The Operating Creator: A Weekly Note About the History, Economics & Future of the Creator Economy From Operating by John Brewton

The Creator Economy at the Start of 2026: Consolidation, Professionalization, and Structural Transformation

In 2026, I’m working directly with 100 creators building real businesses.

I want to bring operating strategy, competitive positioning, and financial planning to a community that’s fundamentally different from my typical industrial and technology clients.

For the first 100 creator founders: Four 60-minute 1:1 advisory sessions for $95.

Context: My standard engagement starts at $10K/month. This isn’t that. This is me learning from you while helping you build something sustainable.

Limited to 100 spots. Message me with questions or to claim yours or just click below to sign up (sign up requires browser access):

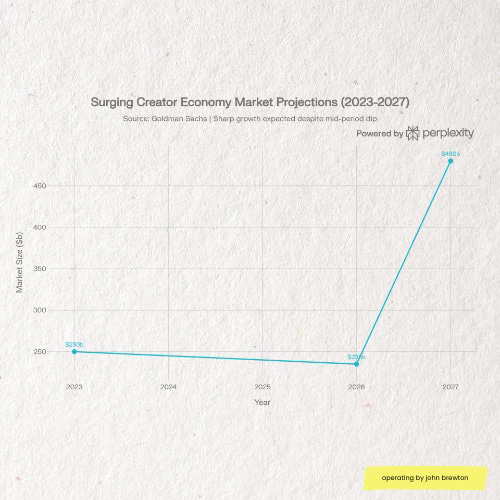

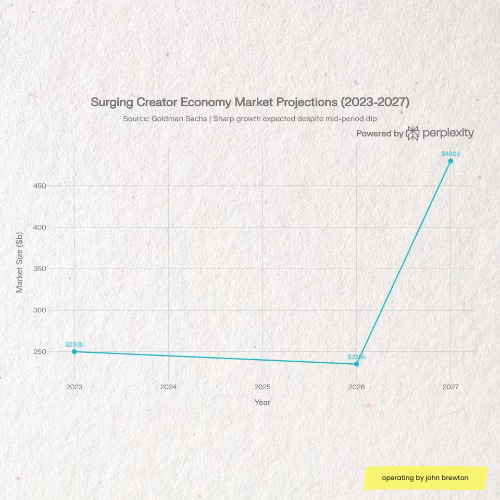

Goldman Sachs projects the creator economy will nearly double from $250 billion in 2023 to $480 billion by 2027, reflecting sustained institutional confidence despite near-term market adjustments.

Too Long, No Time To Read (You’re Welcome:)

The creator economy has transitioned from experimental to institutional. Valued at $235 billion with 22.5% compound annual growth, the sector is experiencing the consolidation and professionalization patterns typical of maturing industries. Goldman Sachs projects a $480 billion valuation by 2027.

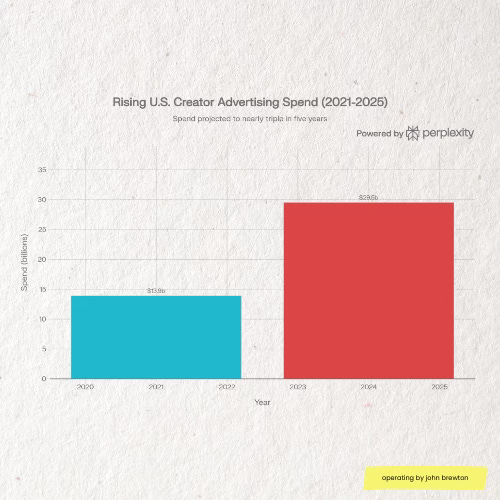

Key Financial Metrics: U.S. creator advertising spending reached $29.5 billion in 2024 and projects to $37 billion in 2025—a 27% compound annual growth rate since 2021. Eighty-three percent of chief marketing officers report increasing creator investments in 2026, with two-thirds of new budget deriving from reallocation of digital and paid advertising spending rather than net-new funds.

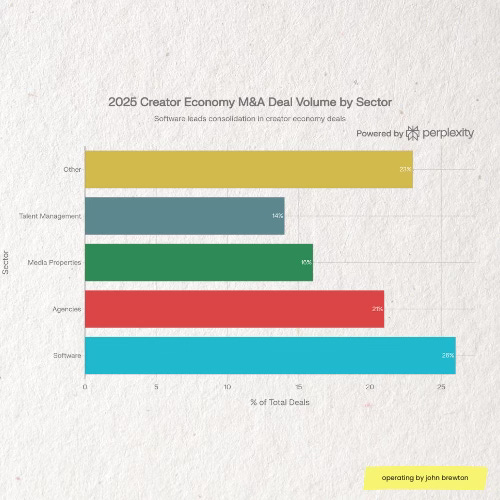

M&A Consolidation: 2025 saw 81 completed transactions (17.4% growth from 2024), with valuations stabilizing at 5-9x EBITDA. Software platforms (26%), agencies (21%), and media properties (16%) comprised three-quarters of deal volume. North America dominated with 71% of transactions, indicating geographic maturity disparity.

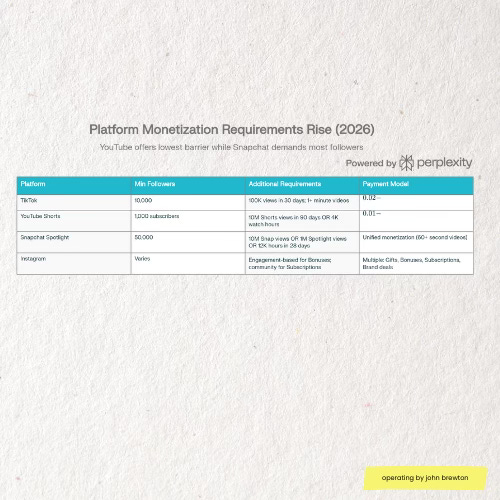

Platform Monetization Evolution: Snapchat raised follower requirements from 1,000 to 50,000—a 5,000 basis point threshold elevation reflecting supply-demand imbalances. TikTok, YouTube Shorts, and Instagram maintain distinct monetization architectures ($0.02-$0.04, $0.01-$0.05, and flexible models respectively per 1,000 views).

Creator Business Formalization: High-performing creators operate according to multi-year strategic plans incorporating “stacked revenue” across 6-8 income streams: platform monetization, brand partnerships, digital products, subscriptions, affiliate commerce, merchandise, and experiences. This diversification functions as risk management against platform dependency.

Vertical Integration: Beast Industries exemplifies the emerging model—integrating YouTube content production (458M subscribers), consumer brands (Feastables), experiences (Beast Land), platform infrastructure (Creator Marketplace), and financial services. By internalizing downstream functions, such enterprises capture substantially larger value shares than creators relying on platform monetization alone.

Regulatory Standardization: Spring 2026 launches the Institute for Responsible Influence certification program addressing FTC disclosure compliance. New York’s Synthetic Performer Disclosure Law (June 2026), EU AI Act transparency provisions (August 2026), and Representative Ro Khanna’s Creator Bill of Rights (January 2026) signal global momentum toward regulatory frameworks.

Strategic Implications: As the market matures, creator economics are converging toward principles of market efficiency, competitive consolidation, and operational professionalization consistent with media and technology industries. Organizations investing in infrastructure, data, and compliance while maintaining operational flexibility will capture disproportionate value.

Start: What a time to be alive, creating and building.

The creator economy, valued at $235 billion and expanding at 22.5% compound annual growth rate, exhibits characteristics consistent with industrial consolidation phases across media, technology, and entertainment sectors. Goldman Sachs projects a $480 billion valuation by 2027. The market is transitioning from an early-stage ecosystem characterized by principal-agent asymmetries and fragmented monetization mechanisms to a mature, structured market with standardized business architecture, institutional investor participation, and regulatory oversight.

Recent developments across five dimensions—merger-and-acquisition activity, platform evolution, creator business formalization, regulatory standardization, and vertical integration—demonstrate institutional capital reallocation and operational professionalization within the sector. U.S. creator advertising expenditures reached $29.5 billion in 2024 and project to $37 billion in 2025, reflecting a compound annual growth rate of approximately 27% since 2021. This trajectory, coupled with record M&A transaction volume and tightening platform monetization thresholds, indicates the sector has transcended experimental status and achieved structural significance within the broader advertising and media spending ecosystems.

For executives and strategists evaluating long-term business architecture, the creator economy constitutes a test case for examining how enterprises function when attention allocation, rather than capital availability or manufacturing capability, constitutes the primary constraint on growth.

U.S. creator advertising spend has more than doubled since 2021, demonstrating the rapid maturation of the creator economy as a core marketing channel.

Check out these popular articles:

Transaction Volume and Valuation Methodology

The creator economy experienced 81 completed M&A transactions in 2025, representing 17.4% growth from 69 transactions in 2024. This trajectory reverses a contraction period from 2022-2023, when macroeconomic tightening and regulatory uncertainty compressed deal flow. The current acceleration reflects institutional confidence that creator-focused assets generate defensible cash flows sufficient to justify acquisition premiums.

Valuation multiples stabilized between 5-9x EBITDA in 2025—a range consistent with software-as-a-service benchmarks and often exceeding traditional media asset multiples. This pricing structure implies investor expectations that creator platforms generate both revenue stability and margin expansion superior to broadcast or legacy digital media. The implied thesis rests on three mechanisms:

Superior content cost structure relative to traditional media production;

Network effects within creator-brand-audience triangulation;

Superior unit economics within talent acquisition and brand partnerships relative to agency-based intermediation.

Sectoral Composition and Strategic Rationale

Transactional activity distributed across four primary categories: software platforms (26%), creative and talent agencies (21%), media properties (16%), and management firms (14%), with remaining transactions (23%) spanning holding companies, analytics platforms, and commerce enablers. This composition reflects strategic buyer motivations diverging sharply from earlier phases of creator economy development.

Software and agency acquisitions dominated creator economy M&A activity in 2025, representing nearly half of all transactions as the industry consolidates.

The predominance of software acquisitions indicates that institutional capital prioritizes infrastructure ownership, systems controlling creator onboarding, audience analytics, commerce integration, and brand relationship management (The B2B Creator Industrial Complex) Rather than acquiring established talent rosters or content franchises, acquirers target platforms enabling scalable creator management and performance attribution. This pattern mirrors historical consolidation within the talent management and advertising technology industries, where infrastructure and data capture constitute greater value than individual relationships.

Conversely, North American domination of transaction flow (71% of global volume) reflects market maturity disparity. European and Asian markets exhibit fragmentation, with dominant local players but insufficient consolidation to warrant large institutional acquisitions. This geographic concentration of capital represents a potential arbitrage opportunity for international acquirers capable of exporting consolidation infrastructure to less mature markets.

Structural Implications for Industry Participants

The consolidation wave creates divergent outcomes for incumbent players. Large, technology-enabled advertising holding companies acquire AI-driven influencer discovery and performance attribution capabilities, enabling performance-oriented creator marketing that smaller independents cannot replicate. Publicis Groupe’s acquisition of Captiv8, Stagwell’s acquisition of LEADERS, and similar strategic acquisitions of data-intensive platforms exemplify this consolidation pattern.

Conversely, “pure-play” talent agencies lacking proprietary technology face commoditization risk. As brands increasingly demand transparent performance metrics, AI-assisted creator matching, and integrated fulfillment across content, commerce, and paid media, agencies offering intermediation without technological differentiation lose competitive positioning. The implied structural evolution mirrors historical patterns within recruiting, where infrastructure and matching algorithms displaced traditional relationship-based intermediation.

This dynamic creates asymmetric returns. Platforms controlling first-party data on creator-brand performance, audience dynamics, and content effectiveness possess optionality unavailable to single-function intermediaries. Consequently, valuations for infrastructure assets command significant premiums relative to talent-dependent businesses, reflecting duration and optionality of cash flows.

Snapchat Spotlight as Platform Repositioning Signal

Snapchat’s unified monetization program, effective February 2025, increased eligibility requirements from 1,000 followers to 50,000 followers, constituting a 5,000 basis point elevation in entry thresholds. Additional requirements include minimum 25 monthly posts to Saved Stories or Spotlight, activity on at least 10 of the preceding 28 days, and achievement of one of the following metrics: 10 million Snap views, 1 million Spotlight views, or 12,000 hours of aggregate view time.

This qualification structure reflects deliberate platform strategy. Snapchat’s Spotlight viewership expanded 25% year-over-year, creating a supply-demand imbalance wherein content demand materially exceeds creator participation. Accordingly, the platform employs eligibility thresholds as a demand-allocation mechanism, channeling inventory toward established creators while minimizing distribution to emerging talent. This approach optimizes advertiser confidence by establishing content quality floors and ensuring stable creator relationships.

From an economic perspective, elevated entry thresholds function as a price discrimination mechanism. Rather than reducing creator compensation to suppress supply and equilibrate demand, Snapchat maintains absolute compensation levels while raising non-monetary barriers. This structure benefits Snapchat directly—by concentrating creators among established participants less likely to migrate—and benefits qualifying creators through reduced competition and marginally higher earnings.

Comparative Monetization Architecture

Platform monetization requirements vary significantly, with Snapchat requiring the highest follower threshold at 50,000, while Instagram offers the most diverse monetization pathways.

Platform monetization systems exhibit heterogeneous design reflecting distinct strategic objectives. TikTok’s Creator Rewards Program imposes 10,000 follower and 100,000 30-day view requirements, compensating at $0.02-$0.04 per 1,000 views. The content threshold, minimum one-minute duration, enforces production standards and discourages economically marginal content requiring minimal effort.

YouTube Shorts employs a 1,000 subscriber threshold and requires either 10 million Shorts views within 90 days or 4,000 aggregate watch hours, yielding payments of $0.01-$0.05 per 1,000 views. The compensation structure diverges fundamentally: rather than direct creator compensation, Shorts revenue constitutes a share of pooled ad inventory distributed proportional to creator view share. This mechanism aligns creator incentives with advertiser value generation, though it introduces revenue volatility depending on advertiser demand and seasonal advertising cycles.

Instagram’s approach prioritizes flexibility without strict threshold requirements, enabling monetization through Subscriptions, Reels Gifts, performance-based Bonuses, and Brand Partnerships. This lower-friction architecture disproportionately benefits nano-influencers and niche creators operating in segments where engagement quality exceeds raw audience scale. By enabling monetization without follower thresholds, Instagram captures creators unlikely to qualify on competing platforms.

These divergent approaches reflect distinct platform positions and revenue optimization strategies. TikTok and Snapchat employ thresholds to concentrate creator inventory among established participants and ensure advertiser quality. YouTube and Instagram optimize for creator diversity, capturing emerging talent with lower monetization thresholds and generating long-term optionality.

Discovery Mechanisms and Algorithmic Intermediation

An underappreciated constraint on creator economics is algorithmic discovery fragmentation. As content volume escalates, algorithmic feed curation increasingly favors low-production-cost formats: clip content, reformatted material, and AI-assisted output. The result is systematic deprioritization of higher-production-value content, which is economically marginal when measured by engagement per production dollar.

This dynamic incentivizes what industry participants term “generative engine optimization” (GEO), the structural alignment of content for discovery through conversational AI systems including ChatGPT, Perplexity, and Google AI Overviews. Unlike traditional search engine optimization, which optimizes for keyword frequency, GEO requires semantic structure enabling machine comprehension and relevance determination. This technical requirement favors creators with production infrastructure and editorial discipline.

The result is bifurcation: high-production, semantic-structured content achieves disproportionate distribution through emerging AI discovery channels, while high-volume, algorithmically-optimized content saturates traditional feeds. This segmentation will likely intensify as conversational interfaces displace search as the primary discovery mechanism.

The Transition from Opportunistic to Planned Business Models

Gary Vaynerchuk’s characterization of 2026 as the “individual empire” era reflects observable formalization within creator business modeling. Rather than opportunistically monetizing audience attention through available platform features, sophisticated creators operate according to multi-year strategic plans incorporating discrete business pillars, technology infrastructure, and organizational capacity. Sophisticated creators are leveraging the followings and businesses they’ve arduously developed to play a patient, long game where others lack discipline.

This transition parallels historical professionalization patterns within entrepreneurship. Early-stage businesses typically exhibit reactive monetization, capturing available margin without systematic analysis of capital efficiency or growth scalability. As markets mature and competition intensifies, participants necessarily adopt formalized approaches to financial planning, unit economics, and capital allocation.

The empirical manifestation is strategic focus prioritizing four mechanisms:

Identification of underpriced attention markets enabling first-mover advantage (Snapchat Spotlight, Facebook);

Offline experience integration that converts digital audience into offline participation and deepens relationship durability;

Live streaming as a supply-constrained format enabling real-time monetization;

Direct audience ownership through email, membership, and proprietary distribution channels insulating participants from algorithmic dependency.

In 2026, I’m working directly with 100 creators building real businesses. For the first 100 creator founders: Four 60-minute 1:1 advisory sessions for $99.

Context: My standard engagement starts at $10K/month. This isn’t that. This is me learning from you while helping you build something sustainable.

Limited to 100 spots. Message me with questions or to claim yours or just click below to sign up (sign up requires browser access):

Stacked Revenue as Risk Mitigation Strategy

Analysis of high-performing creator enterprises reveals consistent revenue diversification across six to eight streams. This “stacked revenue” architecture includes platform monetization (creator funds, ad revenue shares), brand partnerships (sponsored content with performance conditions), proprietary digital products (courses, templates, software), community subscriptions (Patreon, Substack, Discord), affiliate commerce (Amazon Storefronts, LTK partnerships), physical merchandise, and live experiences.

This diversification functions as an insurance mechanism against platform dependency. Platform policy changes, algorithmic shifts, and policy revisions can eliminate revenue streams unilaterally and without creator compensation. By establishing revenue distribution across multiple channels, each subject to different failure modes, creators reduce systematic risk and increase enterprise resilience.

The financial mathematics favor diversification substantially. A creator dependent on a single platform monetization stream faces income volatility approximately equal to the platform’s own performance fluctuations plus idiosyncratic algorithmic variation. A creator distributing revenue across six channels faces volatility representing the weighted average of each channel’s idiosyncratic risk, resulting in substantially lower aggregate variance. This framework explains why sophisticated creators treat monetization diversification as equivalent to enterprise risk management rather than opportunistic upside capture.

Measurement and Unit Economics

CreatorIQ’s analysis of creator compensation structures reveals systematic prioritization of long-term partnership arrangements over transactional brand integrations. This reflects creator-side understanding that long-term partnership economics improve through several mechanisms:

Reduced customer acquisition costs per campaign cycle

Higher creative autonomy enabling superior content quality

Increased leverage in compensation negotiation.

Concurrent with this evolution, creators increasingly adopt standardized financial reporting and performance attribution systems. The prior phase, where creators maintained spreadsheets tracking platform payments and brand compensation, has given way to software infrastructure incorporating automated payment tracking, tax compliance, creator accounting systems, and attribution modeling.

This formalization enables quantitative analysis of individual business unit economics. A creator can now measure contribution margin for each revenue stream, optimize capital allocation to highest-return activities, and identify underperforming channels requiring strategic decision-making. The availability of quantitative data facilitates professionalization at institutional pace.

Organizational Architecture

Jimmy Donaldson’s Beast Industries represents an instructive case study in vertical integration within creator-led enterprises. Rather than monetizing audience attention through a single mechanism, Beast Industries operates across the full value chain: content production (YouTube channel with 458 million subscribers), brand development (Feastables chocolate company, Beast Games television production), experiential delivery (Beast Land), platform infrastructure (Creator Marketplace connecting creators to corporate partners), and financial services expansion.

This organizational architecture consolidates value capture across multiple stages. Content production generates audience attention; brand extensions convert attention into consumer spending and data; experience events deepen engagement and create community membership; platform infrastructure monetizes industry structure shifts; and financial services offer embedded optionality for future expansion.

The economic rationale reflects observed value dispersion across creator monetization channels. A creator capturing pure attention through YouTube monetization realizes perhaps 3-5% of total value generated relative to brand value uplift, consumer spending, and data capture. By internalizing downstream functions, Beast Industries captures a substantially larger share of total value, improving cash flow stability and reducing exposure to platform policy changes.

This vertical integration strategy mirrors historical consolidation patterns in technology and media. Vertical integration proves economically optimal when transaction costs between stages exceed the inefficiency costs of internal organization. In the creator economy, substantial information asymmetries and contract specification difficulties exist between creators and brand partners, between platforms and commerce operators, and between audience insights and financial product development. Internalizing these functions reduces transaction costs and improves organizational optionality.

Disintermediation and the Agency Challenge

Beast Industries’ December 2025 launch of a Creator Marketplace directly connecting influencers to Fortune 1000 brands presents a structural threat to traditional agency intermediation. By eliminating the agency spread, typically 15-30% of campaign value, both creators and brands benefit from improved economics. For a $500,000 campaign, the elimination of agency intermediation represents $75,000-$150,000 in preserved value distributable to creator and brand.

This disintermediation dynamic parallels comparable transitions across financial services (algorithmic trading displacing traditional brokerage), real estate (direct platforms reducing agent intermediation), and professional services (technology platforms enabling client-provider direct connection). In each instance, elimination of informational asymmetries and transactional friction enables value capture previously extracted by intermediaries.

Agencies capable of defending their position against disintermediation must provide services differentiated from mere deal facilitation. This includes strategic consultation, creative development, performance optimization, and risk management, services justifying continued intermediary participation. Agencies lacking these capabilities face commoditization as technology platforms reduce transaction costs below traditional agency spreads.

Expenditure Trajectory and Budget Reallocation Patterns

U.S. creator advertising expenditure expanded from $13.9 billion in 2021 to $29.5 billion in 2024, with 2025 projections reaching $37 billion. This trajectory, representing approximately 27% compound annual growth rate, is substantially decoupled from overall advertising spending growth, indicating systematic budget reallocation from traditional channels to creator partnerships.

Eighty-three percent of chief marketing officers report increasing creator marketing investments in 2026, despite acknowledged measurement difficulties. This disconnect between confidence and quantitative validation suggests that marketing executives perceive empirical benefits insufficient to drive decision-making. Rather, qualitative perception of audience migration, engagement quality, and authentic endorsements appears to drive budget allocation decisions.

Supporting this interpretation, two-thirds of the expanded creator budget allocation derives from reallocation of digital and paid advertising spending rather than net-new budget increases. This reallocation pattern indicates substitution rather than supplemental spending, suggesting marketing organizations view creator partnerships as superior to traditional performance marketing on relevant dimensions.

Attribution and Full-Funnel Measurement

The creator economy confronts a persistent attribution challenge: creator content influences audience perception across awareness, consideration, and evaluation stages, but short-term conversion attribution systematically undervalues these upstream effects. Traditional attribution methodology, last-click or first-click models, allocates credit to final conversion touchpoint, minimizing estimated impact of awareness and perception-shifting activities.

Leading practitioners have begun adopting multi-touch attribution models incorporating full-funnel impact assessment. Dove, for instance, evaluates creator partnership impact across 10+ metrics including organic reach, content virality, brand sentiment, and downstream conversion. This framework disaggregates creator value into distinct components: perception shift, audience expansion, engagement deepening, and conversion contribution.

The measurement challenge becomes tractable through integration of digital ecosystem data. By connecting creator content exposure, subsequent audience behavior in search (search volume for brand terms, product considerations), subsequent web analytics (site traffic patterns), and transactional outcomes, marketing organizations can construct attribution models quantifying creator impact across the full customer journey.

This evolution from engagement-centric to outcome-centric measurement represents a critical inflection. As measurement sophistication increases, marketing organizations will base budget allocation decisions on empirically validated return on investment rather than vanity metrics. This will likely compress total creator economy spending to levels consistent with demonstrated return, while concentrating budgets among creators and partnerships demonstrating measurable impact.

Artificial Intelligence Application

Ninety-two percent of marketing organizations integrated artificial intelligence tools into creator program execution in 2025. However, only 15% deployed AI for critical strategic decisions including creator selection and audience compatibility assessment; 28% applied AI to content concept development. This gap between adoption and strategic application reflects experimentation rather than systematic integration into decision infrastructure.

The strategic opportunity lies in applying machine learning to pattern recognition across creator-brand compatibility, audience overlap prediction, and campaign performance forecasting. Organizations capable of constructing AI models predicting which creator-brand combinations will generate superior performance capture structural competitive advantage. Such predictive capability reduces campaign development cycle time, improves success rates, and enables capital allocation optimization.

Current implementation, however, primarily automates routine tasks, caption generation, basic analytics computation, rather than addressing strategic constraints. This implementation gap reflects both technical limitations (insufficient historical data for robust predictive models) and organizational capability constraints (limited talent capable of designing and deploying proprietary ML infrastructure).

Substack Economics

Substack achieved $45 million annualized revenue by July 2025, representing 22% growth from 2024 and 50% growth from 2023. The platform sustains 5 million paid subscriptions generating approximately $450 million in gross creator revenue. Internal analytics indicate that 25% of paid conversions originate from platform recommendations and feed discovery, metrics demonstrating Substack’s value in customer acquisition.

However, the platform faces creator attrition at the high-revenue segment. Creators exceeding $100,000 annual revenue demonstrate measurable migration toward alternative platforms including Beehiiv and Ghost, motivated by fee structure optimization. Substack’s 10% fee structure generates $10,000+ annual costs for high-revenue creators, a magnitude comparable to annual expenditure for substantive software tools. This economic friction drives migration to platforms offering equivalent functionality at lower cost.

This dynamic illustrates the broader challenge confronting subscription platforms dependent on creator retention. As creator revenue matures, compensation cost structures shift from negligible to material decision factors. Platforms must consequently either reduce fees below levels sustaining long-term profitability, upgrade value propositions to justify fee maintenance, or accept creator migration as a structural characteristic of the business model.

Platform-Agnostic Monetization and Audience Ownership

The strategic imperative driving creator behavior increasingly emphasizes direct audience relationships and platform-independent monetization mechanisms. Rather than relying on algorithmic distribution and platform-mediated compensation, sophisticated creators develop owned distribution channels including email lists, proprietary applications, SMS communities, and membership platforms.

This architectural shift reflects rational responses to platform dependency. Algorithm changes affecting distribution, policy revisions eliminating monetization features, and account termination represent systematic risks to creator income. By establishing revenue relationships independent of platform intermediation, creators reduce correlation between their earnings and platform policy, algorithmic shifts, and competitive dynamics.

The financial implication extends to creator valuation. A creator-led business deriving 80% of revenue from platform monetization possesses different risk characteristics than an equivalent business deriving 30% from platforms and 70% from owned channels. The latter exhibits lower revenue volatility, superior unit economics after platform fees, and reduced exposure to strategic change risk. This risk profile explains why venture capital and acquisition pricing increasingly reflect creator audience ownership and direct relationship infrastructure as critical value components.

Certification and Disclosure Compliance

The Institute for Responsible Influence, established through the BBB National Programs Center for Industry Self-Regulation, is implementing a creator certification program (launch Spring 2026) addressing standardization of regulatory compliance and disclosure best practices. Backing from major advertising associations (ANA, 4A’s, AAF, IBA, ICAS) and industry participants (#paid, Billion Dollar Boy, Linqia) indicates broad stakeholder consensus that industry self-regulation can precede statutory regulation.

The certification structure addresses genuine information asymmetries. Federal Trade Commission regulations require disclosure of material relationships between creators and brands, with both parties subject to enforcement risk. Many creators lack clarity regarding regulatory requirements, disclosure placement standards, and liability allocation. FTC enforcement prioritizes creators with 100,000+ followers, demonstrable non-compliance patterns, claims affecting health or financial outcomes, and cryptocurrency promotions.

Certification reduces regulatory risk through standardized training and documented compliance practices. The mechanism parallels certification programs within other industries where professional standards reduce liability exposure and create competitive advantage for compliant participants. However, certification will likely create barriers for smaller creators lacking sophistication to obtain credentials, potentially generating market stratification.

Labor Classification and Worker Protection Frameworks

Representative Ro Khanna’s Creator Bill of Rights (introduced January 14, 2026) advances statutory recognition that platform-based creative work constitutes meaningful economic activity affecting 12% of U.S. adults. The resolution addresses three systemic challenges:

Income volatility and unpredictability,

Opaque platform rules and changing monetization structures,

Limited recourse when algorithmic changes eliminate earnings sources.

The economic significance of these issues is substantial. A creator deriving 80% of income from a single platform faces income volatility exceeding typical employment income variance. Unilateral platform policy changes—algorithm modifications, monetization feature elimination, account suspension—can reduce income from six figures to zero without compensation mechanism or due process.

Labor economists have characterized creator income as exhibiting characteristics of dependent contractor relationships rather than pure freelance arrangements, particularly when creators demonstrate material relationship exclusivity and platform-prescribed conduct standards. Statutory labor classification could impose substantial obligations on platforms including unemployment insurance contributions, tax withholding, and worker protection provisions.

Global Regulatory Calendar 2026

Multiple jurisdictions implement creator economy regulations throughout 2026. New York’s Synthetic Performer Disclosure Law (effective June 9, 2026) requires disclosure of artificial intelligence-generated content in advertising. The European Union’s AI Act transparency provisions (effective August 2, 2026) mandate identification of AI-manipulated or generated content where risk exists that audiences will be materially misled. India’s Digital Personal Data Protection Act implements consent and data minimization obligations throughout 2026.

These regulatory developments reflect global consensus that creator economy growth warrants statutory oversight. The convergence across jurisdictions suggests that statutory regulation of creator compensation, platform transparency, and AI disclosure will accelerate throughout 2026 and 2027.

Tokenized Ownership Models and Agent-Based Distribution

Emerging models combining artificial intelligence agents and Web3 tokenization propose fundamental restructuring of creator economy architecture. Rather than platforms mediating creator-audience relationships and controlling distribution algorithms, decentralized agents, operating on user devices or blockchain infrastructure, would manage content distribution and revenue allocation.

Tokenized ownership enables audience stakeholder participation in creator enterprises. Fans acquiring tokens gain governance rights, revenue share claims, and development influence. These mechanisms align incentives between creators and communities, theoretically generating superior content quality and community engagement relative to platform-mediated models.

The economic promise rests on removing platform intermediation and reducing principal-agent friction. Platforms extract value through algorithmic control and data capture; decentralized models propose distributing this value to creators and audiences. However, implementation remains constrained by technological immaturity (consensus protocols, smart contract scalability), user adoption barriers, and coordination problems inherent in decentralized governance structures.

Income Inequality and Ownership Concentration

Recent analysis highlights structural income inequality within the creator economy, with top creators capturing disproportionate shares of brand partnerships and platform compensation while the median creator exhibits marginal economics. This concentration stems from platform algorithms favoring established creators, brand preference for proven audiences, and network effects amplifying early winners.

The emerging strategic response emphasizes creator ownership of audience relationships and independent value capture mechanisms. Creators possessing owned email lists, proprietary applications, tokenized community stakes, and direct commerce channels reduce dependence on platform-mediated economics. These assets represent durable sources of value independent of platform policy and algorithmic change.

This dynamic will likely drive increasing divergence between platform-dependent creators (facing structural income challenges) and ecosystem-owning creators (capturing diversified value streams). The strategic implication is that creator success increasingly depends on infrastructure investment in owned audience channels and direct value capture mechanisms.

The Creator Economy as Labor Market Evolution

The creator economy represents a genuine alternative employment model, distinct from traditional W-2 employment and also from conventional freelancing. Traditional employment provides income stability and benefits at the cost of limited autonomy and equity upside. Freelancing provides autonomy and task selection flexibility at the cost of income instability and minimal benefits. Creator-based work offers audience ownership, diversified revenue, and business building optionality, but requires exceptional self-direction and operates subject to platform dependency.

For individuals evaluating career paths, creator work offers value when three conditions are satisfied:

(1) personal circumstances permit income volatility tolerance;

(2) technological and creative skills enable differentiated content production;

(3) long-term vision emphasizes business building rather than maximizing current period income.

For individuals lacking these characteristics, traditional employment or creative services employment (agency, production company roles) likely offers superior expected utility.

From a macroeconomic perspective, the creator economy facilitates higher labor force participation among individuals lacking traditional employment opportunities or preferences. Caregivers, individuals with geographic constraints, and those prioritizing autonomy can generate income through creator activities despite incompatibility with traditional employment arrangements. This represents meaningful utility improvement relative to pre-platform economic arrangements.

Attention Economics and Market Structure Evolution

The creator economy’s analytical foundation rests on attention economics: the economics of monetizing audience attention across multiple value capture mechanisms. As digital supply of attention grows relative to demand (declining attention scarcity due to content proliferation), monetization per unit of attention exhibits structural decline.

This dynamic incentivizes several adaptive responses:

First, creators pursue audience quality improvements—building engaged communities with demonstrated purchasing behavior and willingness to pay. Audience of 1,000 highly engaged supporters generates superior economics to 100,000 casual followers.

Second, creators develop proprietary distribution channels reducing algorithmic dependency. Direct email and membership relationships preserve audience relationships across platform changes and algorithmic fluctuations.

Third, creators move downstream in value chains—from pure attention monetization (YouTube ad revenue) to audience monetization through products, services, and experiences.

This evolution is structurally inevitable given the mathematics of attention supply growth outpacing demand growth. The strategic opportunity for creators is not maximizing audience scale but optimizing audience quality, relationship depth, and downstream value capture.

The Creator Economy as Institutional Change Indicator

Goldman Sachs projects the creator economy will nearly double from $250 billion in 2023 to $480 billion by 2027, reflecting sustained institutional confidence despite near-term market adjustments.

The creator economy’s growth from negligible to $235 billion market size in approximately 15 years represents substantial institutional change. The transition encompasses multiple domains:

Labor market structure (shift from employment-centric to portfolio-based work),

Media production (shift from professional-dominated to distributed production),

Advertising (shift from traditional to performance-and-audience-based),

Consumer behavior (shift from passive content consumption to participatory co-creation).

This institutional change reflects underlying shifts in technology availability and consumer preferences. Digital content production tools available at negligible marginal cost enable near-universal participation. Consumer preference for authentic, relatable communication creates systematic advantages for individual creators relative to corporate communications. These fundamentals are unlikely to reverse, suggesting creator economy institutional significance will persist and likely expand.

For strategists evaluating long-term organizational positioning, the creator economy signals broader institutional shifts toward decentralization, authenticity, and direct creator-consumer relationships. Organizations adapting business models to incorporate creator principles, community building, transparent communication, audience participation in development, will likely capture value more effectively than those maintaining traditional hierarchical structures.

The creator economy at the start of 2026 exhibits characteristics consistent with industrial maturation: consolidation through M&A, regulatory standardization, professionalization of business practices, and institutional capital participation. The phase characterized by rapid growth through experimentation has transitioned into a phase emphasizing sustainable cash flow generation and risk management through diversification and operational efficiency.

Four structural trends will likely define the sector’s evolution through 2027:

Consolidation acceleration: M&A activity will continue as infrastructure-controlling platforms acquire capability and data assets. Pure-play intermediaries lacking proprietary technology will face increasing pressure to consolidate or reposition toward value-added services.

Platform monetization maturation: As platforms standardize monetization features and establish consistent compensation formulas, creator earnings will increasingly stabilize at predictable, platform-specific levels. Creator economics will thus shift from winner-take-most to relatively predictable tier-based compensation correlated with audience scale and engagement.

Creator business professionalization: Sophisticated creators will continue building diversified revenue architectures incorporating owned audience channels, reducing platform dependency. This will accelerate the bifurcation between platform-dependent and ecosystem-owning creators, with corresponding disparities in enterprise value and economic stability.

Regulatory standardization: Global regulatory frameworks will emerge addressing labor classification, platform transparency, and AI disclosure. These regulations will increase compliance costs and create barriers for marginal participants, further consolidating the industry around well-capitalized and compliant participants.

The fundamental question for organizations examining the creator economy’s strategic implications is whether attention markets operate according to economic principles fundamentally distinct from traditional markets, or whether differences are primarily attributable to market youth and imperfect information. The evidence increasingly suggests the latter: As the market matures, creator economics are converging toward principles of market efficiency, competitive consolidation, and operational professionalization consistent with other media and technology industries. Organizations positioning for this transition, investing in infrastructure, data, and compliance while maintaining operational flexibility, will likely capture disproportionate value as the sector matures.

I sincerely hope this helps. Stay tuned next week for another edition of The Operating Creator.

- john -

In 2026, I’m working directly with 100 creators building real businesses. For the first 100 creator founders: Four 60-minute 1:1 advisory sessions for $99.

Context: My standard engagement starts at $10K/month. This isn’t that. This is me learning from you while helping you build something sustainable.

Limited to 100 spots. Message me with questions or to claim yours or just click below to sign up (sign up requires browser access):

Market Overview and Financial Analysis

Forbes (January 26, 2026). “The Creator Economy In 2026: The Era Of Consolidation”

https://www.forbes.com/sites/jasondavis/2026/01/26/the-creator-economy-in-2026---the-era-of-consolidation/

PPC.land (January 24, 2026). “Partnership platform impact.com hits $270M revenue as creator economy reshapes advertising”

https://ppc.land/partnership-platform-impact-com-hits-270m-revenue-as-creator-economy-reshapes-advertising/

eMarketer (December 17, 2025). “Creator Economy Trends to Watch in 2026”

https://www.emarketer.com/content/creator-economy-trends-watch-2026

eMarketer (January 15, 2026). “FAQ on the creator economy: How marketers can stand out in 2026”

https://www.emarketer.com/content/faq-on-creator-economy--how-marketers-stand-2026-

Forbes (January 12, 2026). “Why The Creator Economy Is Now Wall Street Ready”

https://www.forbes.com/sites/ianshepherd/2026/01/12/why-the-creator-economy-is-now-wall-street-ready/

Goldman Sachs (April 18, 2023). “The creator economy could approach half-a-trillion dollars by 2027”

https://www.goldmansachs.com/insights/articles/the-creator-economy-could-approach-half-a-trillion-dollars-by-2027

M&A Activity and Consolidation

New Economies (January 12, 2026). “2026 Creator Economy M&A Report”

Business Insider (January 13, 2026). “As Creator Economy M&A Heats up, These Are Potential Buyers in 2026”

https://www.businessinsider.com/creator-economy-mergers-acquisition-buyers-publicis-talent-influencer-marketing-2026-1

MarketMinute/Financial Content (January 11, 2026). “The Great Consolidation: Creator Economy M&A Hits Fever Pitch in 2026”

https://markets.financialcontent.com/dailynews/article/marketminute-2026-1-12-the-great-consolidation-creator-economy-m-and-a-hits-fever-pitch

Gary Vaynerchuk and VaynerMedia Insights

LinkedIn News (December 18, 2025). “Gary Vaynerchuk Predicts Rise of ‘Individual Empire’ in 2026”

https://www.linkedin.com/posts/linkedin-news_bigideas2026-activity-7407856329127534592-zYnQ

Creator Economy NYC Newsletter (December 18, 2025). “Where Gary Vee says creators should focus in 2026”

https://mail.creatoreconomynyc.com/p/where-gary-vee-says-creators-should-focus-in-2026

Platform Monetization and Creator Earnings

InfluenceFlow (January 20, 2026). “TikTok Creator Payment Rate Guide 2026 Update”

https://influenceflow.io/resources/tiktok-creator-payment-rate-guide-2026-update/

Bluehost (January 19, 2026). “How Much Do YouTube Shorts Make for Creators in 2026?”

https://www.bluehost.com/blog/how-much-do-youtube-shorts-make/

Thornberry Media (December 16, 2025). “TikTok Monetization Requirements in 2026: Exact Numbers You Need”

https://www.thornberrymedia.com/post/tiktok-monetization-requirements-in-2026-a-breakdown-for-beginners

Stan Store Blog (December 10, 2025). “How Much YouTube Pays Creators in 2026 (Per View, 1K, and 1M)”

https://stan.store/blog/how-much-does-youtube-pay/

Hopp (January 19, 2026). “How to Monetize Instagram in 2026: Your Ultimate Guide”

https://www.hopp.co/post/how-to-monetize-instagram-2026

Los Angeles Times (December 15, 2024). “Snapchat announces expanded revenue-sharing program”

https://www.latimes.com/business/story/2024-12-16/snapchat-creators-monetization

Syllaby (June 25, 2025). “How to Successfully Meet Snapchat Monetization Requirements in 2026”

https://syllaby.io/blog/snapchat-monetization-requirements/

Brand Spending and Marketing Trends

Marketing Interactive (December 31, 2025). “Over 60% of marketers set to supercharge creator investments in 2026”

https://www.marketing-interactive.com/over-60-of-marketers-set-to-supercharge-creator-investments-in-2026

YouTube (January 14, 2026). “The Creator Economy Report 2026 & Beyond”

Awisee (December 21, 2025). “Creator Economy Data: Rising Ad Spend & Shifting Consumers (2026)”

https://awisee.com/blog/creator-economy-data/

Later (January 4, 2026). “Where Creator Marketing Budgets Are Moving in 2026”

https://later.com/blog/where-are-creator-marketing-budgets-moving-in-2026/

ROI Measurement and AI Integration

LinkedIn (January 6, 2026). “The Creator Economy in 2026: Platform Evolution, Content Quality and AI Integration”

https://www.linkedin.com/pulse/creator-economy-2026-platform-evolution-content-quality-w5a8c

CreatorIQ (January 22, 2026). “How Leading Brands Are Proving the ROI of Creator Marketing Today”

https://www.creatoriq.com/blog/proving-roi-of-creator-marketing

CreatorIQ (January 15, 2026). “6 Creator Marketing Shifts to Watch for in 2026”

https://www.creatoriq.com/blog/6-creator-marketing-shifts-to-watch-for-in-2026

Netinfluencer (January 18, 2026). “Creator Marketing Spend Set To Rise In 2026 Despite Ongoing Measurement Gaps, Kantar Finds”

https://www.netinfluencer.com/creator-marketing-spend-set-to-rise-in-2026-despite-ongoing-measurement-gaps-kantar-finds/

Subscription Models and Platform-Agnostic Strategies

Uscreen (December 2, 2025). “Top 10 Creator Economy Trends for 2026”

https://www.uscreen.tv/blog/creator-economy-trends/

Sacra (January 21, 2026). “Substack revenue, valuation & funding”

https://sacra.com/c/substack/

Beehiiv Blog (December 19, 2025). “How Much Does Substack Cost Creators In 2026?”

https://www.beehiiv.com/blog/how-much-does-substack-cost

LinkedIn (January 5, 2026). “10 Trends That Will Define Media and the Creator Economy in 2026”

https://www.linkedin.com/pulse/10-trends-define-media-creator-economy-2026-patrik-z9nvf

MrBeast and Vertical Integration

ALM Corporation (January 7, 2026). “Salesforce CEO Marc Benioff Invites MrBeast for Super Bowl 2026 Ad”

https://almcorp.com/blog/salesforce-marc-benioff-mrbeast-super-bowl-2026-ad/

Jim Louderback (December 9, 2025). “What We Know Now About the MrBeast IPO”

https://louderback.com/the-selling-of-the-beast-2026/

Decentralization and Ownership

AI Journ (January 21, 2026). “Creators, Not Platforms: AI Must Flip the Creator Economy”

https://aijourn.com/creators-not-platforms-ai-must-flip-the-creator-economy/

LinkedIn (January 15, 2026). “Creator economy shifts: Top creators dominate, many struggle”

https://www.linkedin.com/posts/nadeaujonathan_todays-creator-economy-makes-headlines-again-activity-7417913590340423681-WJ32

Discovery and Algorithm Changes

YouTube (December 16, 2025). “Change is coming for creators | 2026 Creator economy will trends”

Regulation and Policy

Digiday (January 19, 2026). “The creator economy addresses disclosure and liability risks”

https://digiday.com/marketing/a-step-toward-compliance-the-creator-economy-addresses-disclosure-and-liability-risks/

Rep. Ro Khanna Press Release (January 14, 2026). “REP. RO KHANNA INTRODUCES RESOLUTION TO PROTECT CREATORS IN MODERN PLATFORM ECONOMY”

http://khanna.house.gov/media/press-releases/release-rep-ro-khanna-introduces-resolution-protect-creators-modern-platform

InfluenceFlow (January 7, 2026). “FTC Disclosure Compliance Guide 2026”

https://influenceflow.io/resources/ftc-disclosure-compliance-complete-guide-for-creators-brands-businesses-in-2026/

Netinfluencer (December 28, 2025). “Global Creator Economy Regulation: What Is Scheduled For 2026”

https://www.netinfluencer.com/global-creator-economy-regulation-what-is-scheduled-for-2026/

Investment Bank Research

Investing.com (January 8, 2026). “JPMorgan outlines ten strategic themes that could shape the outlook for 2026”

https://www.investing.com/news/economy-news/jpmorgan-outlines-ten-strategic-themes-that-could-shape-the-outlook-for-2026-4436611

J.P. Morgan (January 6, 2026). “2026 Business Leaders Outlook: Expectations & Trends”

https://www.jpmorgan.com/insights/markets-and-economy/business-leaders-outlook/2026-us-business-leaders-outlook

Industry Reports and Analysis

Business Insider (January 3, 2026). “The 3 creator economy trends that helped startups pull in millions in funding”

https://www.businessinsider.com/creator-economy-trends-helped-startups-pull-in-funding-2026-1

LinkedIn (January 5, 2026). “Creator Economy Predictions for 2026: What the Top Analysts Are Betting On”

https://www.linkedin.com/pulse/creator-economy-predictions-2026-what-top-analysts-betting-hjilf

CreatorIQ (December 31, 2024). “The State of Creator Marketing Report 2025-2026”

https://www.creatoriq.com/white-papers/state-of-creator-marketing-trends-2026

TTT News (January 12, 2026). “Creator Economy: What’s Shaping 2026 - Key Moves, Monetisation and Strategy”

https://www.ttt-news.com/creator-economy-2026-ai-monetisation-professionalisation/

Additional Analysis and Commentary

LinkedIn (January 1, 2026). “Twenty 2026 Creator Economy Predictions”

https://www.linkedin.com/pulse/twenty-2026-creator-economy-predictions-lyle-stevens-kalgc

LinkedIn (September 3, 2025). “How the Creator Economy Is Reshaping Traditional Employment”

https://www.linkedin.com/pulse/how-creator-economy-reshaping-traditional-employment-michael-nadeau-v2ffc

Digiday (January 19, 2026). “Not all creators are the same: How the creator economy breaks down by business model”

https://digiday.com/media/not-all-creators-are-the-same-how-the-creator-economy-breaks-down-by-business-model/

Report compiled from 98 sources published between November 2025 and January 26, 2026, with emphasis on research, analysis, and commentary from the week of January 19-26, 2026.

John Brewton documents the history and future of operating companies at Operating by John Brewton. He is a graduate of Harvard University and began his career as a Phd. student in economics at the University of Chicago. After selling his family’s B2B industrial distribution company in 2021, he has been helping business owners, founders and investors optimize their operations ever since. He is the founder of 6A East Partners, a research and advisory firm asking the question: What is the future of companies? He still cringes at his early LinkedIn posts and loves making content each and everyday, despite the protestations of his beloved wife, Fabiola, at times.

Working directly with founders on strategy, positioning, and financial planning at this stage could make a huge difference in turning passion into a sustainable business.

Fascinating read! I’ve never seen it broken down like this. I would agree that I’m playing (and have been playing) the long game.