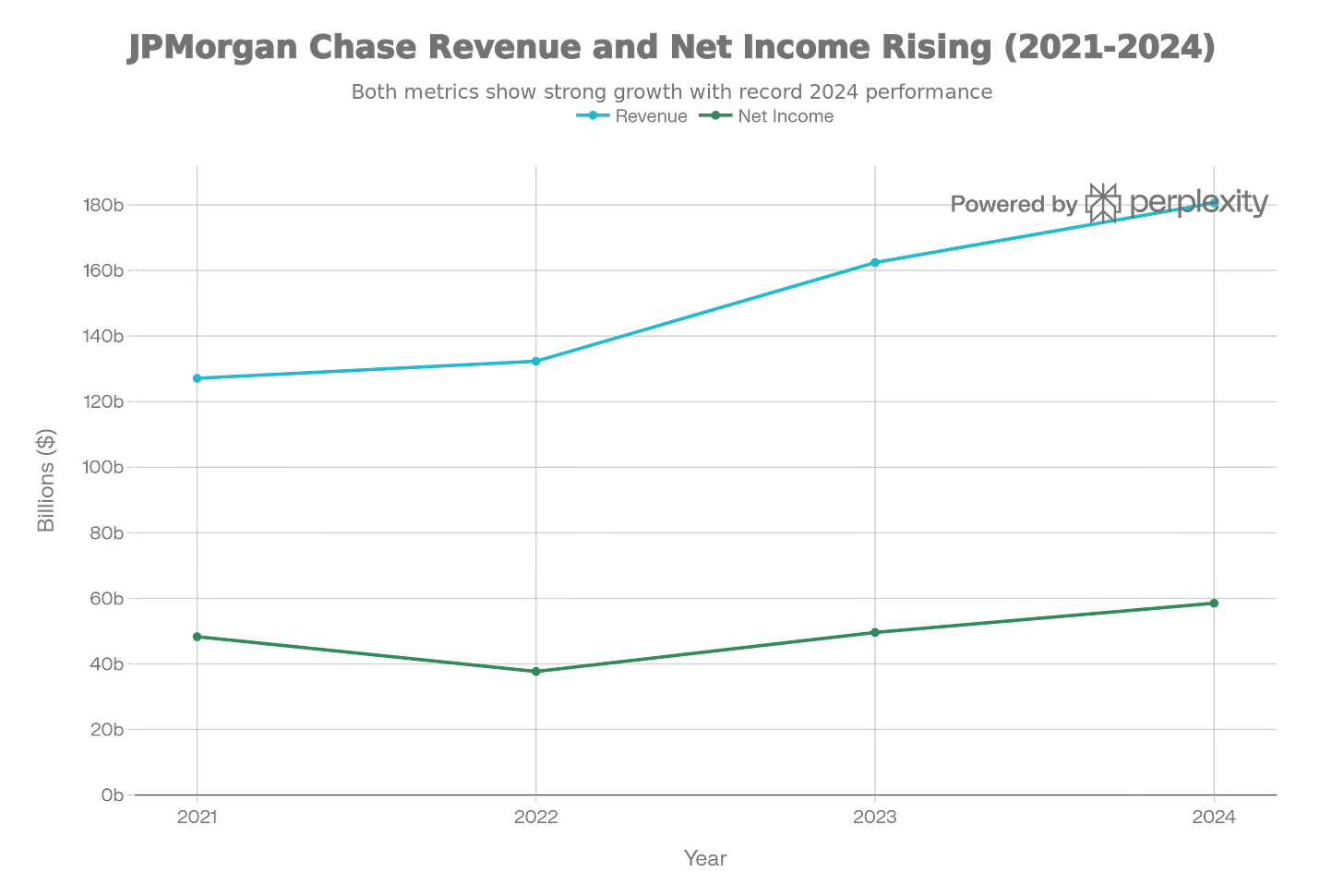

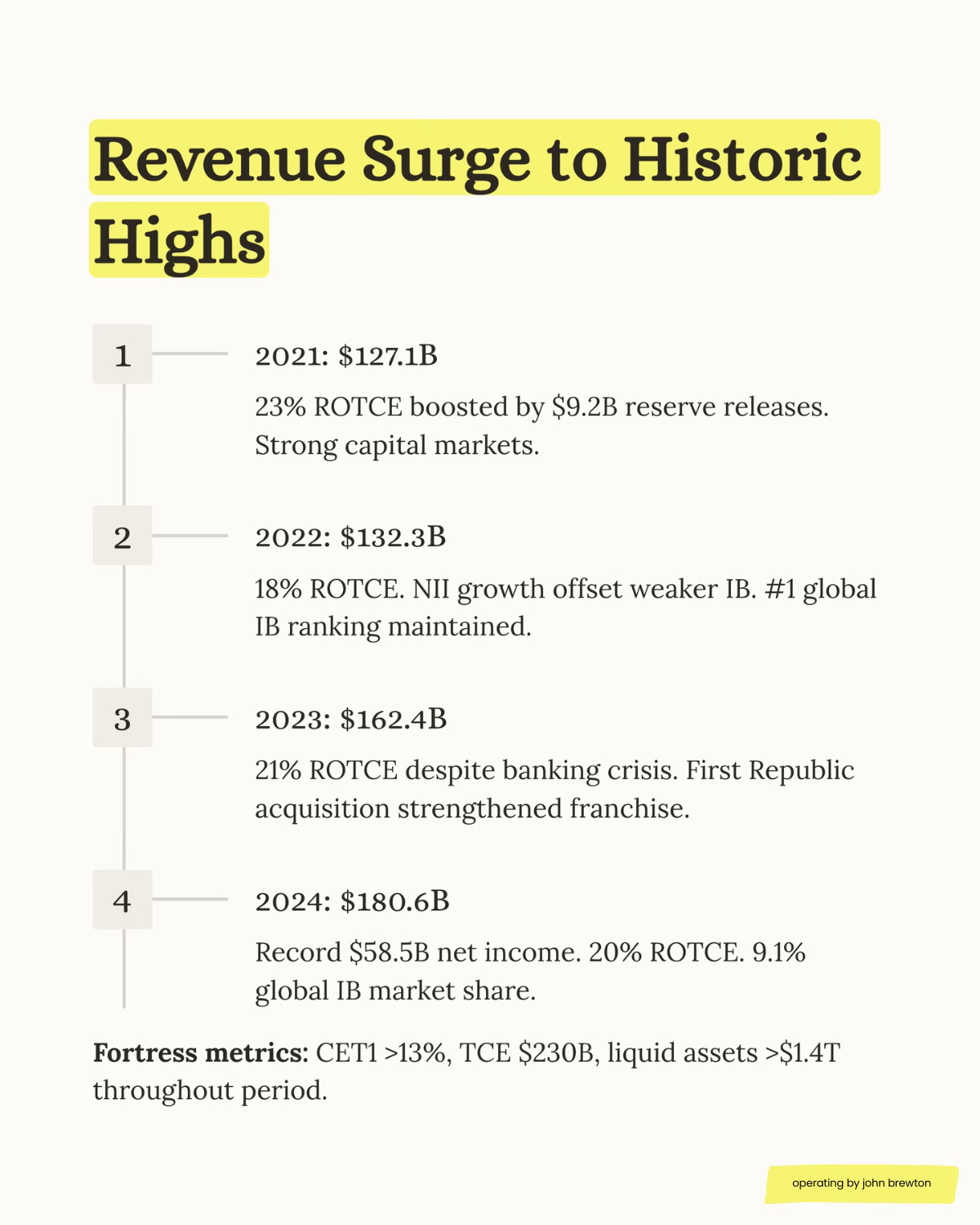

JPMorgan Chase delivered strong revenue growth from 2021-2024, with managed revenue increasing from $127.1B to $180.6B (42% growth). Despite a dip in 2022 (post-reserve release period), net income reached a record $58.5B in 2024, while ROTCE remained consistently strong between 18-23%.

I. Financial Performance Overview: Resilience Through Volatility (2021-2024)

JPMorgan Chase has delivered exceptional financial performance throughout a period marked by pandemic recovery, reserve release volatility, inflation, regional banking turmoil, and aggressive Federal Reserve tightening. The firm’s results demonstrate both earnings power and the value of strategic technology investment.

I’m building something different in 2026: Personally working 1:1 with just 100 serious operators, founders, creators, and builders.

4 quarterly 60-minute working sessions with me (recorded for you) to build your operating strategy, crush team issues, sharpen your brand, or fix whatever’s blocking growth.

For the first 25 who join, I’ve slashed the Operating Founder tier from $550/year to $99/year. Once those spots fill, the price jumps back.

Why $99? I want to partner closely with 100 inventive builders in our AI-first era, learn your stories, and see what’s really working.

Annual Performance Trajectory (2021–2024)

JPMorgan Chase achieved robust revenue growth from 2021 to 2024, with managed revenue rising 42% from $127.1 billion to a record $180.6 billion. Net income reached an all-time high of $58.5 billion in 2024, while ROTCE remained consistently strong in the 18–23% range.

2021: Reserve Releases and Capital Markets Strength

Reported net income of $48.3 billion and 23% ROTCE benefited from ~$9.2 billion in pandemic-era credit reserve releases. Normalized for these releases, earnings approximated $39.1 billion with 18.5% ROTCE—still robust. Results were bolstered by elevated investment banking fees (e.g., Q1 up 222% YoY) and strong trading revenue amid record capital markets activity.

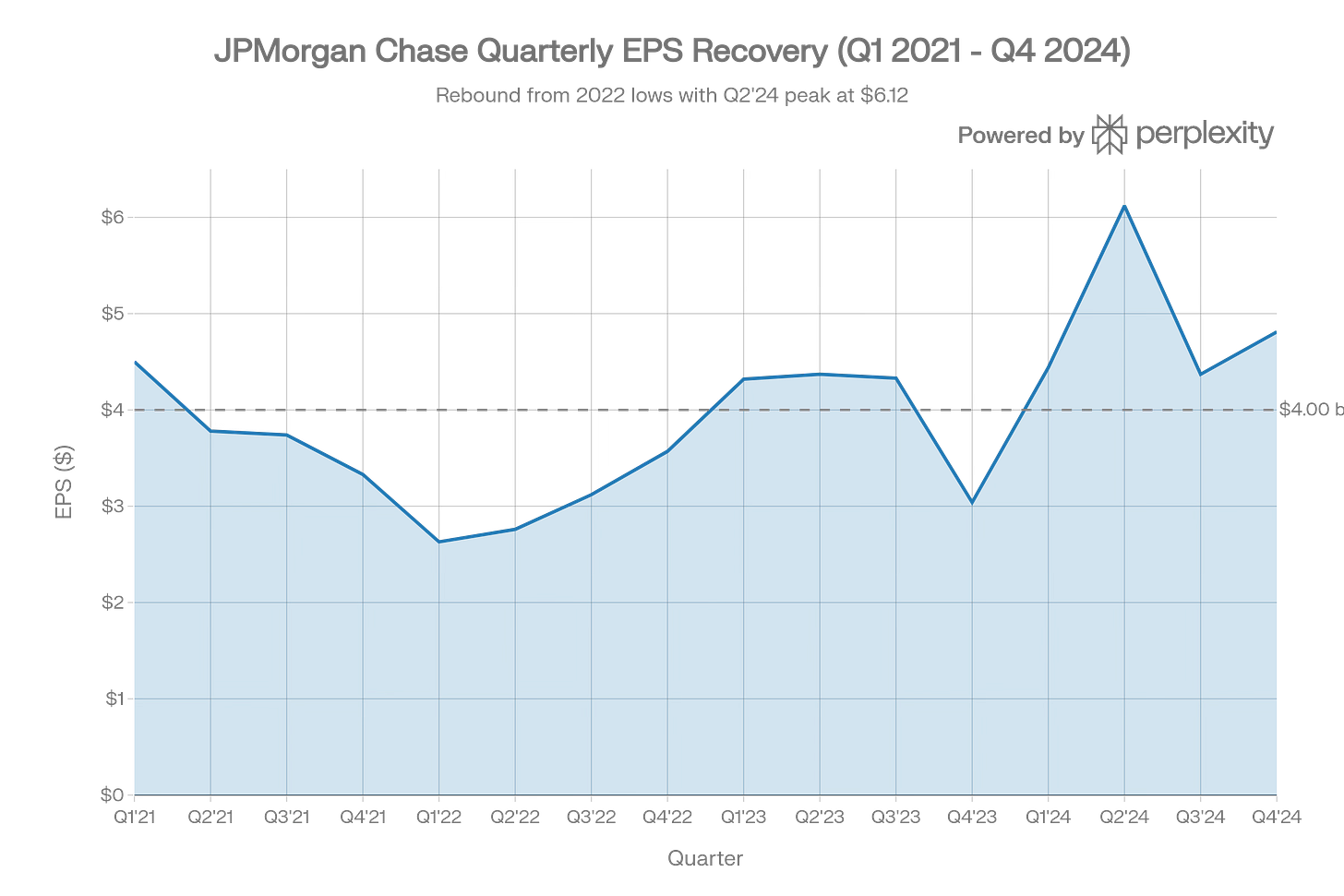

Quarterly EPS volatility from 2021-2024 reflects the transition from pandemic reserve releases ($4.50 in Q1 2021) through normalization (2022 lows around $2.63-$2.76) to record sustained profitability in 2024. The Q2 2024 spike to $6.12 represents peak quarterly earnings performance.

2022: Normalization and NII Tailwinds

Revenue reached a then-record $132.3 billion, but net income fell to $37.7 billion (18% ROTCE) as reserve builds resumed amid economic uncertainty. Rising interest rates drove significant NII growth (e.g., +72% YoY ex-markets in Q4), offsetting weaker investment banking volumes. The firm retained its #1 global IB fee ranking (8% share) and reaffirmed its 17% through-the-cycle ROTCE target.

2023: Resilience Amid Banking Stress

Despite the regional banking crisis, revenue hit a sixth consecutive record of $162.4 billion, with net income of $49.6 billion and 21% ROTCE. The FDIC-assisted First Republic acquisition in May enhanced the franchise and stability. Core performance remained solid (e.g., normalized Q4 ROTCE ~19% excluding FDIC assessment and securities losses), with meaningful market share gains in consumer and investment banking.

2024: Record Profitability

Managed revenue climbed to $180.6 billion, with net income of $58.5 billion (diluted EPS $19.79, +21.8% YoY) and 20% ROTCE. Quarterly results showed consistency and strength, culminating in a Q4 EPS beat ($4.81 vs. $4.03 expected) driven by broad-based momentum across consumer banking, investment banking, and asset/wealth management.

Throughout the period, JPMorgan sustained or expanded leadership positions, ranking #1 globally in investment banking fees (9.1% share in 2024), Markets revenue, retail deposits (11.3% share), and credit card sales/outstandings—reflecting durable competitive advantages and operational excellence.

Multi-Year Financial Perspective

From 2021 through 2024, JPMorgan increased managed revenue by 42%—from $127.1 billion to $180.6 billion. Even accounting for the 2021 reserve release distortions, core profitability strengthened materially. The bank’s fortress balance sheet metrics remained robust throughout: CET1 capital ratios stayed well above 13%, tangible common equity grew from $203 billion (2021) to $230 billion (2024), and liquid assets exceeded $1.4 trillion.

Importantly, this financial performance occurred alongside significant technology investment acceleration, which we examine in detail below.

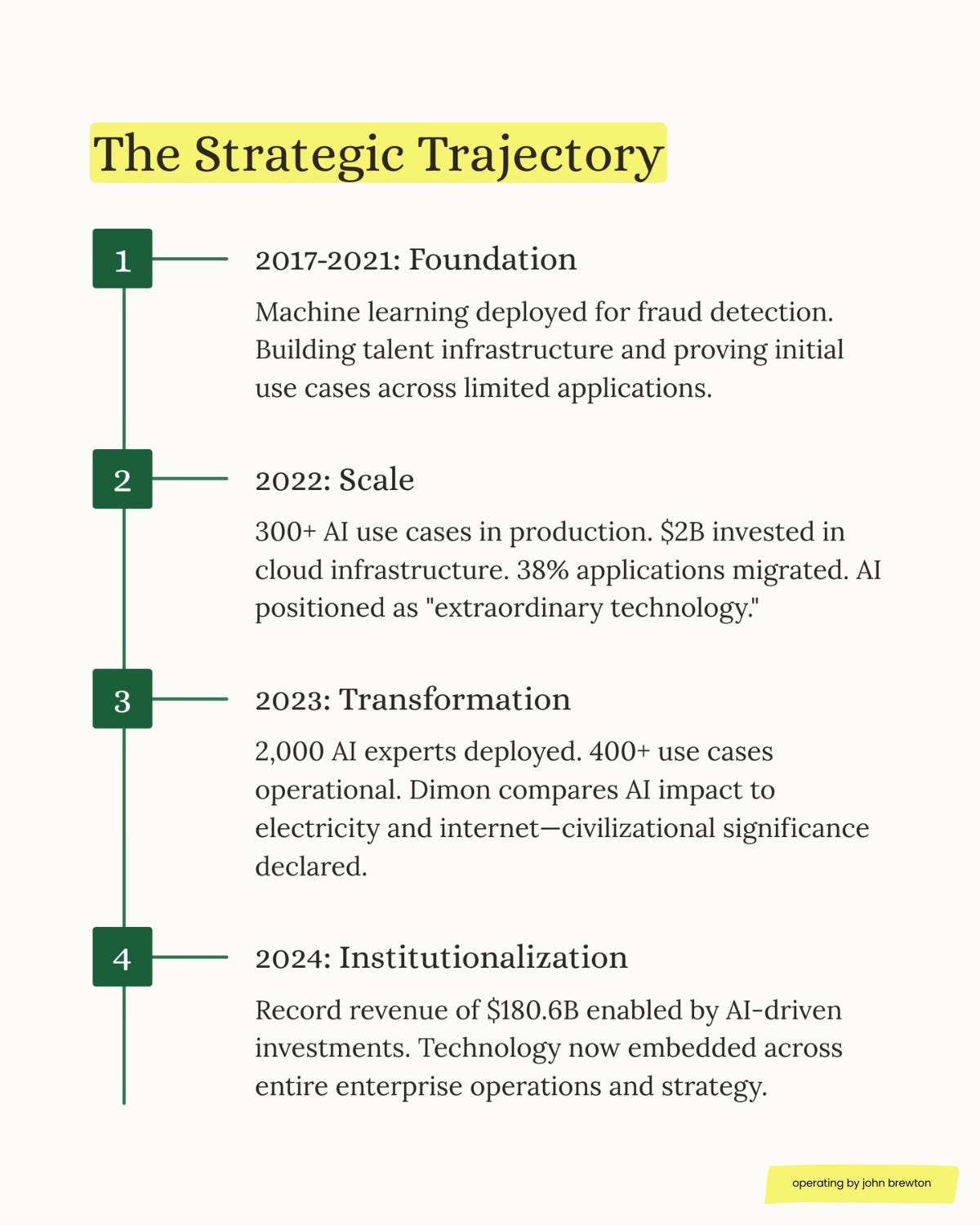

II. The Architecture of AI Investment: A Five-Year Buildout (2021-2026)

JPMorgan Chase’s AI strategy represents a systematic, multi-billion-dollar transformation that predates the November 2022 launch of ChatGPT. The bank had been deploying predictive AI and machine learning in production since at least 2014, giving it a decade-long head start when generative AI emerged as a new frontier.

Technology Budget Evolution and Composition

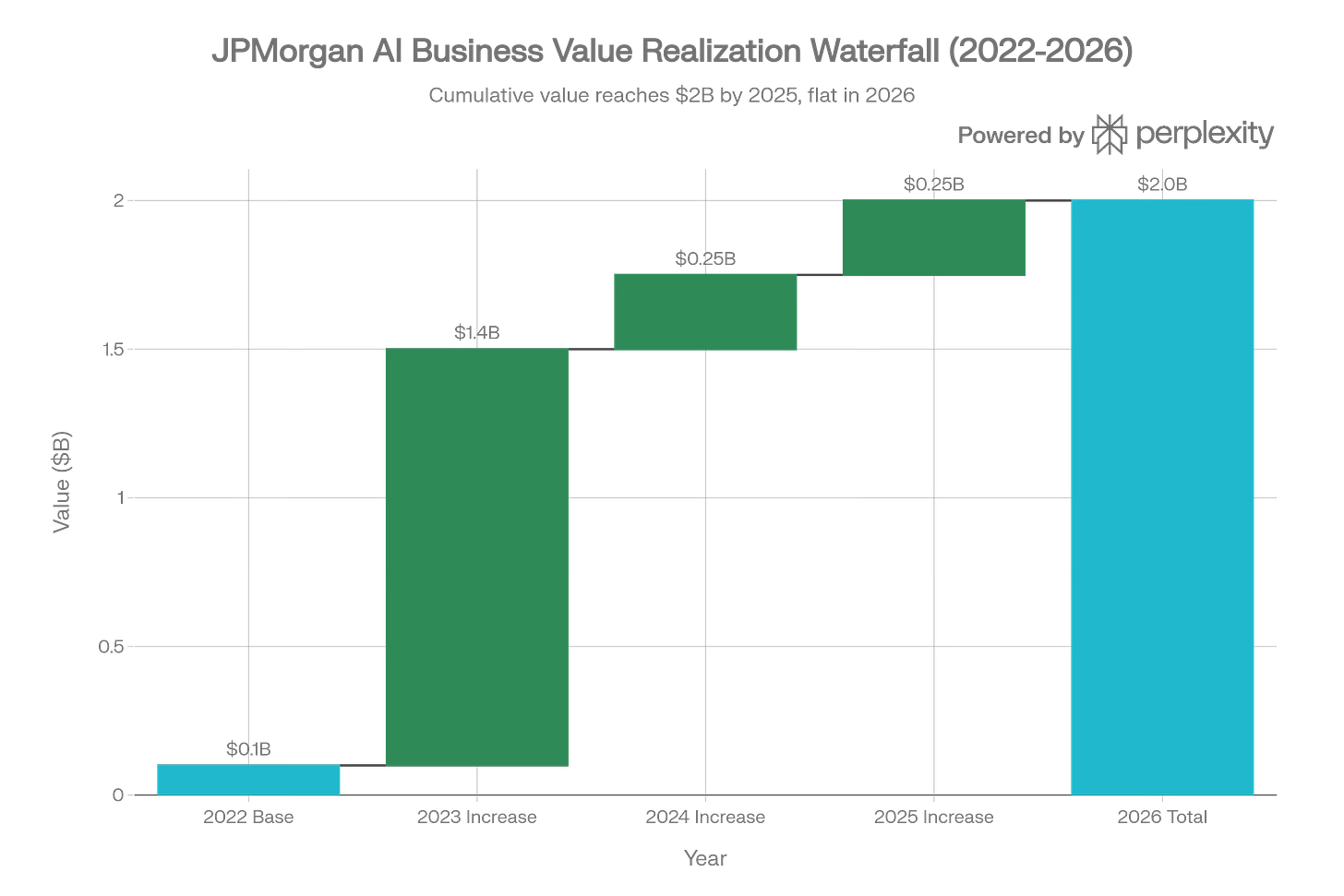

JPMorgan Chase’s AI investment demonstrates accelerating returns: technology budget increased 20% from 2022-2026 ($15B to $18B), while AI-delivered business value surged from $100M to $2B annually. Use cases are projected to more than double from 450 to 1,000 by end of 2026.

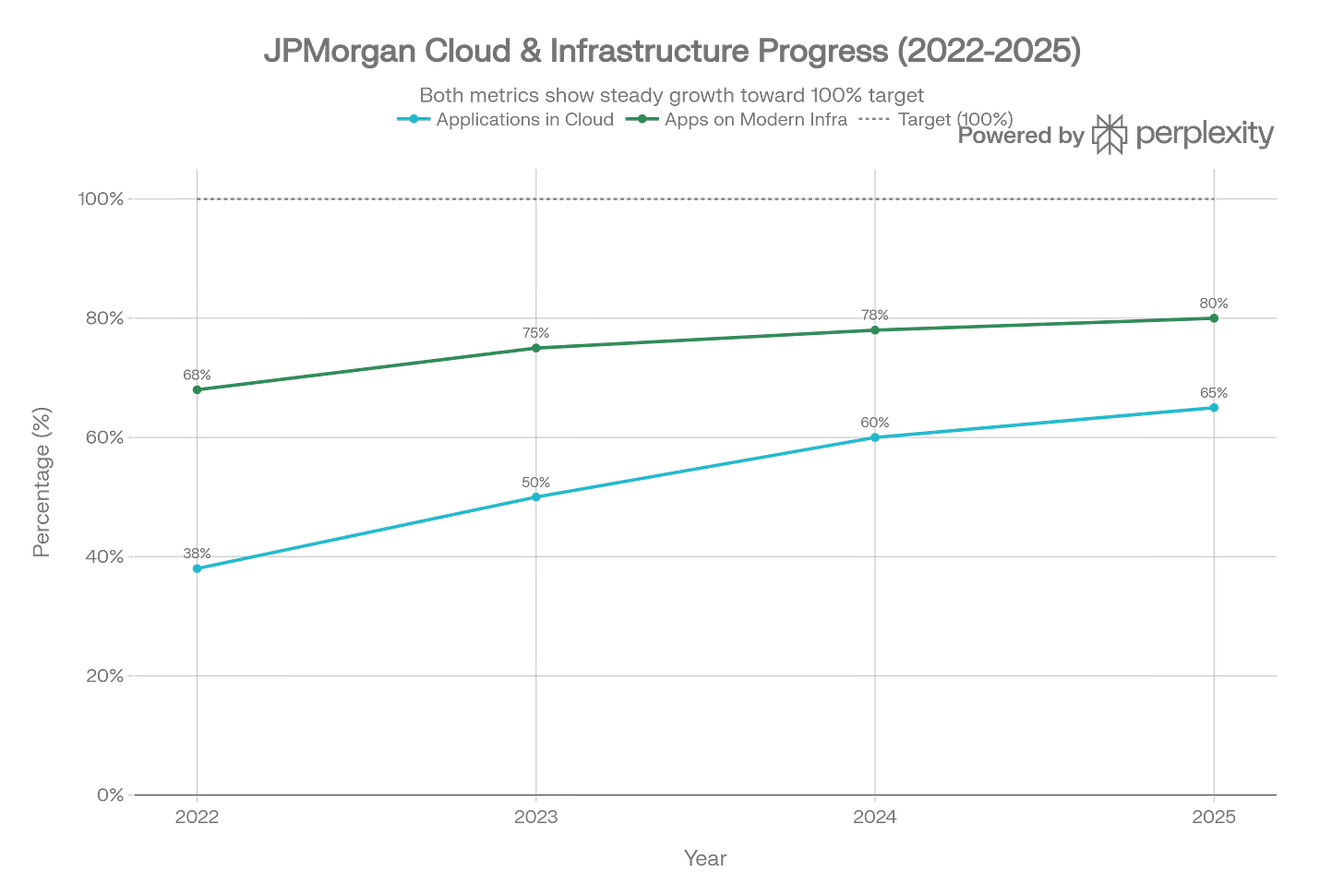

JPMorgan's infrastructure transformation accelerated meaningfully from 2022-2025: cloud adoption increased 71% (38% to 65% of applications) while modern infrastructure penetration reached 80%. This foundation enables the bank's AI ambitions—generative AI and large language models require cloud-scale compute and modern data architectures.

The bank’s technology spending has increased steadily and strategically from approximately $15 billion in 2021-2022 to $18 billion by 2025, representing roughly 10% of annual revenue, a level Dimon characterizes as “less than most other companies”. This budget encompasses far more than AI alone, including modernization, cybersecurity, data centers, public cloud migration, and product development. However, AI has become an increasingly central component and strategic priority.

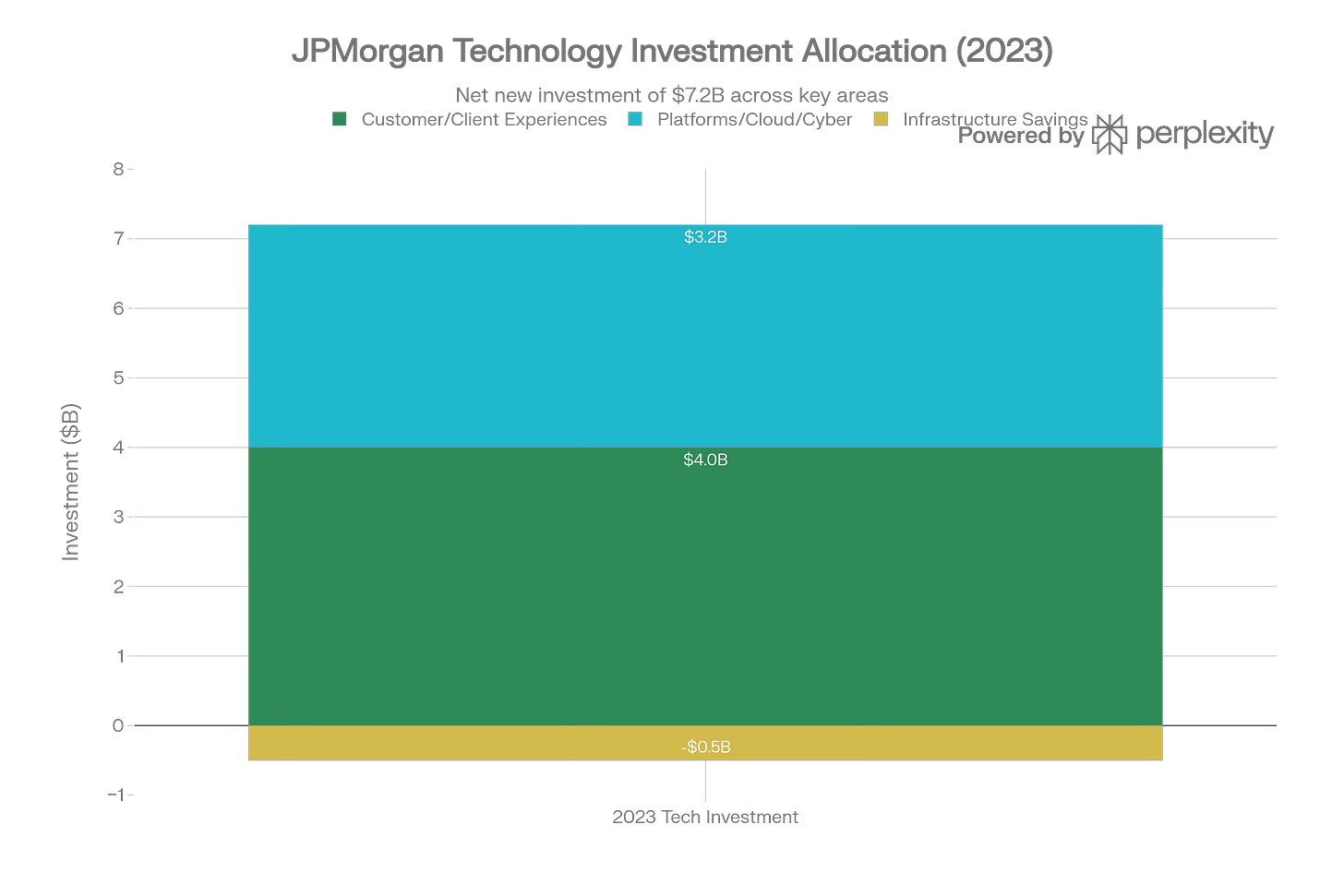

JPMorgan's 2023 technology allocation prioritized customer-facing innovation ($4.0B) and platform modernization ($3.2B), while engineering improvements generated $500M in offsetting savings. This strategic balance between growth investment and efficiency optimization characterizes the bank's approach to technology spending.

In 2023, CIO Lori Beer detailed the allocation at Investor Day: $7.2 billion was directed to new technology investments, split between $4 billion for customer/client experiences and product development, and $3.2 billion for firm-wide platforms including development, data, public cloud, and cybersecurity infrastructure. Notably, modernization investments delivered $300 million in savings through engineering practices and $200 million through infrastructure optimization—demonstrating that technology spending generates immediate efficiency returns even before AI-specific gains.

By 2024, the dedicated AI investment reached approximately $2 billion annually—roughly 11% of the total technology budget. This figure, confirmed by CEO Jamie Dimon in October 2025, represents direct AI-related spending on talent, infrastructure, model development, and deployment rather than the broader technology envelope.

JPMorgan Chase's AI investment demonstrates accelerating returns: technology budget increased 20% from 2022-2026 ($15B to $18B), while AI-delivered business value surged from $100M to $2B annually. Use cases are projected to more than double from 450 to 1,000 by end of 2026.

AI Talent and Organizational Infrastructure

JPMorgan has built the largest AI organization in global banking, a critical competitive advantage that enables execution at scale. As of the 2023 shareholder letter, the bank employed over 2,000 AI and machine learning experts and data scientists. The 2023 Investor Day provided greater granularity: more than 900 data scientists, 600 machine learning engineers, approximately 1,000 people in data management, and a 200-person AI research team focused on “the hardest problems and new frontiers of finance”.

These numbers continued to grow through 2024-2025. By 2025, the bank was hiring specialists such as Sri Shivananda (former PayPal CTO) as firmwide CTO and Manoj Sindhwani (formerly Amazon Alexa) as CIO of the Chief Data and Analytics Office—both hired explicitly to accelerate AI adoption. In June 2023, the bank created a new C-suite position, Chief Data and Analytics Officer, appointing Teresa Heitsenrether to the role, and added the position to the Operating Committee, a clear signal of AI’s strategic priority.

Rather than centralizing all AI work, JPMorgan distributed AI/ML talent across lines of business while maintaining centralized platforms, governance, and research capabilities. This enables rapid experimentation and deployment tailored to specific business needs (credit cards, trading desks, wealth management) while ensuring consistent risk management and compliance standards.

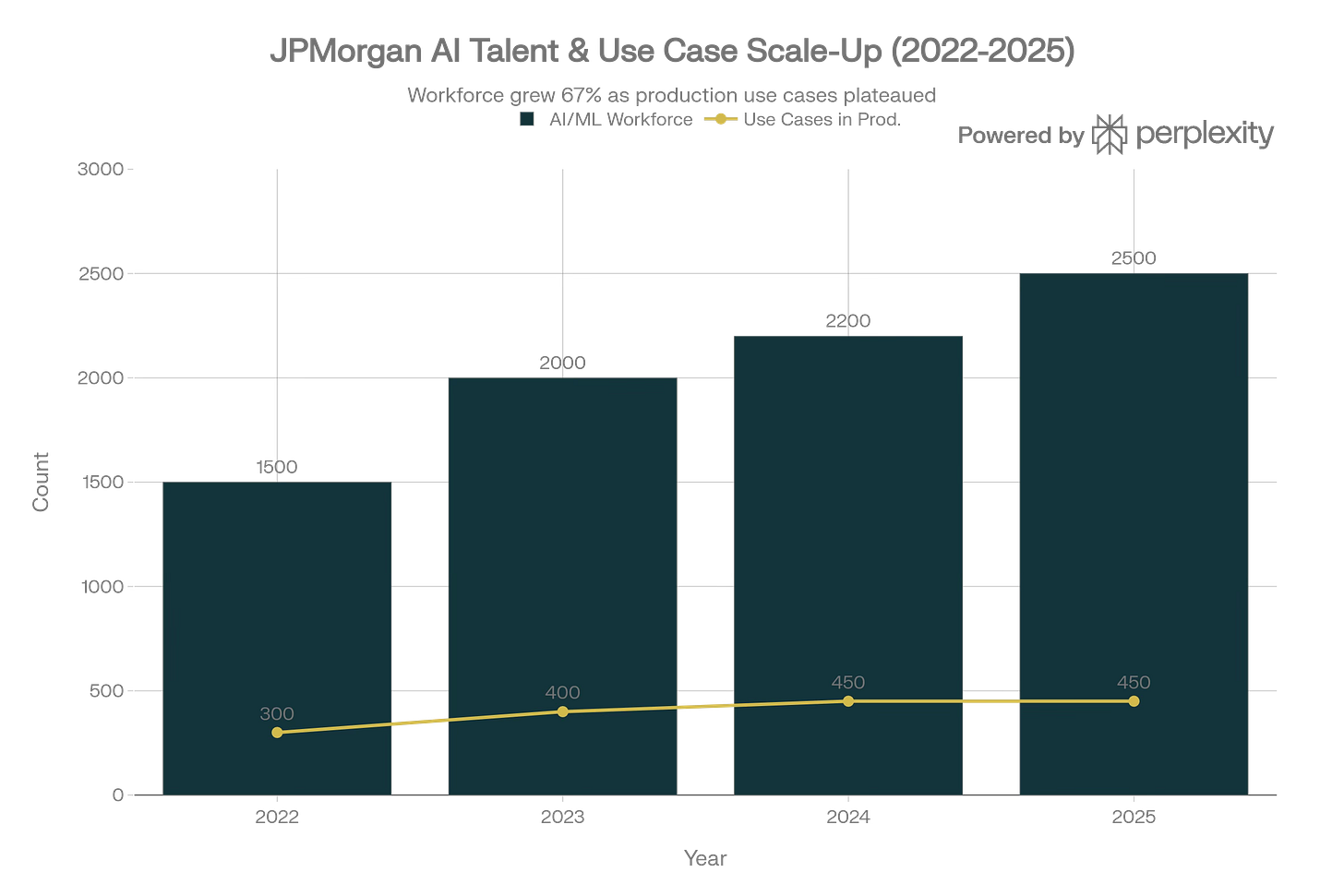

JPMorgan expanded its AI workforce by 67% from 2022-2025 (1,500 to 2,500+ specialists) while production use cases grew 50% (300 to 450). The workforce growth acceleration in 2024-2025 positions the bank for its goal of reaching 1,000 use cases by 2026.

Use Case Proliferation and Production Deployment

The bank’s AI strategy is distinguished by its focus on production deployment rather than pilots. This operational discipline creates measurable business value and differentiates JPMorgan from competitors still experimenting with proofs of concept.

2021-2022: Establishing the Foundation

By 2022, JPMorgan had more than 300 AI use cases in production, deployed across risk management, prospecting, marketing, customer experience, and fraud prevention. These applications ran throughout the bank’s global payments processing and money movement systems, handling trillions of dollars in transactions daily. The 2022 shareholder letter emphasized that “AI has already added significant value,” specifically citing “significantly decreased risk in our retail business (by reducing fraud and illicit activity) and improved trading optimization and portfolio construction”.

2023: Acceleration and Generative AI Entry

The number of use cases increased 34% year-over-year to over 400 by mid-2023. The 2023 Investor Day in May—six months after ChatGPT’s launch—marked a strategic inflection point. CIO Lori Beer announced the bank was “actively evaluating opportunities with large language models and see great potential in that space”. This signaled JPMorgan’s entry into generative AI experimentation while continuing to scale proven predictive AI applications.

The bank ranked #1 on Evident AI’s Index, the first public benchmark measuring AI maturity across major banks. This ranking validated JPMorgan’s operational lead: while other institutions were announcing AI intentions, JPMorgan was delivering production results at scale.

2024: Generative AI in Production

By April 2024, Jamie Dimon’s shareholder letter reported over 400 use cases in production spanning fraud prevention, marketing, customer service, software engineering, operations, and employee productivity. The bank had begun deploying generative AI in customer-facing and operational roles, moving beyond internal efficiency to client experience enhancement.

The LLM Suite—JPMorgan’s proprietary large language model platform—launched in 2024 and rapidly scaled to 200,000 employees (63% of workforce) using it regularly. Applications included research summarization, contract scanning, code generation, and client intelligence. Investment bankers were automating 40% of research tasks; portfolio managers cut research time by up to 83%.

2025-2026: Agentic AI and Workflow Transformation

By late 2025, JPMorgan had approximately 450 AI use cases in production. However, the bank’s ambition expanded significantly: CEO Dimon stated in early 2025 that he anticipated reaching 1,000 use cases “by next year”—more than doubling the portfolio within 12 months.

The nature of applications was also evolving. The bank deployed “agentic AI”—autonomous systems capable of executing multi-step tasks without human intervention. Examples included AI agents that create investment banking presentations in 30 seconds, draft confidential M&A memos, and manage complex back-office processes like trade settlement and account setup.

In January 2026, JPMorgan announced Proxy IQ, an in-house AI platform that replaced external human proxy advisors for shareholder voting in the U.S., a striking demonstration of AI taking over complex governance decisions.

III. Quantifying Returns: From $100M to $2B in Annual Business Value

JPMorgan's AI business value surged 20x from $100M (2022) to $2.0B (2025-2026), with the steepest acceleration in 2023 when the bank raised its target from $1B to $1.5B and exceeded it. The 2025-2026 plateau at $2B reflects mature use cases delivering consistent returns while new initiatives scale.

I’m building something different in 2026: Personally working 1:1 with just 100 serious operators, founders, creators, and builders.

4 quarterly 60-minute working sessions with me (recorded for you) to build your operating strategy, crush team issues, sharpen your brand, or fix whatever’s blocking growth.

For the first 25 who join, I’ve slashed the Operating Founder tier from $550/year to $99/year. Once those spots fill, the price jumps back.

Why $99? I want to partner closely with 100 inventive builders in our AI-first era, learn your stories, and see what’s really working.

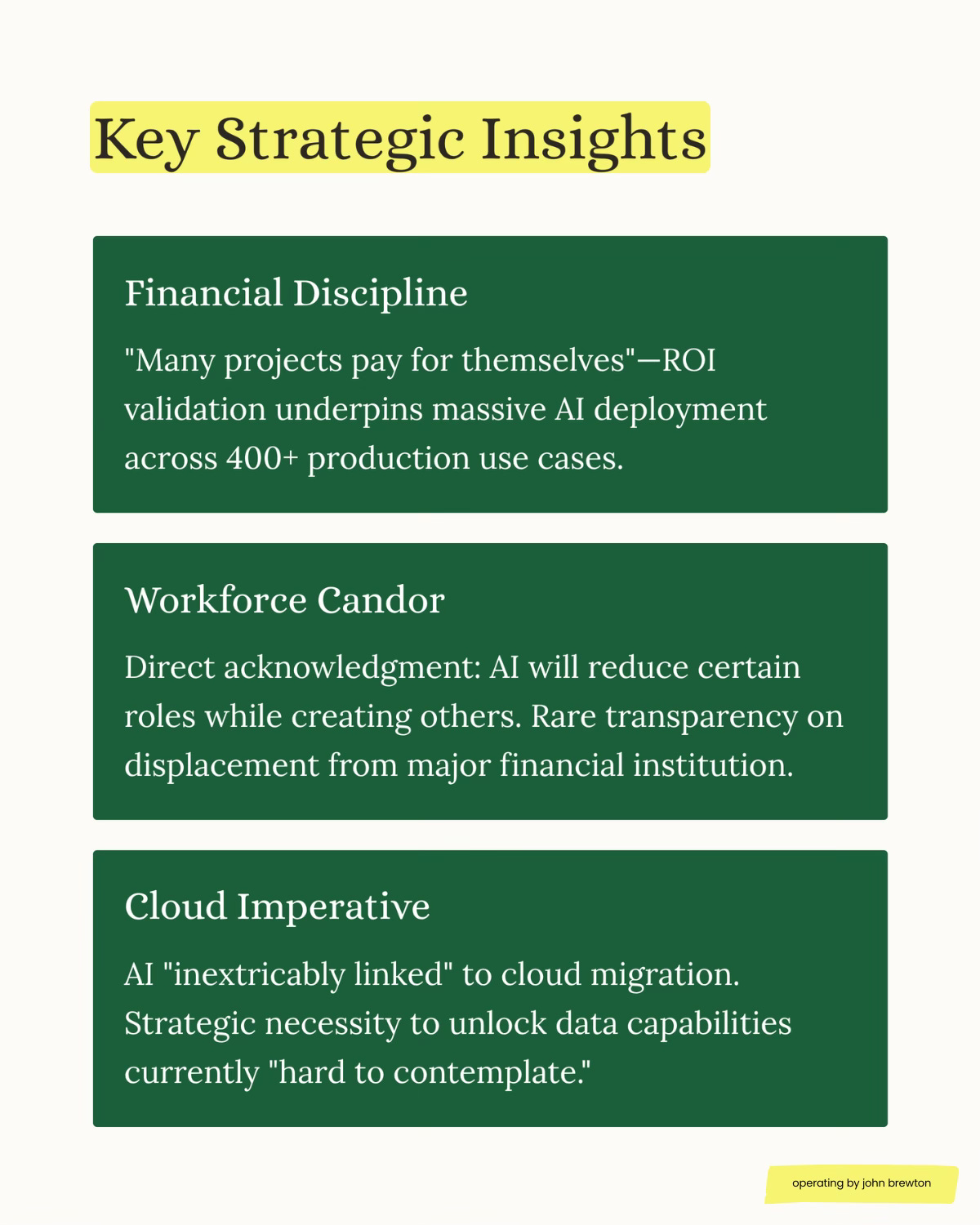

The bank has been unusually transparent about the financial returns from AI investment, a practice that distinguishes it from competitors offering only qualitative claims. This transparency reflects confidence in measurement rigor and creates accountability for continued investment.

The Measurement Framework

Unlike many firms that tout “productivity improvements” without financial quantification, JPMorgan tracks AI returns through specific business value metrics: revenue uplift, expense reduction, cost avoidance, and risk mitigation. CFO Jeremy Barnum emphasized in January 2024 that the bank takes a “pragmatic and disciplined approach” focused on “actual results” rather than “chasing shiny objects”.

The bank does not attempt to measure every productivity gain at a granular level. As Barnum explained on the Q3 2025 earnings call, mandating precise ROI measurement for every AI application can be counterproductive, pushing teams to “use AI in ways that are actually not efficient and that distract you from doing the underlying process reengineering that you need to do”. Instead, JPMorgan measures high-impact use cases while accepting that broader productivity tailwinds are occurring even if not precisely captured.

Documented Returns by Year

2022: Early Returns ($100M)

At the 2023 Investor Day, CIO Lori Beer disclosed that AI-driven growth signals and product suggestions in the Commercial Bank had delivered $100 million of benefit in 2022. This single use case—providing bankers with AI-powered client insights—demonstrated material value from a narrow application.

2023: Accelerating Value ($1.5B)

In May 2023, JPMorgan raised its annual AI business value target from $1 billion to $1.5 billion for the year, with Beer stating the bank was “ahead of plan” on the original commitment. By year-end, the bank had achieved this target.

Specific contributors included:

Retail personalization: AI-driven credit card upgrade offers and product recommendations delivered over $220 million in benefit during the 12 months ending mid-2023

Commercial banking sales intelligence: $100 million in benefit from AI-powered growth signals and product suggestions to bankers

Fraud prevention: Significant cost avoidance, though specific figures not disclosed in 2023

The bank also reported that AI ROI increased 25% from 2021 to 2022, demonstrating improving returns as use cases matured and the organization became more sophisticated in AI deployment.

2024: Scaling Returns ($1.5B-$2.0B)

President and COO Daniel Pinto stated in 2024 that AI use cases were delivering between $1.5 billion and $2.0 billion in tangible annual business value—an increase from the earlier $1.0 billion to $1.5 billion estimate. This upward revision reflected growing confidence as initiatives matured.

Specific 2024 impacts included:

Asset & Wealth Management: Generative AI tools contributed to a 20% year-over-year increase in gross sales between 2023 and 2024. The Coach AI tool enabled advisors to find information 95% faster and increased sales by 20%

Trading optimization: Algorithmic trading win rates improved from 52% to over 60% following deployment of deep reinforcement learning AI

Credit decisioning: 40% improvement in accuracy and 30% reduction in defaults, while loan approval rates increased 20-30%

Fraud detection and prevention: Cited as a “particularly significant contributor” to business value, with real-time fraud detection achieving 40% improvement in accuracy

Harvard Business School published a case study in 2024 examining JPMorgan’s AI tools for 5,000 high-net-worth private banking client advisors, documenting nearly $1.5 billion in cumulative savings through fraud prevention, personalization, trading efficiencies, operational improvements, and credit decisions.

2025-2026: Consistent $2B Annual Value

In October 2025, CEO Jamie Dimon confirmed that AI was saving “about $2 billion of benefit” annually, stating this figure represented ongoing value being realized across the organization. This $2 billion in annual business value was being generated from approximately $2 billion in annual AI investment—a 1:1 return in direct measurable benefits, not accounting for harder-to-quantify productivity gains, competitive positioning, or future option value.

Dimon characterized the $2 billion figure as “the tip of the iceberg,” suggesting that total AI value—including productivity gains, faster product development, improved client experiences, and talent attraction—was substantially higher than the measured financial returns.

Cost Avoidance and Defensive Value

A critical but often overlooked component of AI ROI is defensive cost avoidance—preventing costs that would otherwise occur. JPMorgan faces a 12% compound annual growth rate in fraud attacks. Without AI-powered defenses, fraud losses would escalate exponentially. By using AI to hold fraud costs flat despite surging attack volumes, the bank avoids hundreds of millions in potential losses annually.

The U.S. Treasury’s recovery of over $375 million through AI-powered check fraud detection—using technology influenced by JPMorgan’s approaches—illustrates the magnitude of fraud losses that advanced detection can prevent.

IV. AI in Jamie Dimon’s Shareholder Letters: Strategic Evolution

Jamie Dimon’s annual letters to shareholders serve as the bank's authoritative articulation of its strategic priorities and long-term perspective. The evolution of AI discussion in these letters tracks the technology’s rising importance within the firm’s competitive strategy.

Thematic Consistency

Across the shareholder letters, several themes recur:

Long-term investment horizon: Dimon consistently frames technology investment as essential for positioning the company “to grow and prosper for decades”, explicitly rejecting short-term earnings optimization that sacrifices future competitiveness.

Competitive imperative: The letters acknowledge that “the walls that protect this company are not particularly high — and we face extraordinary competition”. AI investment is positioned as defensive and offensive: necessary to avoid being disrupted while creating a competitive advantage.

Financial discipline: Despite massive spending, Dimon emphasizes that technology investments “pay for themselves” and generate “strong returns”, rejecting the characterization of technology spending as unproductive overhead.

Talent as foundation: The letters repeatedly emphasize that “the foundation of our success rests with our people”, with technology investments meaningless without the human capital to build, deploy, and manage AI systems.

V. Earnings Call Evolution: From Vision to Accountability (2022-2026)

Quarterly earnings calls provide a different lens than annual shareholder letters: they reflect investor questions, near-term results, and management accountability for spending commitments. The evolution of AI discussion in these forums reveals increasing specificity as the technology moved from strategic vision to operational execution.

2022: Building Infrastructure, Limited Public Detail

The Q4 2022 earnings call (January 2023) focused heavily on macroeconomic outlook, credit reserve methodology, and interest rate impacts. AI was not prominently featured in the available transcript, suggesting it remained primarily an internal priority not yet central to the external investment narrative. The focus was on defending strong financial performance ($132.3 billion revenue, $37.7 billion net income, 18% ROTCE) amid economic uncertainty.

2023: Investor Day Breakthrough and Measurement Commitments

The May 2023 Investor Day represented a breakthrough in public AI disclosure. CIO Lori Beer provided granular metrics: more than 300 use cases in production (up 34% year-over-year), $1 billion commitment raised to $1.5 billion in business value for 2023, AI ROI increasing 25% from 2021 to 2022, and detailed talent numbers (900+ data scientists, 600 ML engineers, 200-person research team).

Beer also disclosed specific use-case returns: $220 million in benefits from retail personalization and credit card upgrades, and $100 million in benefits from commercial banking sales intelligence. This level of financial specificity was unprecedented among large banks and created a new standard for AI ROI transparency.

The Investor Day also addressed generative AI directly. Beer stated: “We couldn’t discuss AI without mentioning GPT and large language models. We recognize the power and opportunity of these tools”. This acknowledgment—six months after ChatGPT’s launch—signaled JPMorgan was actively evaluating generative AI while continuing to scale proven predictive AI applications.

2024: Disciplined Execution and Efficiency Focus

The Q1 2024 earnings call (January) featured CFO Jeremy Barnum articulating a “pragmatic and disciplined approach” to AI, emphasizing a “contained, well-chosen list of high-impact use cases” rather than “chasing shiny objects”. This framing responded to the generative AI hype cycle: Barnum wanted investors to understand JPMorgan was focused on results, not experimentation.

Barnum noted the appointment of Teresa Heitsenrether as Chief Data and Analytics Officer as evidence of AI’s strategic priority. He emphasized: “We’re holding ourselves accountable for actual results”.

By Q3 2024 (October), Barnum acknowledged that consensus expense forecasts for 2025 appeared “conservative” and highlighted that increases represented “investments in growth areas such as branches, wealth management, technology, and AI” expected to “yield positive returns”. This defensive posture suggested investor concern about rising expenses, with management positioning AI as a growth investment rather than an unproductive cost.

2025: Efficiency Gains and Headcount Discipline

The May 2025 Investor Day featured CFO Barnum emphasizing the $18 billion technology budget (6% increase over 2024) and CEO Dimon’s memorable framing: “It’s table stakes. It will be for the rest of eternity”. This statement positioned ongoing technology investment as a permanent structural reality of banking, not a cyclical discretionary spend.

Barnum revealed that approximately 65% of applications now run processing in the cloud (up from 50% prior year) and ~80% run on modern infrastructure (up from 75%). He also noted that while overall expenses increased $26 billion over the prior five years, revenue grew $54 billion over the same period—demonstrating positive operating leverage despite heavy investment.

Critically, Barnum stated that the bank’s 317,000 employees represented inefficiencies in headcount introduced during rapid growth, and that management was now asking teams to “resist headcount growth where possible and increase their focus on efficiency”. AI-driven productivity gains gave management confidence in constraining headcount: “We’re going to do the same this year: have a very strong bias against having the reflective response to any given need to hire more people and feeling a little bit more confident in our ability to put that pressure on the organization because we know that, even if we can’t always measure it that precisely, there are definitely productivity tailwinds from AI”.

2026: Competitive Imperative and Long-Term Defense

The Q4 2024 earnings call (January 2026) featured the most forceful public defense of technology spending in the five-year period. Facing questions from Wells Fargo analyst Mike Mayo about the $9.7 billion projected expense increase for 2026, Dimon responded:

“We’re not going to try to meet some expense target, and then 10 years from now, you’d be asking us a question, how did JPMorgan get left behind?”

Dimon positioned the spending as competitive necessity: “We’re going to stay out front, so help us God”. He emphasized competition not just from other banks but from fintech firms like Affirm, SoFi, and Revolut, stating “they’re good players” and JPMorgan needed to outcompete them.

On AI specifically, Dimon said it was “not a big driver” of the $9.7 billion increase but would “likely drive future efficiency”. This nuance was important: the 2026 expense increase was driven more by volume growth, inflation, and strategic expansion (branches, wealth management) than by AI spending itself. However, AI spending would continue, and its efficiency benefits would help offset other cost pressures.

Dimon declined to provide specific AI investment figures, stating he had already been “quite blunt” but wouldn’t disclose details that could create “competitive disadvantage”. On anticipated returns, he said simply: “Part of it is to trust me, I’m sorry”. This represented a rare appeal to investor confidence rather than quantitative justification—perhaps reflecting that some AI investments involve long-term competitive positioning whose financial returns are difficult to project precisely.

VI. Specific AI Applications and Measured Impacts

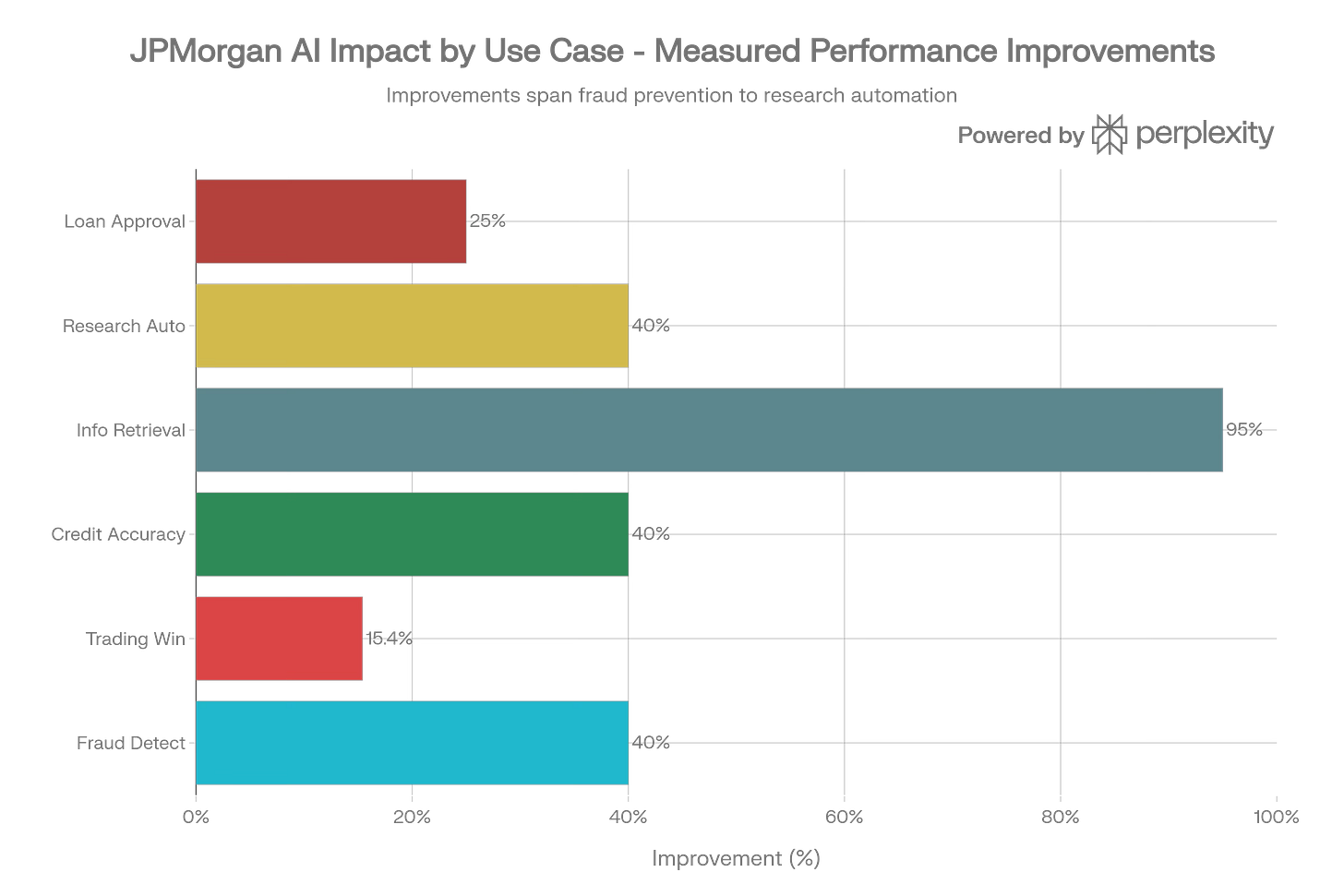

AI delivers heterogeneous but significant impacts across JPMorgan's operations: 95% faster information retrieval for advisors transforms client service economics, while 40% improvements in fraud and credit accuracy directly reduce losses. Even the "modest" 15.4 percentage point trading win rate improvement (52% to 60%) generates millions in daily P&L gains on $260B trading volume.

While aggregate financial returns demonstrate AI’s value, understanding specific use cases reveals how the technology creates value across diverse banking operations.

Fraud Detection and Risk Management

JPMorgan’s AI-powered fraud detection represents one of the highest-value applications, combining revenue protection (preventing losses) with cost avoidance (holding fraud costs flat despite surging attacks).

Real-time fraud detection systems analyze transaction patterns across massive datasets, distinguishing legitimate activity from fraudulent behavior with 40% better accuracy than traditional rule-based systems. The systems identify fraud patterns invisible to human analysts by processing correlations across millions of accounts simultaneously.

The bank faces a 12% compound annual growth rate in fraud attacks. Without AI, fraud losses would grow exponentially. By using AI to detect and prevent fraud proactively, JPMorgan holds fraud costs flat—a massive cost avoidance equivalent to hundreds of millions in annual savings. Cumulative fraud prevention value from AI has been estimated at over $1.5 billion when combined with other security enhancements.

The U.S. Treasury Department adopted AI-powered check fraud detection methodologies influenced by JPMorgan’s technology, recovering over $375 million. This third-party validation demonstrates the effectiveness of JPMorgan’s fraud AI at institutional scale.

Algorithmic Trading and Markets

JPMorgan has deployed AI on trading desks for over eight years as of 2025, using machine learning to optimize execution, identify market signals, and manage portfolio construction. The bank trades approximately $260 billion in volume daily, reaching $500 billion during peak periods.

Specific impacts include:

Trading win rates: Deep reinforcement learning algorithms increased algorithmic trading win rates from 52% to over 60%—a substantial improvement that translates to millions in daily P&L gains

Optimal execution: AI systems identify the best timing, venue, and sizing for trades across multiple data streams (news feeds, social media sentiment, economic indicators, historical patterns) at machine speed

Pattern recognition: AI detects arbitrage opportunities and market signals that exist for fractions of a second, enabling the bank to capitalize on micro-opportunities inaccessible to human traders

The adaptive nature of these systems is critical: machine learning models continuously refine trading logic based on changing market conditions without manual intervention, effectively creating a trader who “never sleeps, never gets emotional, and gets smarter with every transaction”.

Wealth Management and Client Advisory

The Coach AI tool deployed for JPMorgan’s private client advisors represents a breakthrough in AI-augmented knowledge work. This generative AI application helps advisors retrieve research, answer client questions, and create personalized recommendations at dramatically faster speeds.

Measured impacts include:

95% faster information retrieval: Advisors can find relevant content and research 95% faster than manual searching, freeing time for client conversations rather than document hunting

20% sales increase: Between 2023 and 2024, Asset & Wealth Management saw a 20% year-over-year increase in gross sales, with GenAI tools cited as a key contributor

50% client base expansion potential: JPMorgan projects advisors will be able to expand their client bases by 50% over 3-5 years as AI handles research tasks, enabling each advisor to serve more clients without quality degradation

During the April 2025 market volatility triggered by U.S. tariff announcements, Coach AI enabled advisors to rapidly provide personalized guidance to anxious clients. Mary Erdoes, CEO of Asset & Wealth Management, noted: “The market has experienced several fluctuations that are not typical, making it quite challenging to consider all your clients and their various needs. AI tools enabled advisors to swiftly address client inquiries by analyzing their trading behaviors and predicting their questions”.

The tool also performs “anticipatory work,” helping advisors prepare for client conversations by pre-analyzing portfolios and generating scenario analyses. This predictive capability transforms advisor-client relationships from reactive to proactive.

Credit Decisioning and Underwriting

AI-powered credit models have improved both the speed and accuracy of lending decisions while expanding access to previously underserved borrowers.

Documented improvements include:

40% accuracy improvement: AI models predict default risk with 40% better accuracy than traditional credit scoring

30% reduction in defaults: Better risk assessment translates to lower actual default rates

20-30% increase in approval rates: By incorporating non-traditional data sources (cash flow patterns, transaction behaviors, utility payments), AI extends credit to applicants who would have been declined under traditional FICO-based models

Speed gains are equally important: loan decisions that previously took hours or days now occur in seconds, enabling real-time lending decisions at the point of sale. This speed advantage is particularly valuable in competitive consumer lending markets where applicants often apply to multiple lenders simultaneously.

The inclusiveness dimension is noteworthy: by assessing creditworthiness through behavioral data rather than just traditional credit history, AI enables JPMorgan to serve populations historically excluded from banking (thin-file borrowers, immigrants, young adults without established credit).

Operations and Back-Office Automation

Operations represents one of the largest opportunity areas for AI-driven efficiency, and also the area where workforce displacement is most visible.

Productivity gains: Operations productivity historically improved at about 3% annually but has accelerated to approximately 6% annual improvement with AI deployment. JPMorgan expects each operations specialist to become 40-50% more productive over time as AI automates routine tasks.

Agentic AI for complex workflows: The bank is deploying autonomous AI agents that execute multi-step processes independently. Examples include:

Investment bankers creating 5-page presentation decks in 30 seconds (work that previously took junior analysts hours)

Lawyers scanning and generating contracts with covenant extraction occurring instantly

Trade settlement and account setup processes handled end-to-end by AI agents

Call center enhancement: The EVEE Intelligent Q&A tool deployed in call centers delivers context-aware responses, improving resolution times and customer satisfaction.

Workforce implications: Consumer banking chief Marianne Lake announced in 2025 that operations staff would decline at least 10% as agentic AI takes over complex tasks. This represents one of the first explicit headcount-reduction commitments by a major bank CEO, directly attributed to AI.

New roles are emerging to support AI operations: “context engineers” ensuring AI systems have proper information, knowledge management specialists, and up-skilled software engineers building agentic systems. However, the net employment effect is clearly negative for traditional operations roles.

Software Engineering and Code Generation

AI is transforming JPMorgan’s software development process, a critical capability given the bank’s 60,000+ technology employees and $18 billion technology budget.

Code generation at scale: Alphabet CEO Sundar Pichai stated in 2024 that “nearly half of all code [is] generated by AI”. JPMorgan has implemented similar capabilities. Wells Fargo reported in Q3 2025 that there had been “more than 1 million AI-driven automated code reviews this year, creating 100,000 hours of weekly capacity for developers”—providing a peer benchmark for JPMorgan’s likely gains.

Code deployment velocity: JPMorgan has increased code deployments by over 70% over the past two years while achieving a 20% reduction in work being replanned—demonstrating that AI-assisted development is both faster and higher quality.

Investment banking automation: Investment bankers are automating 40% of research tasks using AI tools, and portfolio managers have cut research time by as much as 83%. These gains enable senior professionals to focus on client relationships and strategic advisory rather than information gathering.

VII. Strategic Implications and Competitive Positioning

JPMorgan’s AI strategy has profound implications for global banking's competitive dynamics. The bank’s scale, investment capacity, and execution discipline are widening the gap with smaller competitors.

The AI Moat: Capital, Talent, and Data

Three mutually reinforcing advantages position JPMorgan to sustain AI leadership:

1. Financial capacity: With $180.6 billion in annual revenue and $58.5 billion in net income, JPMorgan can sustain $18 billion annual technology budgets and $2 billion annual AI spending that smaller banks cannot match. Regional banks with $5-10 billion in annual revenue cannot allocate equivalent percentages to technology without destroying profitability.

2. Talent concentration: JPMorgan employs over 2,000 AI/ML experts and data scientists—more than the total technology workforce of many regional banks. The bank offers base salaries exceeding $275,000 for AI specialists, competing directly with Big Tech for talent. Smaller institutions cannot match this compensation or offer the scale and complexity of problems that attract top AI researchers.

3. Data volume and velocity: JPMorgan processes nearly $10 trillion in payments daily across 120 currencies and more than 160 countries, safeguarding over $32 trillion in assets. This “data flywheel” provides an unparalleled source of proprietary training data for AI models. A regional bank processing $50 billion in daily payments—1/200th JPMorgan’s volume—simply cannot train models with equivalent predictive power.

Daniel Pinto, JPMorgan’s President and COO, characterized the firm’s advantage as a “data flywheel”: “a virtuous cycle powered by over $10 trillion in daily transactions, which provides an unparalleled source of high-stakes, proprietary data for training superior AI models”.

Valuation Premium and Market Recognition

JPMorgan’s AI execution has translated into a persistent valuation premium versus banking peers. The stock trades at approximately 2.68x book value and 15-16x forward earnings—multiples that exceed large-cap bank averages and reflect investor confidence in sustained competitive advantage.

Analyst commentary explicitly links this premium to AI productivity:

“JPMorgan trades at a premium as AI productivity offsets rising cost guidance”

“The combination of earnings power, AI-driven productivity, non-interest income growth and robust credit metrics means JPM still justifies a Buy-tilted stance”

Wells Fargo analyst Mike Mayo: “AI financial gains could rise by an additional billion dollars for the bank”

The stock advanced approximately 35% in 2025, outperforming bank indices and justifying the premium through demonstrated profitability. Investors are effectively paying for the expectation that JPMorgan’s AI-driven efficiency and margin expansion will persist for years, creating a structural advantage over peers.

Competitive Response and Industry Dynamics

Other large banks are responding to JPMorgan’s AI lead, but gaps remain substantial:

Wells Fargo: Mentioned AI only once during its Q3 2025 earnings call, highlighting automation efforts to drive efficiency. CFO Michael Santomassimo noted: “AI helps on some of that for sure,” but provided no specific use cases, financial returns, or strategic roadmap. This vague treatment suggests Wells Fargo is in early AI deployment stages, years behind JPMorgan.

Citigroup: Co-CIO Shadam Zafar outlined a “four phases” AI strategy with immediate focus on productivity and back-office use cases. Citigroup has approximately 30,000 employees using AI for software engineering and platform modernization. However, the bank has not disclosed specific financial returns or use case counts, suggesting it is still building foundational capabilities.

Goldman Sachs: Introducing generative AI assistants for bankers, traders, and asset managers, but has not disclosed production use case counts or financial returns. CEO David Solomon stated on Q3 2025 call: “We are drilling in on a handful of front-to-back work streams that can significantly benefit from AI-driven process reengineering”—suggesting early-stage focus on identifying opportunities rather than scaled deployment.

Bank of America: Has implemented AI in call centers and operational processes, but public disclosures lack the granularity of JPMorgan’s reporting.

A Consistent Pattern: competitors acknowledge AI’s importance and are investing, but none have disclosed production use case counts, specific financial returns, or organizational scale approaching JPMorgan’s transparency and demonstrated execution.

Fintech Competition and Defensive Positioning

Jamie Dimon’s January 2026 statement that JPMorgan competes not just with banks but with fintech firms like Affirm, SoFi, and Revolut reflects a critical strategic reality. These fintech challengers are digital-native, operate on modern technology stacks, and lack legacy infrastructure constraints.

JPMorgan’s AI strategy is explicitly defensive against fintech disruption:

User experience parity: AI-powered personalization (credit card upgrades, product recommendations, real-time fraud alerts) matches or exceeds fintech UX while leveraging JPMorgan’s broader product suite

Speed and automation: Real-time credit decisions, instant account setup, and 24/7 AI-powered service match fintech convenience expectations

Cost efficiency: AI-driven operations productivity gains enable JPMorgan to compete on cost despite legacy infrastructure burdens

Dimon’s comment—”We’re going to stay out front, so help us God”—reveals leadership concern that complacency could allow nimbler fintech competitors to capture younger customer cohorts before they develop banking relationships with incumbents.

VIII. Workforce Transformation and Human Capital Implications

JPMorgan’s AI deployment is visibly reshaping workforce composition, a transformation the bank has addressed with unusual candor compared to peers emphasizing only positive “augmentation” narratives.

Explicit Headcount Discipline

In May 2025, CFO Jeremy Barnum stated that JPMorgan’s 317,000 employees represented some inefficiency introduced during rapid growth, and management was asking teams to “resist headcount growth where possible”. This marked a strategic shift: rather than allowing AI to create capacity for more hiring, the bank would capture AI productivity gains as margin expansion.

Barnum explained the logic: “We’re going to have a very strong bias against having the reflective response to any given need to hire more people and feeling a little bit more confident in our ability to put that pressure on the organization because we know that, even if we can’t always measure it that precisely, there are definitely productivity tailwinds from AI”.

In 2025, Consumer Banking Chief Marianne Lake announced that operations staff would decline at least 10% as agentic AI takes over complex tasks. This represents one of the first explicit headcount reduction targets directly attributed to AI by a major U.S. bank CEO. The 10% figure applied specifically to operations—back-office roles handling account setup, fraud investigation, trade settlement, and similar tasks—rather than firmwide employment.

Differential Impact by Role Type

AI’s workforce impact is highly non-uniform:

Beneficiaries (augmented roles):

Private bankers and wealth advisors: AI handles research, enabling advisors to serve 50% more clients

Traders and investment bankers: AI automates 40% of research tasks, freeing time for client relationships and deal structuring

Software developers: AI-powered code generation increases deployment velocity 70% while reducing rework 20%

Risk managers: AI identifies fraud patterns and risk signals invisible to human analysis

At-risk roles (displaced or significantly reduced):

Operations specialists: Back-office processing automated by agentic AI, leading to 10% headcount reduction

Junior analysts: Research and presentation creation automated, reducing entry-level hiring needs

Call center agents: EVEE AI handles routine inquiries, reducing human escalation needs

Administrative staff: Document processing, contract review, and compliance tasks automated

Emerging roles (new categories):

Context engineers: Ensure AI systems have proper information access and retrieval

Knowledge management specialists: Curate and structure data for AI consumption

AI trainers and validators: Ensure model outputs align with regulatory and quality standards

Agentic AI supervisors: Monitor and manage autonomous AI agent workflows

Generational and Entry-Level Implications

Stanford researchers analyzing ADP data found that early-career workers (ages 22-25) in AI-exposed occupations experienced a 6% employment decline from late 2022 to July 2025. This suggests AI is reducing entry-level hiring across the economy, not just in banking.

For JPMorgan, this creates a management challenge: traditional career progression assumes large cohorts of junior analysts and associates who gain experience through repetitive tasks before advancing to senior roles. If AI eliminates 40% of junior analyst work, how does the bank develop future managing directors?

One answer, suggested by JPMorgan executives, is that junior employees will gain early management experience by overseeing AI agents—effectively managing “digital workers” rather than human teams. Whether this substitutes adequately for traditional skill development remains uncertain.

Training and Change Management

JPMorgan has implemented extensive training programs to prepare employees for AI integration. The bank has trained “tens of thousands of employees” on using AI tools effectively in daily work. The LLM Suite platform has 200,000 users (63% of workforce), with over half using it multiple times daily.

This democratization strategy—making AI accessible to broad employee populations rather than concentrating it in specialized teams—aims to capture productivity gains across the organization while building a culture of AI literacy.

X. Conclusion: The AI Transformation Imperative

JPMorgan Chase’s AI strategy from 2021 through 2026 represents the most comprehensive, transparent, and financially disciplined enterprise AI deployment in global banking. The bank has moved from 300 use cases and $100 million in annual value (2022) to 450+ use cases and $2 billion in annual value (2025), with a clear path to 1,000 use cases by 2026.

This transformation rests on three interdependent pillars:

Capital and Investment: $18 billion annual technology budgets, $2 billion dedicated AI spending, $2+ billion in cloud data center infrastructure, and willingness to absorb near-term expense increases for long-term competitive positioning.

Talent and Organization: Over 2,000 AI/ML experts and data scientists, 200-person research team, C-suite leadership with Chief Data and Analytics Officer on the Operating Committee, and firmwide AI democratization with 200,000 employees using AI tools daily.

Data and Scale: $10 trillion in daily transaction data, 84 million U.S. customers, 90% of Fortune 500 relationships, and proprietary datasets that create a self-reinforcing data flywheel impossible for smaller competitors to replicate.

The measured financial returns, $2 billion annually from $2 billion in AI investment, represent a 1:1 direct ROI, not accounting for harder-to-quantify benefits (faster product development, improved client experiences, talent attraction, competitive positioning, option value). CEO Dimon’s characterization of this as “the tip of the iceberg” suggests management believes total value substantially exceeds measured returns.

JPMorgan’s AI leadership is visible in comparative metrics: the bank ranks #1 on Evident AI’s Index for AI maturity, employs more AI talent than any global peer, has disclosed more production use cases and specific financial returns than competitors combined, and commands a valuation premium (2.68x book, 15-16x forward earnings) that reflects investor confidence in sustained competitive advantage.

The strategic necessity underlying this investment is captured in Jamie Dimon’s January 2026 statement: “We’re not going to try to meet some expense target, and then 10 years from now, you’d be asking us a question, how did JPMorgan get left behind?”. This reflects recognition that AI is not a discretionary technology investment but an existential competitive imperative—comparable to the introduction of ATMs, online banking, or mobile apps in previous eras.

The workforce transformation accompanying AI deployment is profound and irreversible. Operations staff declining 10%, junior analyst tasks automated 40%, operations productivity doubling from 3% to 6% annual improvement, and headcount discipline despite revenue growth all signal a structural shift in banking’s labor economics. JPMorgan’s candor about these changes—rare among large employers—reflects confidence that efficiency gains will outweigh the organizational friction of workforce reduction.

Looking forward, JPMorgan’s AI strategy positions the bank to sustain competitive advantage through the next decade. The combination of scale, data, talent, capital, and execution discipline creates a widening moat versus smaller competitors who lack the resources for equivalent investment. Regional banks spending $200-300 million annually on technology cannot match JPMorgan’s $18 billion budget; community banks with 50 data scientists cannot compete with 2,000+ AI specialists.

However, risks remain material. Execution challenges in scaling from 450 to 1,000 use cases, potential commoditization of AI capabilities through cloud APIs, intensifying cybersecurity threats, regulatory scrutiny of AI fairness and explainability, and potential credit cycle downturns all threaten the investment thesis.

The ultimate question is whether AI creates sustainable competitive advantage or evolves into table-stakes commodity functionality, similar to how ATMs and online banking transitioned from differentiators to universal expectations. JPMorgan is betting $2+ billion annually that early leadership, proprietary data, and execution excellence will create a persistent moat. The financial results from 2021-2026 suggest that bet is paying off, but the full return will only be visible over the coming decade.

For business strategists, operators and economists studying the future of companies, JPMorgan Chase provides the most detailed case study available on how a $4 trillion financial institution navigates the AI transformation: with massive capital commitment, relentless focus on measured returns, candor about workforce displacement, and recognition that technology investment is no longer discretionary but existential.

References: Here is a Google Doc I put together with comprehensive links and access to all of the underlying research and data for the article.

I’m building something different in 2026: Personally working 1:1 with just 100 serious operators, founders, creators, and builders.

4 quarterly 60-minute working sessions with me (recorded for you) to build your operating strategy, crush team issues, sharpen your brand, or fix whatever’s blocking growth.

For the first 25 who join, I’ve slashed the Operating Founder tier from $550/year to $99/year. Once those spots fill, the price jumps back.

Why $99? I want to partner closely with 100 inventive builders in our AI-first era, learn your stories, and see what’s really working.

John Brewton documents the history and future of operating companies at Operating by John Brewton. He is a graduate of Harvard University and began his career as a Phd. student in economics at the University of Chicago. After selling his family’s B2B industrial distribution company in 2021, he has been helping business owners, founders and investors optimize their operations ever since. He is the founder of 6A East Partners, a research and advisory firm asking the question: What is the future of companies? He still cringes at his early LinkedIn posts and loves making content each and everyday, despite the protestations of his beloved wife, Fabiola, at times.

This is an unusually clear case study of what “AI transformation” actually looks like when it’s treated like infrastructure + governance + measurement, not a demo! What I appreciate most is the clinical-like discipline JPM brings: define the problem, build the substrate (data + platforms), standardize workflows, and then hold the system accountable to outcomes. The “we’re holding ourselves accountable for actual results” mindset (and the explicit $100M → $2B value narrative) is exactly the kind of measurement culture most organizations lack, whether in banking or healthcare.

Also, the sequencing matters: this reads less like “AI is magic” and more like “AI is a force multiplier once you’ve done the unglamorous work”; cloud migration, modern infrastructure, org design, and incentives aligned to productivity rather than headcount reflexes.

As a physician-scientist, I couldn’t help seeing the parallel to medicine: we keep trying to bolt “AI” onto fragmented data and variable workflows, then act surprised when impact is modest. The real lesson here is boring, but decisive: data quality, standardization, and accountability are the intervention; the model is just the drug delivery system.

which operating habit do you think smaller organisations most underestimate when they look at institutions like this?