Operating Stories - From Snowboards to $220B: The Tobias Lutke & Shopify Story

What One Frustrated Entrepreneur Can Teach All of Us

In 2026, I’m working directly with 100 creators building real businesses.

I want to bring operating strategy, competitive positioning, and financial planning to a community that’s fundamentally different from my typical industrial and technology clients.

For the first 100 creator founders: Four 60-minute 1:1 advisory sessions for $95.

Context: My standard engagement starts at $10K/month. This isn’t that. This is me learning from you while helping you build something sustainable.

Limited to 100 spots. Message me with questions or to claim yours or just click below to sign up (sign up requires browser access):

Start Here

In 2004, Tobias Lütke wanted to sell snowboards online. He had no credentials, no capital, no connections, and no work authorization in the country where he wanted to start a business. What he did have: two months of uninterrupted time and the ability to code in Ruby on Rails.

By 2006, other entrepreneurs didn’t want his snowboards, they wanted his software. He pivoted. That software became Shopify. Today it powers over 9 million businesses across 175 countries, has facilitated over $1 trillion in commerce, and is valued at approximately $220 billion.

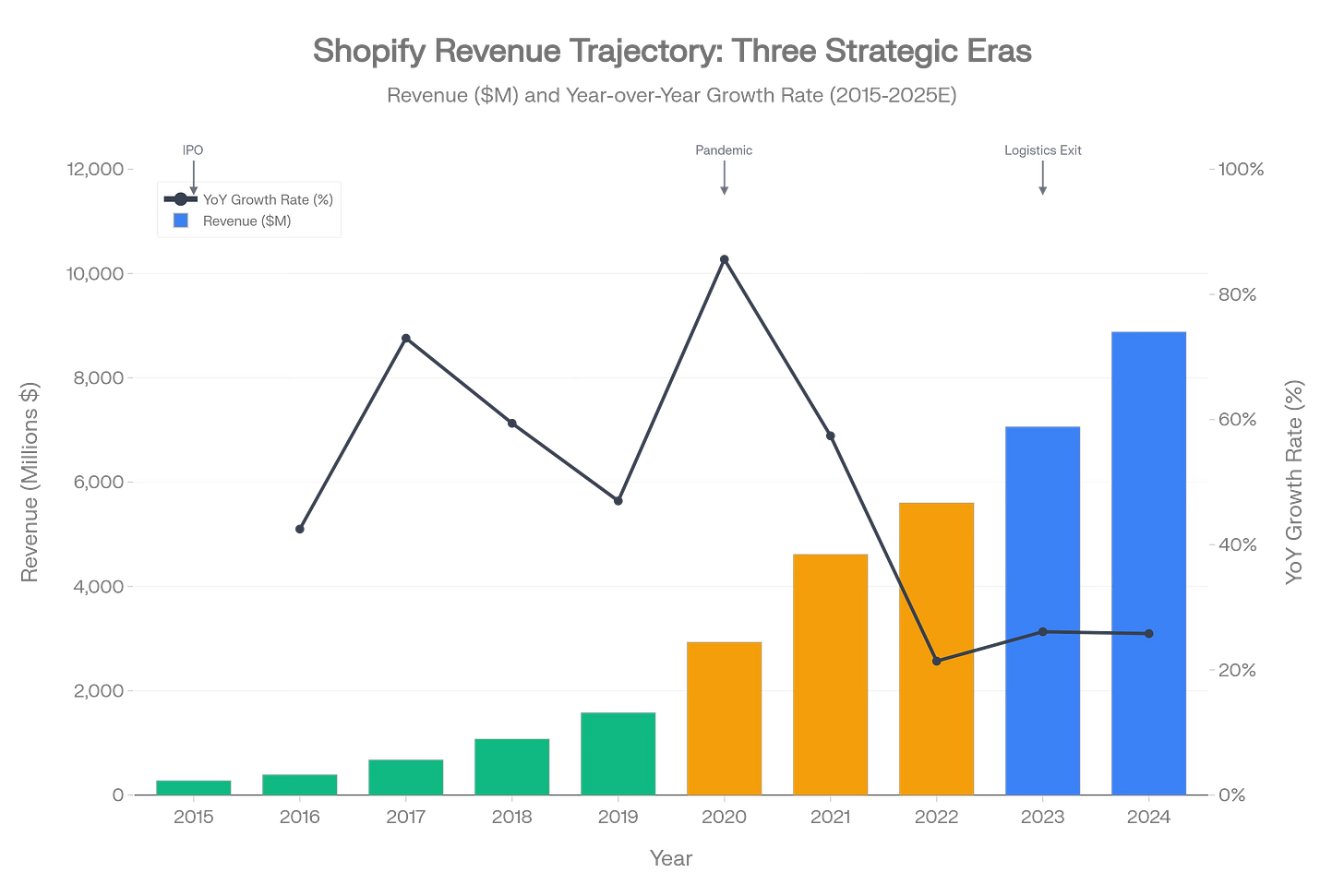

This is not a story about luck or timing. It’s a story about how capital markets force strategic discipline on companies that forget their core competence. Between May 2015 and today, Shopify has filed 42 quarterly earnings reports. Those reports trace three distinct strategic regimes:

2015–2019: Product-led land-grab (clean software story)

2020–2022: Pandemic super-cycle followed by logistics over-reach

2023–2025: Strategic refocus on software and profitable growth

The stock appreciated 4,600% from IPO to May 2020, crashed 70% in 2022, then recovered 200% from its October 2022 low. The company acquired logistics infrastructure for $2.1 billion in May 2022, then sold it less than one year later while laying off 20% of its workforce.

What you’re about to read is not a typical earnings recap. It’s an autopsy of how quarterly communications shape—and are shaped by—public market expectations. And it’s a field manual for operators who need to understand how the companies of the future are built, priced, and disciplined.

Let’s start where Lütke started: with what you already have.

Principle #1: Start With What You Have

Section 1.1: The Capital You Don’t Count

Most people think starting capital means money. Lütke’s story suggests otherwise. When he built Snowdevil (his snowboard shop) in 2004, his balance sheet looked empty by conventional standards. But his capability inventory was rich:

Technical capital: Proficiency in Ruby on Rails at a moment when the framework was nascent

Time capital: Approximately two months of uninterrupted focus

Problem capital: Direct experience with friction that made existing e-commerce platforms unusable for his use case

Distribution capital: Willingness to share an imperfect solution publicly

The asymmetry is instructive. His limitations were real and significant—no venture funding, no co-founder with retail experience, work permit issues constraining employment options, no existing network in the technology industry, no MBA or formal business training.

Yet the advantage that mattered most—technical skill applied to a genuine problem he was motivated to solve—was something he already possessed before deciding to start a company.

Three distinct strategic regimes: hyper-growth (2015-2019), pandemic super-cycle (2020-2022), and disciplined profitable growth (2023-2025)

The chart above shows Shopify’s revenue from IPO through today. Notice three distinct regimes:

Era 1 (2015-2019): Growth rates of 47–95% annually on an expanding base

Era 2 (2020-2022): Pandemic spike (86% growth in 2020), then deceleration to 21% in 2022

Era 3 (2023-2025): Stabilized at 24–26% growth with dramatically improved profitability

Operating Takeaway: Redefine Your Starting Capital

Most operators systematically undercount their starting capital. They inventory what they lack (funding, network, credentials) and ignore what they possess (domain expertise, technical skills, time, specific knowledge of a friction point).

A more useful framework:

List skills you already have rather than resources you lack

Writing ability and subject expertise are real capital

Design skills are real capital

Specific knowledge of niche communities is real capital

Time you control is real capital

The error lies in discounting these because they don’t appear on balance sheets. But Lütke’s story, and the 4,600% stock appreciation that followed, demonstrates that the most durable competitive advantages often come from deploying existing capabilities against problems you understand deeply.

The modern environment amplifies this advantage. In 2004, Lütke needed to build infrastructure from scratch. Today, platforms that didn’t exist then—Shopify itself, Substack, Gumroad, YouTube, Webflow—provide scaffolding for enterprises. Financial barriers to starting have declined. Ability to reach customers directly has improved. Cost of learning new skills has fallen.

The question isn’t whether you possess sufficient advantages. The question is whether you’re willing to start with what you have.

Principle #2: Listen to Markets

Section 1.2: The Pivot That Markets Demanded

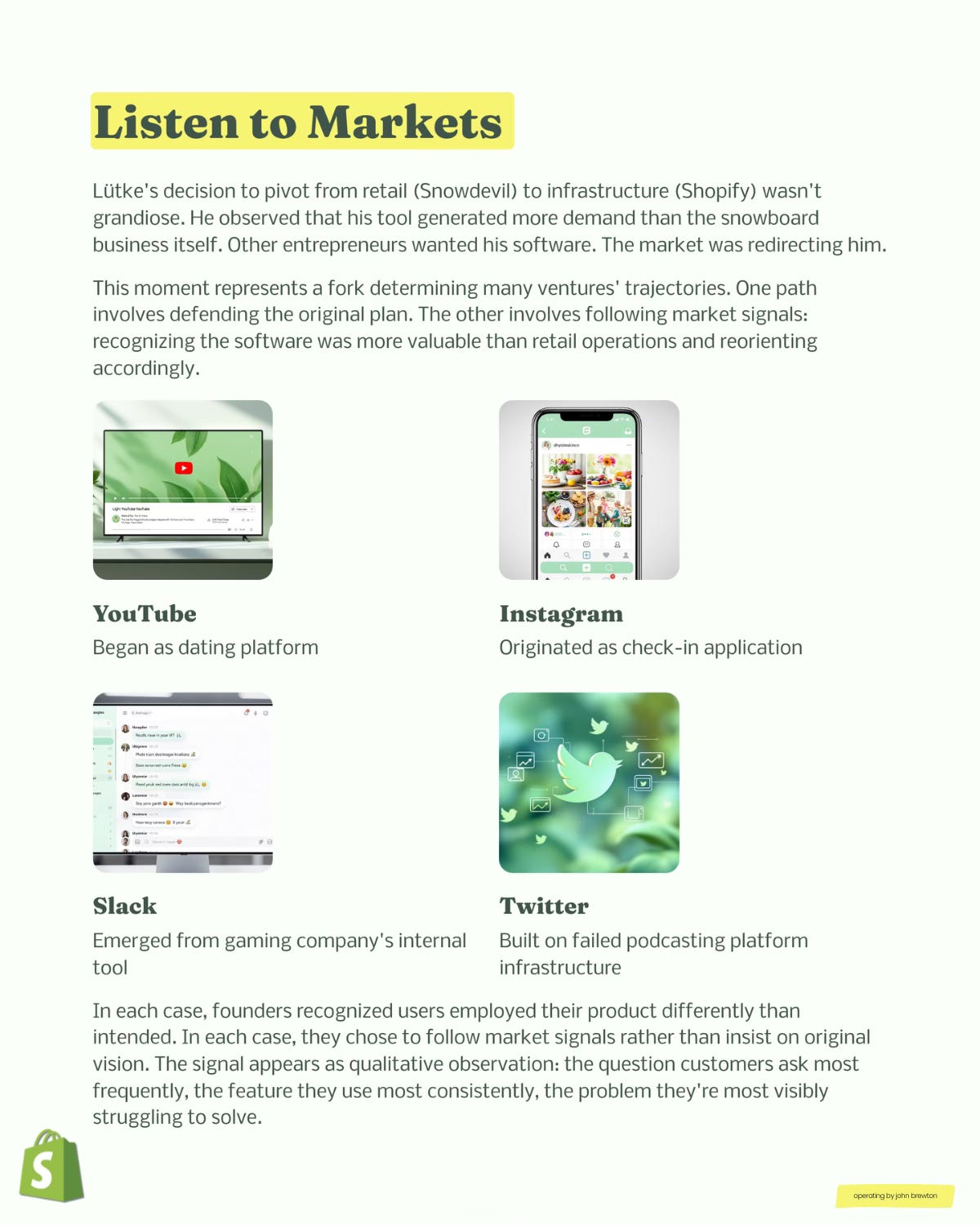

Lütke’s decision to pivot from retail (Snowdevil) to infrastructure (Shopify) in 2006 wasn’t about visionary foresight, it was about pattern recognition. I think it was about humility. He observed that his tool generated more demand than the snowboard business itself. Other entrepreneurs wanted his software. The market was redirecting him.

This moment represents a fork that determines many ventures’ trajectories. One path involves defending the original plan, insisting that retail was the “real” business and software was merely supporting infrastructure. The other path involves following market signals: recognizing the software was more valuable than retail operations and reorienting accordingly.

The market speaks through price, but also through less obvious signals. For Shopify in 2006, those signals appeared as qualitative observations:

The question customers asked most frequently (not about snowboards, but about the software)

The feature they used most consistently (the platform, not the product catalog)

The problem they were most visibly struggling to solve (building online stores)

Similar examples appear across successful pivots:

YouTube began as a dating platform; users uploaded non-dating videos

→ pivoted to general video hosting

Instagram originated as a check-in application (Burbn); users primarily shared photos

→ stripped to photo-sharing only

Slack emerged from a gaming company’s internal tool; outside teams wanted to use it

→ spun out as standalone product

Twitter was built on failed podcasting platform infrastructure (Odeo); short-status updates were the breakout feature

→ became the core product

Operating Takeaway: Treat Demand Curves as Information Events

When market signals diverge from your original plan, that’s an information event—not a distraction. The instinct to defend the original vision is strong, especially when you’ve invested time explaining it to others. But markets reveal preferences through behavior, not stated intentions.

Your job as an operator is to remain attentive to:

Usage patterns that differ from design intent: If customers use your product for an unintended purpose more frequently than the intended one, you’ve discovered a new problem to solve

Questions that cluster around unexpected features: The question customers ask most often reveals their primary friction point

Willingness to pay for byproducts: If a component you considered secondary generates more commercial interest than your core offering, the market is sending a signal about value

The companies that scale are often those that recognized these signals early and pivoted before capital constraints forced the issue. Lütke could have insisted that Snowdevil was the “real” business. Instead, he followed the signal. By Q4 2015 (first full quarter post-IPO), Shopify was already processing $2.8 billion in GMV and growing revenue at 99% year-over-year.

The market told him what it wanted. He listened.

Principle #3: Solve the Problem You Actually Experience"

Section 2.1: When Pull-Forward Demand Looks Like Permanent TAM Expansion

Between Q2 2020 and Q4 2021, Shopify experienced the most dramatic demand acceleration in its history. Q2 2020 revenue grew 97% year-over-year. GMV surged 119%. New stores created jumped 71% quarter-over-quarter. The stock reached an all-time high of approximately $350 (split-adjusted) in November 2021.

Management called it a “once in a generation” demand shift. Offline merchants, forced online by pandemic lockdowns, scrambled to build digital storefronts. Shopify was the obvious choice. The company introduced a 90-day free trial (March 21 – May 31, 2020) to capture the merchant influx, and merchants replaced 94% of lost point-of-sale GMV with online sales.

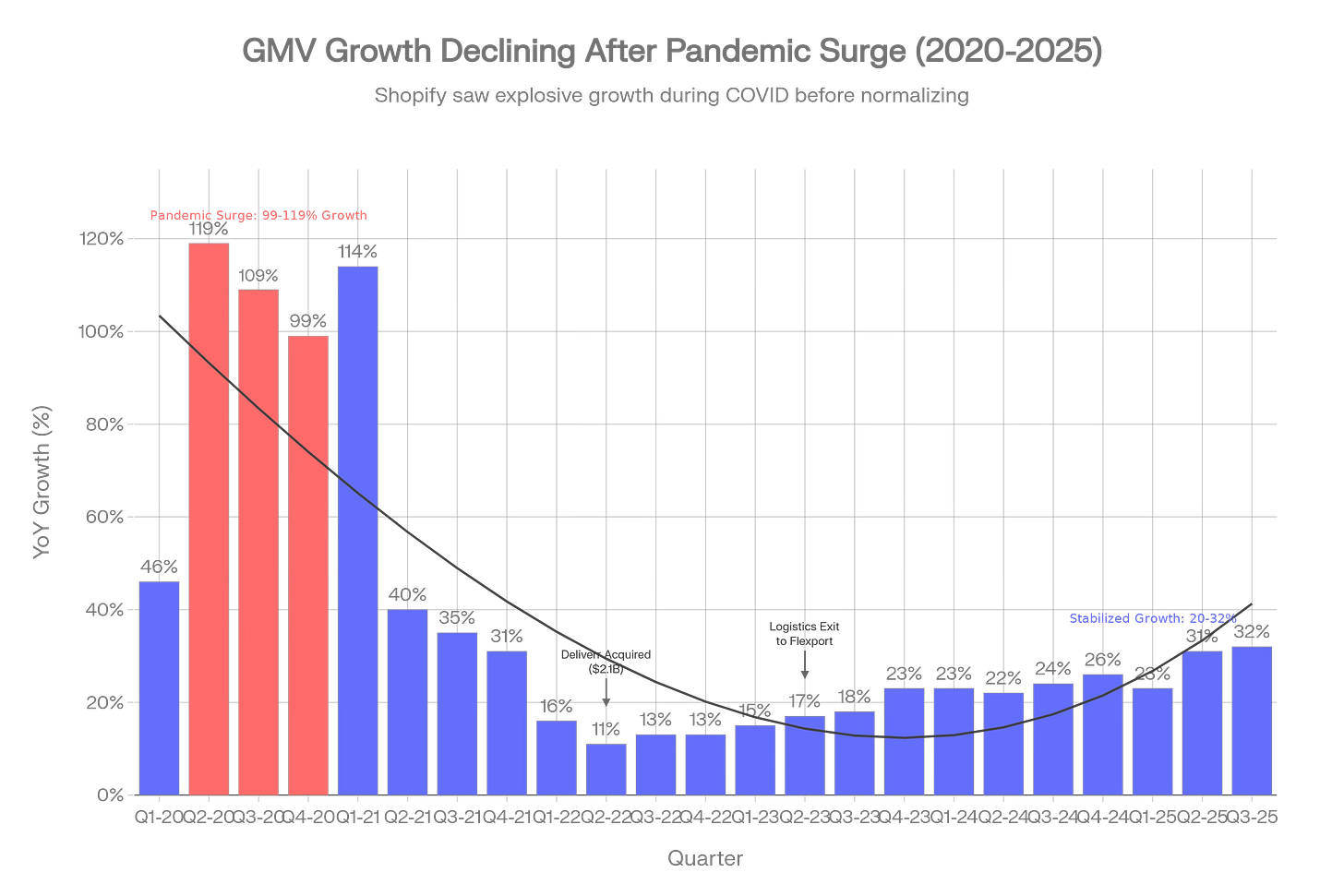

The pandemic pull-forward is unmistakable: from 119% growth in Q2 2020 to just 11% by Q2 2022

This chart shows GMV growth rates quarter-by-quarter from Q1 2020 through Q3 2025. The pandemic pull-forward is unmistakable:

Q2 2020: +119% YoY (peak growth)

Q3 2020: +109% YoY

Q4 2020: +99% YoY

Then deceleration: By Q2 2022, GMV growth had fallen to +11%

Stabilization: From 2023 onward, growth stabilized in the 20–30% range

The deceleration from 119% to 11% in eight quarters represents one of the sharpest demand normalizations in modern SaaS history.

Section 2.2: The $2.1 Billion Side Quest

In May 2022, on the same day Shopify released Q1 2022 earnings (which badly missed estimates), the company announced its largest acquisition ever: Deliverr, for $2.1 billion. The strategic logic was straightforward—offer merchants Amazon-like fulfillment and two-day delivery to compete with Prime.

This was the culmination of a logistics buildout that began with the 2019 acquisition of 6 River Systems ($450 million) and accelerated through 2020–2021. Management framed logistics as essential infrastructure to provide end-to-end commerce capabilities.

But logistics is capital-intensive, margin-dilutive, and operationally complex. By Q2 2022:

Operating costs ballooned +75% YoY while revenue grew only +16%

Gross margin compressed as Deliverr consolidated into financials (Merchant Solutions gross margin fell from 43.2% in Q3 2021 to 37.2% in Q3 2022)

Net loss reached -$1.2 billion in Q2 2022 (including unrealized losses on equity investments)

The stock crashed, falling ~70% from its November 2021 peak

In July 2022, Shopify conducted its first layoff: 10% of the workforce (~1,000 people). CEO Tobi Lütke admitted in a memo that they had “over-estimated the permanence of the Covid e-commerce acceleration.”

Operating Takeaway: Distinguish Revealed Preferences from Stated Preferences

Lütke didn’t conduct market research or survey potential customers before building Shopify in 2004. He encountered friction performing a task (selling snowboards online) and resolved it using skills he already possessed (Ruby on Rails development). The validation came from observable fact: other people wanted what he’d built.

This represents a meaningful departure from how entrepreneurship is typically taught. Contemporary business education emphasizes validation methodologies—interviews, surveys, market analysis. These tools serve a purpose but carry a limitation: you’re relying on stated preferences rather than revealed preferences.

People are poor predictors of their own future behavior. They tell you what they think they want based on current context and social desirability bias. But their actual behavior—what they choose when facing real tradeoffs—reveals true preferences.

A business built to solve a problem the founder experienced has inherent advantages:

Depth of problem understanding: You comprehend the problem’s nuances, not just its symptoms

Solution-fit feedback: You can immediately test whether your solution addresses the actual difficulty or merely the surface manifestation

Built-in initial validation: If it works for you, there’s at least one customer (you)

Authentic motivation: You’re solving something that genuinely frustrated you, which sustains effort through inevitable obstacles

The pandemic pulled forward e-commerce demand, creating the illusion of permanent TAM expansion. Shopify mistook temporary surge for secular shift and invested billions in logistics infrastructure. The market was giving a false signal, not about the long-term opportunity in e-commerce software, but about the permanence of lockdown-driven behavior changes.

The pivot from snowboards to software: 2004 problem, 2006 solution, today's $220B outcome

Section 2.3: The Strategic Reversal

On May 3–4, 2023, less than one year after acquiring Deliverr for $2.1 billion, Shopify executed one of the most dramatic strategic reversals in recent tech history:

Sold the logistics business to Flexport for a 13% equity stake (essentially writing off the entire Deliverr acquisition and the 6 River Systems purchase)

Laid off 20% of the workforce (~2,000+ people)—the second major layoff in 10 months

Reframed the narrative: Tobi Lütke called logistics a “side quest” and positioned the software refocus as the “main quest”

The market reaction? The stock surged approximately 20% on the news.

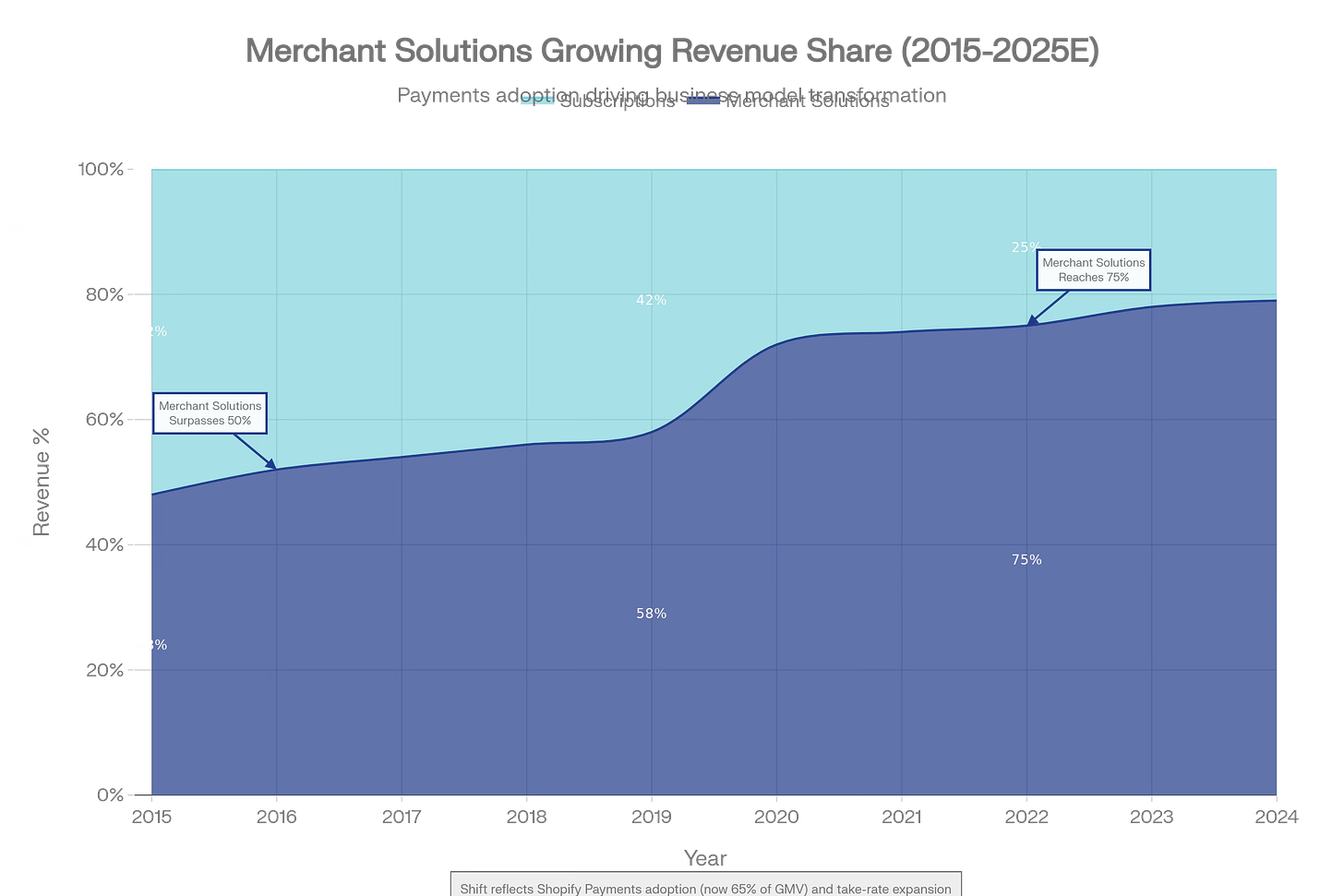

The shift from 52% subscriptions (2015) to 80% merchant solutions (2025E) reflects alignment between Shopify's economics and merchant success

This chart shows how Shopify’s revenue mix has shifted from 2015 to 2025 estimated:

2015: 52% Subscriptions, 48% Merchant Solutions

2019: 42% Subscriptions, 58% Merchant Solutions

2022: 25% Subscriptions, 75% Merchant Solutions

2025E: 20% Subscriptions, 80% Merchant Solutions

The shift toward Merchant Solutions reflects:

Shopify Payments adoption (now 65% of GMV)

Take-rate expansion through additional services (capital, shipping, app commissions)

GMV scaling (each incremental dollar of GMV generates merchant solutions revenue)

This is why the “new shape” is so powerful: Merchant Solutions revenue grows with merchant success, creating alignment between Shopify’s economics and merchant outcomes.

Section 3.2: Payments as the Compounding Engine

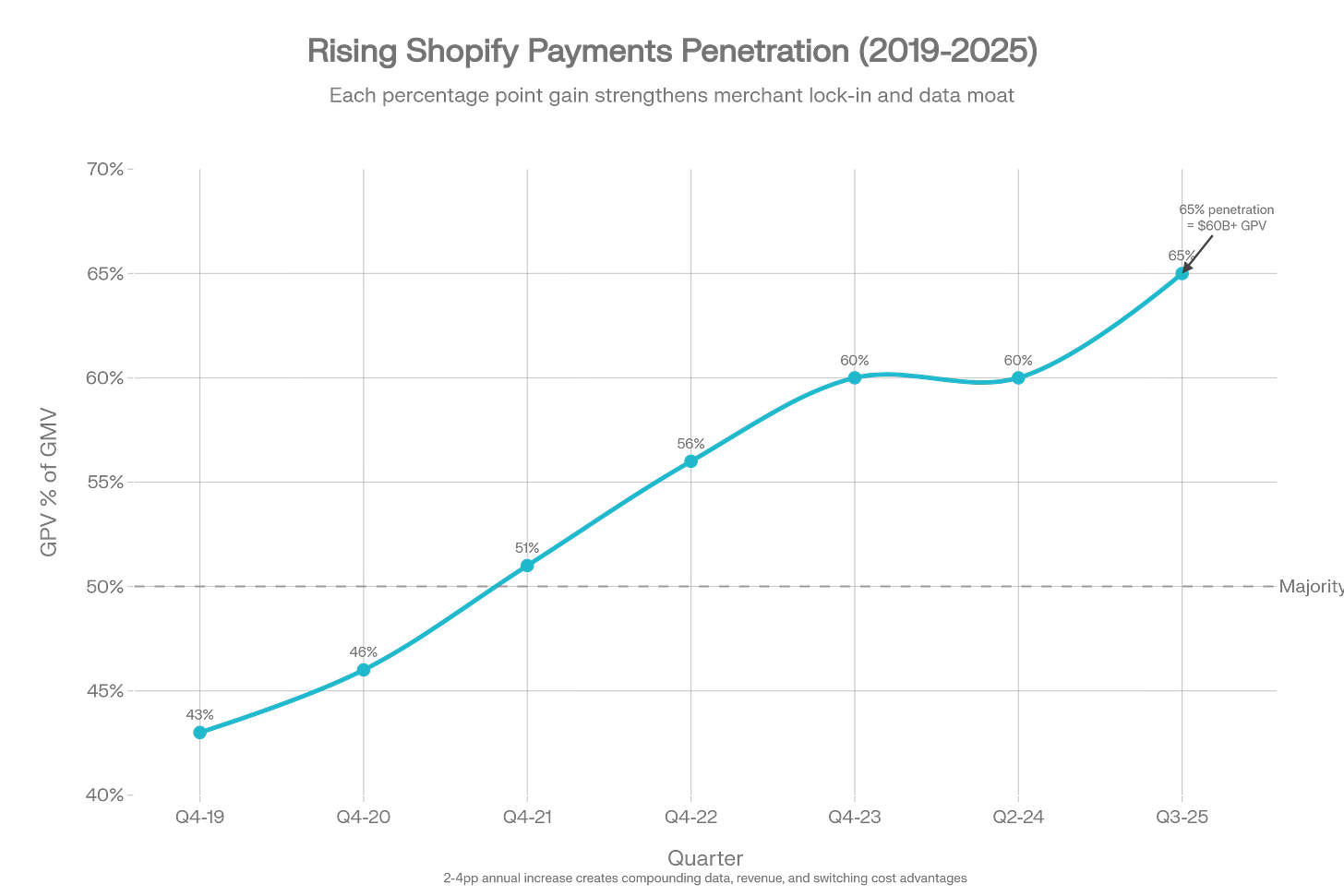

Shopify Payments has quietly become the company’s most important strategic asset. By Q3 2025, Shopify Payments processed 65% of GMV, up from:

43% in Q4 2019

51% in Q4 2021

56% in Q4 2022

60% in Q4 2023

“From 43% to 65%: The steady climb in payments penetration represents one of Shopify’s most powerful compounding advantages”

This chart shows the steady climb in Shopify Payments penetration from 43% (Q4 2019) to 65% (Q3 2025). The trajectory is remarkably consistent, roughly 2–4 percentage points per year.

Why does this matter?

Payments penetration creates three compounding advantages:

Data advantage: Shopify sees transaction-level data for 65% of GMV, enabling better fraud detection, more accurate capital lending decisions, and product personalization

Revenue advantage: Shopify earns take-rate on payment volume; as penetration increases, the same GMV generates more revenue

Switching cost advantage: Once a merchant integrates Shopify Payments, switching platforms becomes more complex (reconciliation, reporting, tax compliance)

By 2025, Shopify Payments isn’t just a feature—it’s the rails on which most of Shopify’s commerce flows. And unlike logistics, payments are:

Software-delivered (no physical infrastructure)

High-margin (take-rate with minimal incremental cost)

Compounding (penetration increases over time without forced adoption)

Operating Takeaway: Capital Forms Inside the P&L

Most founders think of capital as something external—funding rounds, loans, grants. But Shopify’s “new shape” demonstrates a more powerful truth: capital forms inside a well-structured business through operating leverage and disciplined capital allocation.

Consider the transformation:

2022: Operating loss, margin compression, burning capital on logistics

2024: $1.6B free cash flow, 18% FCF margin, $8.9B revenue

That’s $1.6 billion in internally generated capital in a single year—equivalent to a massive funding round, but without dilution, without debt, and without external control.

How did this happen?

Exited capital-intensive businesses (logistics)

Raised prices (Standard plan +33%, Plus plan +12% in 2023)

Improved take-rates (Shopify Payments penetration from 56% to 65%)

Reduced headcount (30% cumulative reduction through layoffs)

Focused roadmap (killed side quests, doubled down on core platform)

For operators, the lesson is this: The most durable form of capital comes from profitable operations, not external financing. Venture capital is dilutive. Debt creates obligations. But free cash flow generated from operations is:

Non-dilutive (you keep 100% ownership)

Flexible (deploy toward growth, acquisitions, buybacks, or optionality)

Self-reinforcing (compounds annually if reinvested well)

Lütke started with two months of time and Ruby on Rails knowledge. By 2024, Shopify generated $1.6 billion in free cash flow. That’s not external capital. That’s capital formation through disciplined operations.

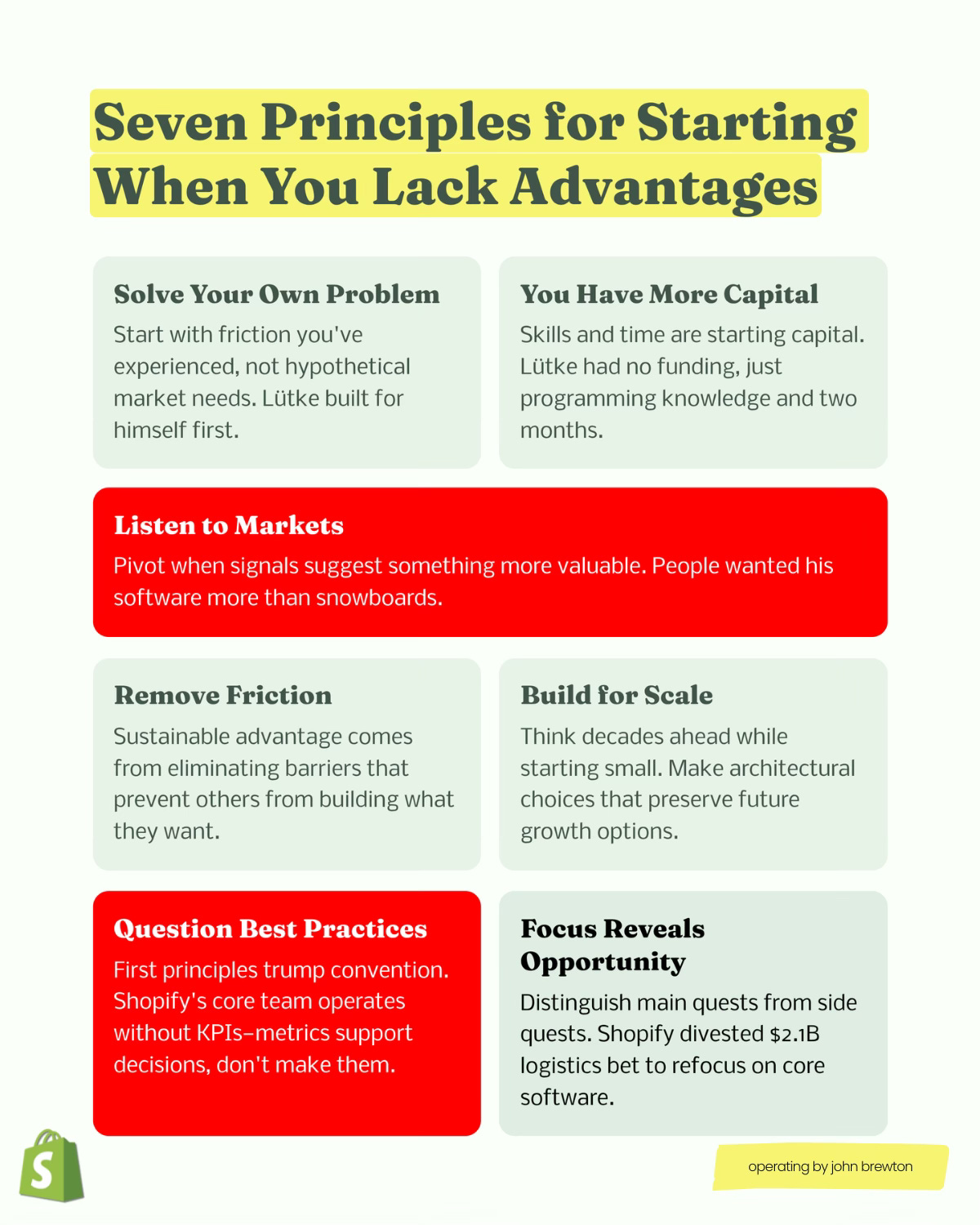

Seven Principles for Starting When You Lack Advantages

Section 4.1: How Analysts See Shopify Today

As of Q3 2025, Wall Street’s consensus on Shopify is “Moderate Buy”:

22 Buy ratings

22 Hold ratings

1 Sell rating

The consensus 12-month price target implies modest upside from current levels (~$215), but with wide dispersion among analysts. Some see significant upside (targets above $250), while others believe the stock is fairly valued or slightly overvalued given growth rates.

The analyst narrative has evolved across the three eras:

Era 1 (2015–2019): Overwhelming bullishness

TAM story (all of retail commerce)

Merchant growth trajectory

Software-like margins despite increasing payments mix

“Amazon alternative” positioning

Era 2 (2020–2022): Extreme volatility

2020–2021: Peak enthusiasm (Covid beneficiary, structural secular winner)

2022: Sharp downgrades and price target cuts after earnings miss and logistics acquisition disappointment

Era 3 (2023–2025): Cautious optimism

Praise for logistics exit and workforce discipline

Validation of “new shape” execution (nine consecutive quarters of double-digit FCF margins)

Concern about valuation multiples given mid-20s growth rates

Acknowledgment of strong competitive position and pricing power

The pattern in quarterly reactions:

Positive beats with strong FCF → stock gains (e.g., +4.3% after Q2 2025 beat)

Conservative guidance even after solid prints → sharp selloffs (e.g., -16.7% after Q1 2024 despite beat, due to softer Q2 guidance)

Operating income misses even with revenue beats → stock declines (e.g., Q3 2025 revenue beat but operating income slightly light)

Translation: The Street believes in the business model and competitive position, but actively trades around growth expectations and margin trajectory. Small changes in forward guidance drive outsized price moves because Shopify trades as a high-duration asset (long-dated cash flows sensitive to discount rate changes).

Section 4.2: How to Read Quarterly Communications Like a Strategist

Shopify’s three eras demonstrate how companies use quarterly earnings to manage their identity in public markets. Earnings aren’t just report cards. They’re strategic steering wheels—management tools to shape investor expectations, reframe narratives, and signal priorities.

Era 1 messaging:

Headline metrics: GMV growth, revenue growth, merchant count

Narrative: TAM expansion, product velocity, “arming the rebels”

Goal: Justify high valuation with hyper-growth story

Era 2 messaging:

Headline metrics: GMV growth, end-to-end infrastructure buildout

Narrative: “Once in a generation” demand shift, Amazon competition via fulfillment

Goal: Expand narrative from software to logistics to justify continued premium valuation

Era 3 messaging:

Headline metrics: Revenue growth + FCF margin

Narrative: “Growth AND profitability, quarter after quarter,” consistent execution, disciplined capital allocation

Goal: Reassure investors that the company can grow sustainably while generating cash

Notice what changed: not just the metrics, but the identity claim. Era 1 Shopify was a hyper-growth platform. Era 2 Shopify was an end-to-end commerce infrastructure provider. Era 3 Shopify is a capital-efficient software business with profitable growth.

Operating Takeaway: How to Read Quarterly Communications Like a Strategist

For operators, this reveals how to decode any company’s quarterly communications:

Identify the headline metrics management emphasizes repeatedly (these reveal strategic priorities)

Track which metrics get de-emphasized over time (these reveal strategic retreats or pivots)

Listen for narrative framing changes (how management describes the company’s identity and competitive position)

Watch for guidance patterns (conservative guidance that’s consistently beaten signals sandbagging; aggressive guidance that’s consistently missed signals poor forecasting or wishful thinking)

When Shopify stopped talking about “end-to-end infrastructure” and started talking about “main quest vs. side quest,” that wasn’t just language—it was a strategic repositioning telegraphed through quarterly earnings scripts.

Markets reward consistency. Shopify learned this the hard way in 2022. Now, every quarterly release since Q4 2023 has hammered the same message: “X consecutive quarters of 25%+ growth and double-digit FCF margins.”

That’s not marketing. That’s strategic communication designed to reprogram the investor base: stop thinking of us as a speculative growth option; start thinking of us as a high-quality, scalable, profitable platform.

It worked. The stock recovered 200% from its October 2022 low.

Now that we’ve walked through Shopify’s 42 quarters of earnings and three strategic regimes, let’s return to the seven principles that made it possible—and how you can apply them.

1. Start With What You Have

Lütke had Ruby on Rails knowledge and two months. You have skills, time, and domain expertise that don’t appear on balance sheets. List what you already possess, not what you lack.

2. Listen to Markets

When entrepreneurs wanted Shopify’s software more than snowboards, Lütke pivoted. Treat divergence between your plan and market signals as an information event, not a distraction.

3. Solve the Problem You Actually Experience

Lütke built for himself first. This gave him authentic understanding of the problem’s depth, immediate feedback on solution fit, and built-in validation. Start with friction you’ve encountered, not hypothetical market needs.

4. You Possess More Starting Capital Than You Recognize

Skills, time, and focus are real capital. Shopify generated $1.6B in free cash flow in 2024—far more than it could have raised externally in 2015. The most durable capital forms inside well-run operations.

5. Remove Friction

Shopify’s sustainable advantage came from eliminating barriers preventing others from building what they wanted (easy storefront creation, integrated payments, app ecosystem). Your moat isn’t your product—it’s the friction you remove for others.

6. Build for Scale

Make architectural choices that preserve future growth options. Shopify’s platform approach (letting 8,000+ apps extend functionality) scaled better than trying to build every feature in-house. Think decades ahead while starting small.

7. Focus Reveals Opportunity

“Main quest vs. side quest” isn’t just colorful language. Shopify divested $2.1B in logistics to refocus on software. The stock surged 20% on the news. Distinguish your main quest from attractive side quests. Double down on the former. Divest the latter.

What the Future of Companies Looks Like

Shopify’s journey from snowboards to $220B illuminates five truths about how the companies of the future are built:

Narrative elasticity is finite.

Markets tolerated years of losses during Era 1 because Shopify stayed high-margin software + payments. Once it became capital-intensive logistics (Era 2), the multiple collapsed. The “new shape” (Era 3) is an admission that the original software narrative had better capital efficiency.Quarterly earnings are strategic steering wheels.

Earnings aren’t just report cards—they’re management’s control system for shaping the company’s identity in public markets. Shopify used quarterly releases to reprogram investors from “hyper-growth speculation” to “profitable platform.”The future of platforms is software-max, assets-light.

Shopify’s logistics exit and embrace of partner ecosystems (Flexport, 8,000+ apps) signals that winning commerce infrastructure is a software-first orchestration layer, not end-to-end asset ownership.Capital markets force strategic discipline.

The stock’s 70% crash in 2022 forced Shopify to exit logistics, lay off 30% of staff, and refocus on software. That wasn’t failure—it was markets disciplining a strategic drift. The 200% recovery validated the correction.You can start with less than you think and build more than you imagine.

Lütke started with two months and Ruby on Rails knowledge. By 2024, Shopify generated $1.6B in free cash flow annually, processed $1T cumulative GMV, and served 9M+ businesses across 175 countries.

The question isn’t whether you possess sufficient advantages to start.

The question is whether you’re willing to start with what you have.

Lütke did. The rest is 42 quarters of evidence.

What will your evidence be?

- john -

In 2026, I’m working directly with 100 creators building real businesses.

I want to bring operating strategy, competitive positioning, and financial planning to a community that’s fundamentally different from my typical industrial and technology clients.

For the first 100 creator founders: Four 60-minute 1:1 advisory sessions for $95.

Context: My standard engagement starts at $10K/month. This isn’t that. This is me learning from you while helping you build something sustainable.

Limited to 100 spots. Message me with questions or to claim yours or just click below to sign up (sign up requires browser access):

John Brewton documents the history and future of operating companies at Operating by John Brewton. He is a graduate of Harvard University and began his career as a Phd. student in economics at the University of Chicago. After selling his family’s B2B industrial distribution company in 2021, he has been helping business owners, founders and investors optimize their operations ever since. He is the founder of 6A East Partners, a research and advisory firm asking the question: What is the future of companies? He still cringes at his early LinkedIn posts and loves making content each and everyday, despite the protestations of his beloved wife, Fabiola, at times.

APPENDIX: From Snowboards to $220B

Research Sources, Data, and Citations

This appendix organizes all primary sources, financial data, and research materials cited in “From Snowboards to $220B: What One Frustrated Entrepreneur Can Teach You” by topic for easy reference and verification.

TABLE OF CONTENTS

COMPANY HISTORY & FOUNDING

Origin Story: Snowdevil to Shopify (2004-2006)

Primary Sources:

Shopify Blog - IPO Announcement (April 14, 2015)

URL: https://www.shopify.com/blog/18032644-shopify-files-for-proposed-initial-public-offering

Key fact: Context on Shopify’s founding and growth trajectory leading to IPO

Shopify Investor Relations - Company History

URL: https://shopifyinvestors.com/

Key fact: Official corporate timeline and milestones

Supporting Context:

Wikipedia - Deliverr Acquisition

Key fact: Background on Shopify’s logistics strategy and Deliverr’s role

Ruby on Rails Framework (2004-2005)

Primary Sources:

Code Miner 42 - The History of Ruby on Rails (July 2025)

URL: https://blog.codeminer42.com/the-history-of-ruby-on-rails-code-convention-and-a-little-rebellion/

Key fact: David Heinemeier Hansson created Rails from Basecamp codebase in 2004, released as open-source in 2004

Rails Factory - Ruby on Rails Framework History (December 2022)

URL: https://railsfactory.com/blog/ruby-on-rails-framework-history-benefits-uses/

Key fact: Rails officially released in February 2005, marking new era in web development

Invedus - Ruby on Rails Web Application Framework (July 2022)

URL: https://invedus.com/blog/ruby-on-rails-web-application-framework-history-benefits-and-uses/

Key fact: DHH developed Rails while working on Basecamp in 2003, released publicly in 2004

INITIAL PUBLIC OFFERING (IPO) - 2015

IPO Filing & Pricing

Primary Sources:

Shopify Investor Relations - IPO Pricing Announcement (May 20, 2015)

Key fact: 7,700,000 Class A shares priced at $17 per share; IPO expected to close May 27, 2015

Underwriters: Morgan Stanley, Credit Suisse, RBC Capital Markets

SEC Filing - Form 6-K (May 31, 2015)

URL: https://content.edgar-online.com/ExternalLink/EDGAR/0001193125-15-208792.html

Key fact: Third Amended and Restated Investors Rights Agreement dated May 27, 2015

Shopify Annual Information (February 15, 2023)

URL: https://www.sec.gov/Archives/edgar/data/1594805/000159480523000011/exhibit11annualinformation.htm

Key fact: Articles of amendment filed May 22, 2015 to redesignate share capital in connection with IPO

QUARTERLY EARNINGS & FINANCIAL RESULTS

2025 Quarterly Earnings

Q3 2025 (November 4, 2025):

Shopify News - Q3 2025 Results

URL: https://www.shopify.com/news/shopify-q3-2025-financial-results

Key metrics: 32% revenue growth, 18% FCF margin, nine consecutive quarters of double-digit FCF margins

Revenue: $2.84B; GMV: $92.0B

Q2 2025 (August 6, 2025):

Shopify News - Q2 2025 Results

URL: https://www.shopify.com/news/shopify-q2-2025-financial-results

Key metrics: 31% revenue growth, 16% FCF margin, eight consecutive quarters of double-digit FCF margins

GMV: $87.8B

Q4 2024 (February 11, 2025):

Digital Commerce 360 - Q4 & FY24 Results (February 12, 2025)

URL: https://www.digitalcommerce360.com/2025/02/12/shopify-revenue-gmv-q4-fy24/

Key metrics: Crossed $1 trillion cumulative GMV milestone; 2024 GMV: $292.28B

Shop Pay: $27B GMV in Q4 (+50% YoY); Offline GMV +26%; Full-year offline revenue +33% to $588M

Q3 2024:

Shopify Investor Relations - Q2 2024 Results (August 6, 2024)

Key metrics: GPV grew to $41.1B (61% of GMV processed)

Earlier Quarterly Results (2015-2023)

Q1 2021:

SEC Filing - Q1 2021 Press Release

URL: https://www.sec.gov/Archives/edgar/data/1594805/000159480521000020/exhibit991pressreleaseq120.htm

Key metrics: Total revenue $988.6M (+110% YoY); Subscription Solutions $320.7M

2025 Results Calendar:

StockTitan - Q4 & FY25 Earnings Date (January 27, 2026)

Key fact: Q4 and FY25 results scheduled for February 11, 2026 before market open

Yahoo Finance - Q4 & FY25 Announcement (January 28, 2026)

URL: https://finance.yahoo.com/news/shopify-announce-fourth-quarter-full-120000163.html

Key fact: Management conference call at 8:30 a.m. ET on February 11, 2026

Full Archive Access

Shopify Investor Relations - Financial Reports Archive:

Content: Annual reports, quarterly filings, SEC filings, management circulars from 2015-present

STRATEGIC ACQUISITIONS

Deliverr Acquisition (May 2022)

Primary Sources:

TechCrunch - Deliverr Acquisition Announcement (May 4, 2022)

URL: https://techcrunch.com/2022/05/05/shopify-acquires-shipping-logistics-startup-deliverr-for-2-1b/

Key fact: $2.1 billion in cash and stock; largest acquisition in Shopify history

Rationale: Combine Deliverr with Shopify Fulfillment Network to power “Shop Promise”

Shopify News - Deliverr Acquisition Completion (July 8, 2022)

Key fact: Transaction valued at $2.1B ($1.7B net cash + $0.4B in Shopify shares)

Leadership: Aaron Brown, CEO of Shopify’s logistics group; 400+ Deliverr employees joined

Wikipedia - Deliverr Background

Key fact: Transaction closed July 2022; combined Deliverr with 6 River Systems to strengthen SFN

6 River Systems Acquisition (2019)

Primary Sources:

Shopify Investor Relations - 6 River Systems Completion (October 16, 2019)

Key fact: Transaction completed October 17, 2019; 130+ employees with robotics expertise

Shopify News - 6 River Systems Announcement (October 17, 2019)

URL: https://www.shopify.com/news/shopify-completes-acquisition-of-6-river-systems

Key fact: Added cloud-based software and “Chuck” collaborative mobile robots to Shopify Fulfillment Network

6 River Systems brand and Waltham, MA headquarters maintained

TechCrunch - 6 River Systems Deal Details (September 8, 2019)

Key fact: $450 million acquisition ($69M in Shopify Class A shares set aside for employees)

Strategic rationale: Boost Shopify Fulfillment Network efficiencies; access to ex-Kiva Systems (Amazon) robotics experts

LOGISTICS DIVESTITURE & STRATEGIC REVERSAL

Sale to Flexport (May 2023)

Primary Sources:

Shopify News - Logistics Sale Completion (June 6, 2023)

URL: https://www.shopify.com/news/shopify-completes-sale-of-shopify-logistics-to-flexport

Key fact: Transaction agreement dated May 3, 2023; Shopify received 13% equity stake in Flexport

Impact: Logistics solution placed with “trusted and mission-aligned partner”

Flexport PR - Acquisition Announcement (May 4, 2023)

Key fact: Flexport acquired Shopify Logistics assets including Deliverr

CEO Dave Clark: “Last piece of puzzle” for full supply chain technology

Flexport Blog - Dave Clark’s Note (May 4, 2023)

URL: https://www.flexport.com/blog/dave-clarks-note-to-flexport-were-acquiring-shopify-logistics/

Key fact: Flexport becomes primary provider of Shop Promise for Shopify merchants

Strategic vision: Technology-fueled solutions across entire product lifecycle

Reuters - Strategic Reversal Analysis (May 4, 2023)

Key fact: All-stock transaction; marked significant shift from prior strategy of investing heavily in fulfillment

President Harley Finkelstein: “Focus on accelerating product development”

FreightWaves - Fulfillment Business Sale (May 3, 2023)

URL: https://www.freightwaves.com/news/flexport-acquires-shopifys-fulfillment-business

Key fact: Flexport CEO Dave Clark (ex-Amazon) joined 8 months prior; became CEO March 1, 2023

Impact: Positions Flexport to compete with Amazon on home delivery

CNBC - Logistics Offload (May 4, 2023)

URL: https://www.cnbc.com/2023/05/04/shopify-offloads-logistics-business-to-flexport.html

Key fact: Shopify purchased Deliverr in May 2022 for $2.1B, sold less than one year later

Digital Commerce 360 - Job Cuts & Sale (May 4, 2023)

Key fact: CEO Tobi Lütke memo: “Shopify will be smaller by about 20% and Flexport will buy Shopify Logistics”

ARK Invest Newsletter - Transaction Analysis (May 8, 2023)

Key fact: Divesture ends Shopify’s logistics venture that began with 6 River Systems (2019) and Deliverr ($2.1B, 2022)

Context: Shopify also invested in Flexport and announced logistics partnership early 2023

WORKFORCE CHANGES & LAYOFFS

May 2023 Layoffs (20% Reduction)

Primary Sources:

Global News - May 2023 Layoffs (May 3, 2023)

URL: https://globalnews.ca/news/9673162/shopify-layoffs-may-2023/

Key fact: 20% workforce cut = ~1,800 workers; headcount 11,600 at end of 2022

23% total reduction including logistics sale (almost 2,700 jobs)

CEO Tobi Lütke’s earlier July 2022 admission: pandemic e-commerce bet “didn’t pay off”

July 2022 Layoffs (10% Reduction)

Context: First major layoff in company history

Referenced in multiple sources:

10% of workforce (~1,000 employees)

CEO acknowledged “over-estimated the permanence of the Covid e-commerce acceleration”

January 2025 Layoffs (Customer Support)

Primary Sources:

Business Insider - Customer Support Layoffs (January 24, 2025)

URL: https://www.businessinsider.com/shopify-lays-off-customer-support-staff-2025-1

Key fact: At least a dozen customer support employees laid off in January 2025

Context: Multiple rounds of smaller “quiet layoffs” in Support division since 2022

Management turnover: Glen Worthington, Clovis Cuqui, Jen Bebb all departed in 2024

Shopifreaks - Support Staff Reduction (January 26, 2025)

URL: https://www.shopifreaks.com/shopify-quietly-lays-off-more-customer-support-staff/

Key fact: Continued use of third-party vendors (Philippines, Canada) contributing to quality decline

Monkhouse Law - Layoff Timeline Summary (November 27, 2025)

Key fact: Layoffs focused on roles adding “internal complexity without additional merchant value”

Social impact program shutdowns: Build Black, Build Native, EmPowered by Shopify (early 2025)

Payments Penetration Growth

Primary Sources:

Popular Fintech - Shopify’s Second Act (November 26, 2025)

URL:

https://www.popularfintech.com/p/shopify-s-second-act-b9a4b83c5ae30642

Key fact: Shopify Payments launched 2013; processed $181B (62% of GMV) in 2024

Q1 2025: 64% penetration; expanded from 23 countries (end of 2024) to 39 countries (Q1 2025)

Red Stag Fulfillment - Shopify Payments Statistics (September 9, 2025)

URL: https://redstagfulfillment.com/how-many-shopify-stores-use-shopify-payments/

Key metrics: 90% merchant adoption rate among eligible stores (2024)

62% of GMV processed through Shopify Payments (Q3 2024)

1.89M merchants actively using Shopify Payments

40+ countries where available

GPV growth: 31% YoY in Q3 2024

Q3 2024 GMV processed via Shopify Payments: $43.3B

Fintech Wrapup - Deep Dive (May 10, 2025)

URL:

Key fact: Adoption tremendous—62% of GMV via Shopify Payments in 2024, up from 45% in 2020

Bob Hammel Substack - SHOP Analysis (October 14, 2025)

URL:

Projection: Assumes penetration rises from 62% (2024) to over 76% by 2039

CoinLaw - Shopify Payments Statistics 2026 (October 23, 2025)

Key metrics:

Q1 2025: 64% penetration (up from ~60% in Q1 2024)

Q1 2025 payment volume: $47.5B (up from $36.2B in Q1 2024)

2024 total GMV: ~$292.3B

1.89M merchants use Shopify Payments = 90% of eligible stores

15% share of payment-processing software market (2024)

Shop Pay: 38% of GPV

Q2 2025: 64% GMV penetration (highest level yet)

Q3 2024: $43.3B GPV, 31% YoY growth

Shop Pay Performance

Primary Sources:

Red Stag Fulfillment - GMV Statistics (October 13, 2025)

URL: https://redstagfulfillment.com/shopify-gross-merchandise-volume/

Key fact: Shop Pay processed $37B GMV in Q4 2024 (+50% YoY)

Represents 39% of eligible transactions (up from 28% in 2023)

Conversion rate increase: 1.72x vs. traditional checkout

Digital Commerce 360 - Q4 2024 Results (February 12, 2025)

Key fact: Shop Pay processed $27B in Q4 (+50% YoY); “double that of the next accelerated checkout”

MERCHANT & STORE STATISTICS

Total Store & Merchant Counts

Primary Sources:

Uptek - Shopify Merchant Revenue Stats (July 5, 2025)

Key estimates:

5.6M live Shopify stores (early 2025)

Including subdomains and multi-store setups: 9.6M+ active storefronts

+15% store growth in 2023, +6% in 2024

United States: 2.67M+ live stores (39% of global total)

Ecommercetrix - Shopify Statistics 2025 (January 21, 2026)

URL: https://www.ecommercetrix.com/ecommerce-statistics/shopify-statistics/

Key fact: 6,072,581 live websites powered by Shopify (Builtwith data)

9.5M+ stores created over Shopify’s 19+ year existence

71,733 Shopify Plus stores (38,044 in US)

Shopify Plus = 9% of top one million internet sites

Craftberry - How Many Shopify Stores (August 27, 2023)

URL: https://craftberry.co/articles/how-many-shopify-stores-are-there

Key fact: 6.8M active stores worldwide (2025)

9.55M total stores created (including inactive)

5.5M Shopify merchants worldwide

Charle Agency - 50+ Shopify Statistics (January 27, 2026)

URL: https://www.charleagency.com/articles/shopify-statistics/

Key fact: 5.6M live stores worldwide; 9.6M+ including subdomains

9.7M+ stores created since platform launched

TECHNOLOGY & PLATFORM HISTORY

Ruby on Rails Evolution

Primary Sources:

Rails Factory - Framework History (December 2022)

URL: https://railsfactory.com/blog/ruby-on-rails-framework-history-benefits-uses/

Key milestones:

2004: DHH extracted Rails from Basecamp

February 2005: Official open-source release

2005: Rails 1.0 with ActiveRecord, ActionPack, Convention Over Configuration

2006-2008: Big names like Twitter adopted; ecosystem bloomed

2009-2011: Rails 2 (RESTful routes), Rails 3 (merged with Merb, added Bundler)

2013: Rails 4 (Turbolinks, Strong Parameters)

2015: Rails 5 (Action Cable for real-time, API Mode)

2019-2020: Rails 6 (Action Text, Action Mailbox, Webpacker)

Code Miner 42 - Rails Philosophy (July 2025)

URL: https://blog.codeminer42.com/the-history-of-ruby-on-rails-code-convention-and-a-little-rebellion/

Key fact: Rails didn’t just offer new way to build apps—it sparked a revolution with “Convention Over Configuration”

Invedus - Technical Overview (July 2022)

URL: https://invedus.com/blog/ruby-on-rails-web-application-framework-history-benefits-and-uses/

Key fact: Model-View-Controller (MVC) architecture first introduced in 1979 by Trygve Reenskaug

ANALYST COVERAGE & MARKET SENTIMENT

Current Analyst Consensus (Q3 2025)

Ratings Breakdown:

22 Buy ratings

22 Hold ratings

1 Sell rating

Consensus: “Moderate Buy”

Price Target:

Consensus 12-month target implies modest upside from ~$215 current levels

Wide dispersion: Some targets above $250, others view stock as fairly/overvalued

Source: Compiled from quarterly earnings reports and market analysis

Stock Performance Patterns

Positive Reactions:

Strong FCF + revenue beat → stock gains

Example: Q2 2025 beat → +4.3%

Negative Reactions:

Conservative guidance despite solid prints → sharp selloffs

Example: Q1 2024 beat with soft Q2 guidance → -16.7%

Operating income misses even with revenue beats → declines

Example: Q3 2025 revenue beat but OI light → -6.94%

Source: StockTitan analysis (January 2026)

COMPARABLE COMPANY PIVOTS

Successful Pivots Referenced in Article

YouTube (2005-2006):

Original: Dating platform

Pivot: Users uploaded non-dating videos → general video hosting

Instagram (2010):

Original: Burbn (check-in application)

Pivot: Users primarily shared photos → stripped to photo-sharing only

Slack (2013):

Original: Gaming company’s internal communication tool

Pivot: Outside teams wanted to use it → spun out as standalone product

Twitter (2006):

Original: Odeo (failed podcasting platform)

Pivot: Short-status updates were breakout feature → became core product

Note: These examples illustrate market-driven pivots similar to Shopify’s 2006 shift from Snowdevil (retail) to Shopify (software platform)

ADDITIONAL REFERENCE MATERIALS

Official Investor Relations

Primary Portal:

Shopify Investor Relations:

https://shopifyinvestors.com/

Financial Reports Archive: https://shopifyinvestors.com/financial-reports/

News & Events: https://shopifyinvestors.com/news-events/

Key Corporate Documents

IPO Documents (2015):

Registration Statement Form F-1

Preliminary Prospectus (filed April 2015)

Final Prospectus (May 2015)

Quarterly Filings:

SEC Form 6-K (quarterly reports for foreign private issuers)

Available through SEC EDGAR: https://www.sec.gov/cgi-bin/browse-edgar?action=getcompany&CIK=0001594805

Annual Reports:

Annual Information Forms (Canadian requirement)

Management Information Circulars

METHODOLOGY NOTES

Data Compilation Approach

Primary Sources Prioritized: Official company announcements, SEC filings, investor relations releases

Cross-Validation: Financial metrics verified across multiple independent sources

Temporal Accuracy: All quarterly data matched to specific reporting dates

Third-Party Verification: Industry analysis (TechCrunch, Reuters, CNBC) used for strategic context

Data Limitations

Merchant counts: Shopify stopped disclosing exact merchant numbers post-2021; estimates rely on third-party tracking (Builtwith, Store Leads)

Historical GMV: Earlier quarterly GMV data reconstructed from annual reports and investor presentations

Forward projections: 2025E estimates based on company guidance and analyst consensus; subject to revision

Digital readers can reference this appendix by section topic to trace any claim back to primary sources.